The United States Department of Labor (DOL) is one of the executive departments of the U.S. federal government. It is responsible for the administration of federal laws governing occupational safety and health, wage and hour standards, unemployment benefits, reemployment services, and occasionally, economic statistics. It is headed by the secretary of labor, who reports directly to the president of the United States and is a member of the president's Cabinet.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

The Fair Deal was a set of proposals put forward by U.S. President Harry S. Truman to Congress in 1945 and in his January 1949 State of the Union Address. More generally, the term characterizes the entire domestic agenda of the Truman administration, from 1945 to 1953. It offered new proposals to continue New Deal liberalism, but with a conservative coalition controlling Congress, only a few of its major initiatives became law and then only if they had considerable Republican Party support. As Richard Neustadt concludes, the most important proposals were aid to education, national health insurance, the Fair Employment Practices Commission, and repeal of the Taft–Hartley Act. They were all debated at length, then voted down. Nevertheless, enough smaller and less controversial items passed that liberals could claim some success.

The term New Frontier was used by Democratic presidential candidate John F. Kennedy in his acceptance speech in the 1960 United States presidential election to the Democratic National Convention at the Los Angeles Memorial Coliseum as the Democratic slogan to inspire America to support him. The phrase developed into a label for his administration's domestic and foreign programs.

The Job Training Partnership Act of 1982 was a United States federal law passed October 13, 1982, by Congress with regulations promulgated by the United States Department of Labor during the Ronald Reagan administration. The law was the successor to the previous federal job training legislation, the Comprehensive Employment and Training Act (CETA). It was repealed by the Workforce Investment Act of 1998 during the administration of President Bill Clinton.

The Workforce Investment Act of 1998 was a United States federal law that was repealed and replaced by the 2014 Workforce Innovation and Opportunity Act.

The Employment and Training Administration (ETA) is part of the U.S. Department of Labor. Its mission is to provide training, employment, labor market information, and income maintenance services. ETA administers federal government job training and worker dislocation programs, federal grants to states for public employment service programs, and unemployment insurance benefits. These services are primarily provided through state and local workforce development systems.

Trade Adjustment Assistance (TAA) is a federal program of the United States government to act as a way to reduce the damaging impact of imports felt by certain sectors of the U.S. economy. The current structure features four components of Trade Adjustment Assistance: for workers, firms, farmers, and communities. Each cabinet-level department was tasked with a different sector of the overall Trade Adjustment Assistance program. The program for workers is the largest, and is administered by the U.S. Department of Labor. The program for farmers is administered by the U.S. Department of Agriculture, and the firms and communities programs are administered by the U.S. Department of Commerce.

Temporary Assistance for Needy Families is a federal assistance program of the United States. It began on July 1, 1997, and succeeded the Aid to Families with Dependent Children (AFDC) program, providing cash assistance to indigent American families through the United States Department of Health and Human Services. TANF is often simply referred to as welfare, but some argue this is a misnomer. Unlike AFDC, which provided a guaranteed cash benefit to eligible families, TANF is a block grant to states that creates no federal entitlement to welfare and is used by states to provide non-welfare services, including educational services, to employed people.

The Oklahoma Employment Security Commission (OESC) is an independent agency of the state of Oklahoma responsible for providing employment services to the citizens of Oklahoma. The commission is part of a national network of employment service agencies and is funded by money from the United States Department of Labor. The commission is also responsible for administering the Workforce Investment Act of 1998 on behalf of the state.

The Rehabilitation Services Administration (RSA) is a federal agency under the United States Department of Education, Office of Special Education and Rehabilitative Services, and is headquartered within the Department of Education in Washington, D.C. It was established to administer portions of the Rehabilitation Act of 1973. Its mission is to provide leadership and resources to assist state and other agencies in providing vocational rehabilitation (VR) and other services to individuals with disabilities to maximize their employment, independence and integration into the community and the competitive labor market.

The New York State Department of Labor is the department of the New York state government that enforces labor law and administers unemployment benefits.

Workforce Innovation in Regional Economic Development (WIRED) was a project of the United States Department of Labor. It provided a new approach to workforce and economic development. Through the WIRED model, regions integrated economic and workforce development activities to demonstrate that talent development can drive economic transformation in regional economies across the United States.

The United States spends approximately $2.3 trillion on federal and state social programs include cash assistance, health insurance, food assistance, housing subsidies, energy and utilities subsidies, and education and childcare assistance. Similar benefits are sometimes provided by the private sector either through policy mandates or on a voluntary basis. Employer-sponsored health insurance is an example of this.

The Older Americans Act of 1965 was the first federal level initiative aimed at providing comprehensive services for older adults. It created the National Aging Network comprising the Administration on Aging on the federal level, State Units on Aging at the state level, and Area Agencies on Aging at the local level. The network provides funding—based primarily on the percentage of an area's population 60 and older—for nutrition and supportive home and community-based services, disease prevention/health promotion services, elder rights programs, the National Family Caregiver Support Program, and the Native American Caregiver Support Program.

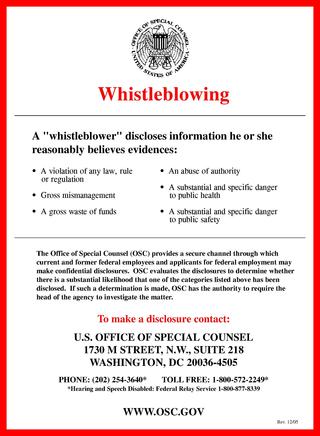

A whistleblower is a person who exposes any kind of information or activity that is deemed illegal, unethical, or not correct within an organization that is either private or public. The Whistleblower Protection Act was made into federal law in the United States in 1989.

The Workforce Innovation and Opportunity Act (WIOA) is a United States public law that replaced the previous Workforce Investment Act of 1998 (WIA) as the primary federal workforce development legislation to bring about increased coordination among federal workforce development and related programs.

Unemployment insurance in the United States, colloquially referred to as unemployment benefits, refers to social insurance programs which replace a portion of wages for individuals during unemployment. The first unemployment insurance program in the U.S. was created in Wisconsin in 1932, and the federal Social Security Act of 1935 created programs nationwide that are administered by state governments. The constitutionality of the program was upheld by the Supreme Court in 1937.

The Consolidated Appropriations Act, 2018 is a United States omnibus spending bill for the United States federal government for fiscal year 2018 enacted by the 115th United States Congress and signed into law by President Donald Trump on March 23, 2018.

Dislocated worker funding is typically used to help workers in events of mass employment loss. A dislocated or displaced worker is defined as an individual who has been laid off or received notice of a potential layoff and has very little chance of finding employment in their current occupation when attempting to return to the workforce. Displaced workers are most frequently found in the manufacturing industry. Legislation addressing training for these workers was first introduced in 1959 through the passing of the Area Redevelopment Act of 1959. Over the years, legislation funding these programs has included wording holding states and private businesses accountable for the roles in the dislocation of workers. Due to the importance of this funding and the negative economic impact of displaced workers, the United States has passed continuing legislation as recent as 2014 and 2015.