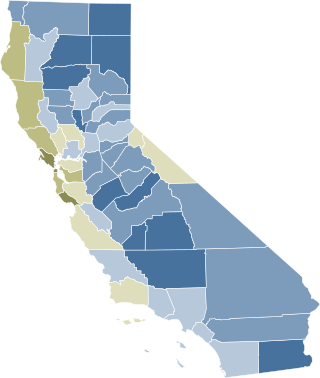

Proposition 215, or the Compassionate Use Act of 1996, is a California law permitting the use of medical cannabis despite marijuana's lack of the normal Food and Drug Administration testing for safety and efficacy. It was enacted, on November 5, 1996, by means of the initiative process, and passed with 5,382,915 (55.6%) votes in favor and 4,301,960 (44.4%) against.

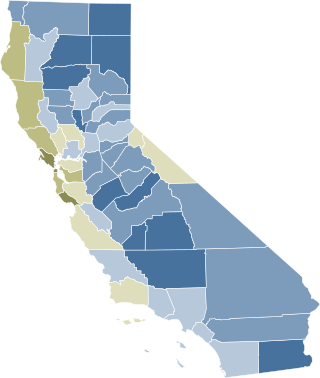

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

Peter Barton Wilson is an American attorney and politician who served as a United States senator from California from 1983 to 1991 and as the 36th governor of California from 1991 to 1999. A member of the Republican Party, he also served as the 29th mayor of San Diego from 1971 to 1983.

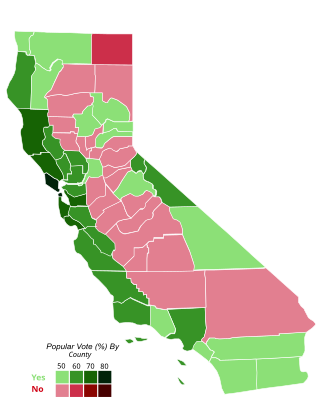

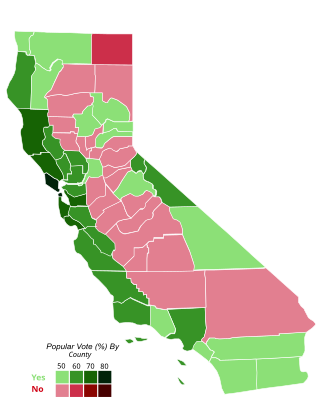

Same-sex marriage has been legal in California since June 28, 2013. The U.S. state first issued marriage licenses to same-sex couples on June 16, 2008 as a result of the Supreme Court of California finding in the case of In re Marriage Cases that barring same-sex couples from marriage violated the Constitution of California. The issuance of such licenses was halted from November 5, 2008 through June 27, 2013 due to the passage of Proposition 8—a state constitutional amendment barring same-sex marriages. The granting of same-sex marriages recommenced following the U.S. Supreme Court's decision in Hollingsworth v. Perry, which restored the effect of a federal district court ruling that overturned Proposition 8 as unconstitutional.

Districts in California geographically divide the U.S. state into overlapping regions for political and administrative purposes.

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in June 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election.

Proposition 8, known informally as Prop 8, was a California ballot proposition and a state constitutional amendment intended to ban same-sex marriage; it passed in the November 2008 California state elections and was later overturned in court. The proposition was created by opponents of same-sex marriage in advance of the California Supreme Court's May 2008 appeal ruling, In re Marriage Cases, which followed the short-lived 2004 same-sex weddings controversy and found the previous ban on same-sex marriage unconstitutional. Proposition 8 was ultimately ruled unconstitutional by a federal court in 2010, although the court decision did not go into effect until June 26, 2013, following the conclusion of proponents' appeals.

California Proposition 5, or the Nonviolent Offender Rehabilitation Act was an initiated state statute that appeared as a ballot measure on the November 2008 ballot in California. It was disapproved by voters on November 4 of that year.

Strauss v. Horton, 46 Cal. 4th 364, 93 Cal. Rptr. 3d 591, 207 P.3d 48 (2009), was a decision of the Supreme Court of California, the state's highest court. It resulted from lawsuits that challenged the voters' adoption of Proposition 8 on November 4, 2008, which amended the Constitution of California to outlaw same-sex marriage. Several gay couples and governmental entities filed the lawsuits in California state trial courts. The Supreme Court of California agreed to hear appeals in three of the cases and consolidated them so they would be considered and decided. The supreme court heard oral argument in the cases in San Francisco on March 5, 2009. Justice Kathryn Mickle Werdegar stated that the cases will set precedent in California because "no previous case had presented the question of whether [a ballot] initiative could be used to take away fundamental rights".

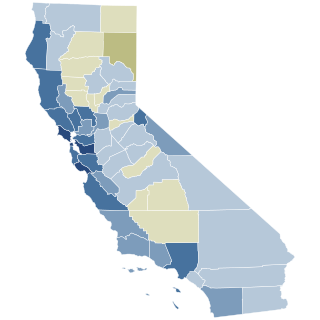

Cannabis in California has been legal for medical use since 1996, and for recreational use since late 2016. The state of California has been at the forefront of efforts to liberalize cannabis laws in the United States, beginning in 1972 with the nation's first ballot initiative attempting to legalize cannabis. Although it was unsuccessful, California would later become the first state to legalize medical cannabis through the Compassionate Use Act of 1996, which passed with 56% voter approval. In November 2016, California voters approved the Adult Use of Marijuana Act with 57% of the vote, which legalized the recreational use of cannabis.

Taxes in California are collected by state and local governments through a number of tax categories.

Proposition 39 is a ballot initiative in the state of California that modifies the way out-of-state corporations calculate their income tax burdens. The proposition was approved by voters in the November 6 general election, with 61.1% voting in favor of it.

Proposition 47, also known by its ballot title Criminal Sentences. Misdemeanor Penalties. Initiative Statute, was a referendum passed by voters in the state of California on November 4, 2014. The measure was also referred to by its supporters as the Safe Neighborhoods and Schools Act. It recategorized some nonviolent offenses as misdemeanors, rather than felonies, as they had previously been categorized.

The Adult Use of Marijuana Act (AUMA) was a 2016 voter initiative to legalize cannabis in California. The full name is the Control, Regulate and Tax Adult Use of Marijuana Act. The initiative passed with 57% voter approval and became law on November 9, 2016, leading to recreational cannabis sales in California by January 2018.

California Proposition 59 is a non-binding advisory question that appeared on the 2016 California November general election ballot. It asked voters if they wanted California to work towards overturning the Citizens United U.S. Supreme Court ruling.

California state elections in 2018 were held on Tuesday, November 6, 2018, with the primary elections being held on June 5, 2018. Voters elected one member to the United States Senate, 53 members to the United States House of Representatives, all eight state constitutional offices, all four members to the Board of Equalization, 20 members to the California State Senate, and all 80 members to the California State Assembly, among other elected offices.

Proposition 12 was a California ballot proposition in that state's general election on November 6, 2018. The measure was self-titled the Prevention of Cruelty to Farm Animals Act. The measure passed, by a vote of about 63% Yes to 37% No.

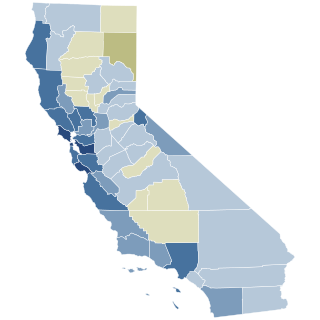

The 2020 California Proposition 17 is a ballot measure that appeared on the ballot in the 2020 California elections on November 3. Prop 17 amended the Constitution of California to allow people who are on parole to vote. Due to the passage of this proposition, more than 50,000 people in California who are currently on parole and have completed their prison sentence are now eligible to vote and to run for public office. This proposition also provides that all those on parole in the future will be allowed to vote and run for public office as well. The work of Proposition 17 comes out of a history of addressing felony disenfranchisement in the United States. California voters approved this measured by a margin of roughly 18 percentage points.

Proposition 1, titled Constitutional Right to Reproductive Freedom and initially known as Senate Constitutional Amendment 10 (SCA 10), is a California ballot proposition and state constitutional amendment that was voted upon in the 2022 general election on November 8. Passing with more than two-thirds of the vote, the proposition amended the Constitution of California to explicitly grant the right to an abortion and contraceptives, making California among the first states in the nation to do so with Michigan and Vermont. The decision to propose the codification of abortion rights in the state constitution was precipitated in May 2022 by Politico's publishing of a leaked draft opinion showing the United States Supreme Court overturning Roe v. Wade and Planned Parenthood v. Casey in Dobbs v. Jackson Women's Health Organization, reversing judicial precedent that previously held that the United States constitution protected the right to an abortion.

The Superior Court of California, County of San Bernardino, also known as the San Bernardino County Superior Court or San Bernardino Superior Court, is the branch of the California superior court with jurisdiction over San Bernardino County.