The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker and debt manager, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank.

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and minting coins, while the treasury executes currency circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes.

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

His Majesty's Treasury, occasionally referred to as the Exchequer, or more informally the Treasury, is a ministerial department of the Government of the United Kingdom. It is responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting, the replacement for the Combined Online Information System, which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts annual financial statements are produced.

The private finance initiative (PFI) was a United Kingdom government procurement policy aimed at creating "public–private partnerships" (PPPs) where private firms are contracted to complete and manage public projects. Initially launched in 1992 by Prime Minister John Major, and expanded considerably by the Blair government, PFI is part of the wider programme of privatisation and macroeconomic public policy, and presented as a means for increasing accountability and efficiency for public spending.

His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the Tudor Crown enclosed within a circle.

The Debt Management Office (DMO) of the United Kingdom is the executive agency responsible for debt and cash management for the UK Government, lending to local authorities and managing certain public sector funds.

The Bureau of the Public Debt was an agency within the Fiscal Service of the United States Department of the Treasury. United States Secretary of the Treasury Timothy Geithner issued a directive that the Bureau be combined with the Financial Management Service to form the Bureau of the Fiscal Service in 2012.

Gilt-edged securities, also referred to as gilts, are bonds issued by the UK Government. The term is of British origin, and then referred to the debt securities issued by the Bank of England on behalf of His Majesty's Treasury, whose paper certificates had a gilt edge, hence the name.

National Savings and Investments (NS&I), formerly called the Post Office Savings Bank and National Savings, is a state-owned savings bank in the United Kingdom. It is both a non-ministerial government department and an executive agency of HM Treasury. The aim of NS&I has been to attract funds from individual savers in the UK for the purpose of funding the government's deficit. NS&I attracts savers through offering savings products with tax-free elements on some products, and a 100% guarantee from HM Treasury on all deposits. As of 2017, approximately 9% of the government's debt is met by funds raised through NS&I, around half of which is from the Premium Bond offering.

The Access Bank Nigerian Government Bond Index is a liquid index that was created to ensure that there exists credible data on the Nigerian sovereign bond market which will help the investors and other stakeholders to make informed investment decisions while providing a benchmark for measuring the performance of the rapidly developing local currency bond markets. This is particularly important as the bonds market is becoming redefined from a primarily sovereign fiscal deficit process to a sound investment option.

The Public Works Loan Board (PWLB) was a statutory body of the UK Government that provided loans to public bodies from the National Loans Fund. In 2020, the PWLB was abolished as a statutory organisation, and its functions were allocated to HM Treasury, where they are discharged through the UK Debt Management Office. The members of the PWLB were known as the Public Works Loan Commissioners.

The Office for Budget Responsibility (OBR) is a non-departmental public body funded by the UK Treasury, that the UK government established to provide independent economic forecasts and independent analysis of the public finances. It was formally created in May 2010 following the general election and was placed on a statutory footing by the Budget Responsibility and National Audit Act 2011. It is one of a growing number of official independent fiscal watchdogs around the world.

The Australian government debt is the amount owed by the Australian federal government. The Australian Office of Financial Management, which is part of the Treasury Portfolio, is the agency which manages the government debt and does all the borrowing on behalf of the Australian government. Australian government borrowings are subject to limits and regulation by the Loan Council, unless the borrowing is for defence purposes or is a 'temporary' borrowing. Government debt and borrowings have national macroeconomic implications, and are also used as one of the tools available to the national government in the macroeconomic management of the national economy, enabling the government to create or dampen liquidity in financial markets, with flow on effects on the wider economy.

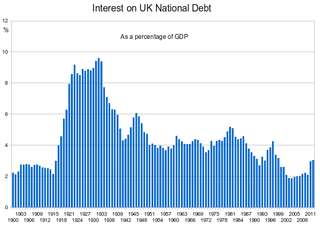

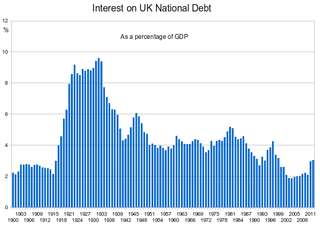

The United Kingdom national debt is the total quantity of money borrowed by the Government of the United Kingdom at any time through the issue of securities by the British Treasury and other government agencies.

The history of the British national debt can be traced back to the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt, which evolved into the Bank of England. In 1815, at the end of the Napoleonic Wars, British government debt reached a peak of £1 billion.

The Local Capital Finance Company is a United Kingdom-based quango and private company that provides loans to local authorities. It is an alternative for local authorities to borrowing via the Public Works Loan Board of the UK Debt Management Office, which in turn is part of UK Governments HM Treasury.

The UK Municipal Bonds Agency is Local Government Funding Agency that exists primarily to reduce councils' capital long term financing costs in the United Kingdom. It allows local authorities to diversify funding sources and borrow at a lower cost than is available from Central Government via the Public Works Loan Board of the UK Debt Management Office, which is part of HM Treasury. The agency will sell municipal bonds on the capital markets, raising funds that it will then lend to councils.

The Debt Management Office (DMO) is a government agency established on 4 October 2000, tasked with centralizing the management of Nigeria's debt. It was created in response to challenges in Nigeria's debt portfolio, which included high external and domestic debt, substantial debt service, low external reserves, and weak debt management capacity.

The Nigeria national debt or simply national debt of Nigeria is the total amount of money that the Federal Government of Nigeria owes to its creditors, both domestic and external. The national debt is composed of two main components: debt held by the public and debt held by government accounts. Debt held by the public includes Treasury securities held by investors outside the federal government, such as individuals, corporations, the Central Bank of Nigeria, and foreign, state and local governments. Debt held by government accounts includes non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Nigeria Social Insurance Trust Fund. The national debt is measured as the face value of the outstanding Treasury securities at a given point in time.