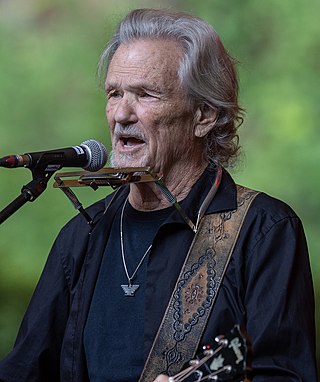

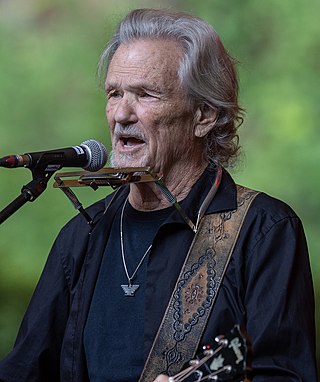

Fire Down Below is a 1997 American action film starring Steven Seagal and directed by Félix Enríquez Alcalá in his directorial debut. The film also includes cameos by country music performers Randy Travis, Mark Collie, Ed Bruce, Marty Stuart and Travis Tritt, and country-rocker and the Band member Levon Helm, as well as Kris Kristofferson in a supporting role. Steven Seagal plays Jack Taggert, an EPA agent who investigates a Kentucky mine and helps locals stand up for their rights. The film was released in the United States on September 5, 1997.

Kristoffer Kristofferson is an American retired country singer, songwriter, and actor. Among his songwriting credits are "Me and Bobby McGee", "For the Good Times", "Sunday Mornin' Comin' Down", and "Help Me Make It Through the Night", all of which were hits for other artists.

The Whitewater controversy, Whitewater scandal, Whitewatergate, or simply Whitewater, was an American political controversy during the 1990s. It began with an investigation into the real estate investments of Bill and Hillary Clinton and their associates, Jim and Susan McDougal, in the Whitewater Development Corporation. This failed business venture was incorporated in 1979 with the purpose of developing vacation properties on land along the White River near Flippin, Arkansas.

The Panic of 1837 was a financial crisis in the United States that began a major depression, which lasted until the mid-1840s. Profits, prices, and wages dropped, westward expansion was stalled, unemployment rose, and pessimism abounded.

Nicholas Biddle was an American financier who served as the third and last president of the Second Bank of the United States. Throughout his life Biddle worked as an editor, diplomat, author, and politician who served in both houses of the Pennsylvania state legislature. He is best known as the chief opponent of Andrew Jackson in the Bank War.

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, Individual Retirement Arrangements (IRAs). Other arrangements include employer-established benefit trusts and individual retirement annuities, by which a taxpayer purchases an annuity contract or an endowment contract from a life insurance company.

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence.

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system, numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the amount of cash customers may withdraw, either by imposing a hard limit or by scheduling quick deliveries of cash, encouraging high-return term deposits to reduce on-demand withdrawals or suspending withdrawals altogether.

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs affecting banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops.

ICICI Bank Limited is an Indian multinational bank and financial services company headquartered in Mumbai with registered office in Vadodara. It offers a wide range of banking and financial services for corporate and retail customers through a variety of delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

Harshad Shantilal Mehta was an Indian stockbroker and a convicted fraudster. Mehta's involvement in the 1992 Indian securities scam made him infamous as a market manipulator.

Prime brokerage is the generic term for a bundled package of services offered by investment banks, wealth management firms, and securities dealers to hedge funds which need the ability to borrow securities and cash in order to be able to invest on a netted basis and achieve an absolute return. The prime broker provides a centralized securities clearing facility for the hedge fund so the hedge fund's collateral requirements are netted across all deals handled by the prime broker. These two features are advantageous to their clients.

The Silver Tongued Devil and I is the second studio album recorded by singer-songwriter Kris Kristofferson. It was produced by Fred Foster, released in July 1971 on Monument Records and followed his critically acclaimed debut Kristofferson.

The Freedman's Saving and Trust Company, known as the Freedman's Savings Bank, was a private savings bank chartered by the U.S. Congress on March 3, 1865, to collect deposits from the newly emancipated communities. The bank opened 37 branches across 17 states and Washington DC within 7 years and collected funds from over 67,000 depositors. At the height of its success, the Freedman's Savings Bank held assets worth more than $3.7 million in 1872 dollars, which translates to approximately $80 million in 2021.

The Diamond–Dybvig model is an influential model of bank runs and related financial crises. The model shows how banks' mix of illiquid assets and liquid liabilities may give rise to self-fulfilling panics among depositors. Diamond and Dybvig, along with Ben Bernanke, were the recipients of the 2022 Nobel Prize in Economics for their work on the Diamond-Dybvig model.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

The 2003 banking crisis of Myanmar was a major bank run in private banking that hit Myanmar (Burma) in February 2003. It started with a decline in the trust for private financial institutions following the collapse of small financial enterprises and proliferating rumors about the liquidity of major private banks. Leading to a bank run on the Asia Wealth Bank, the crisis quickly spread to all major private banks in the country. It led to severe liquidity problems for private banks and scarcity of the kyat. Though exact data is not available, it is believed that the crisis caused major economic hardship for many in Myanmar.

The 1992 Indian stock market scam was a market manipulation carried out by Harshad Shantilal Mehta with other bankers and politicians on the Bombay Stock Exchange. The scam caused significant disruption to the stock market of India, defrauding investors of over ten million USD.