Electronic data interchange (EDI) is the concept of businesses electronically communicating information that was traditionally communicated on paper, such as purchase orders and invoices. Technical standards for EDI exist to facilitate parties transacting such instruments without having to make special arrangements.

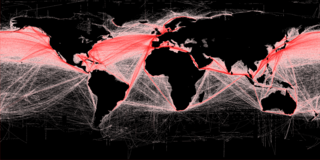

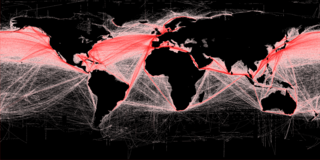

Freight transport is the physical process of transporting commodities and merchandise goods and cargo. The term shipping originally referred to transport by sea but in American English, it has been extended to refer to transport by land or air as well. "Logistics", a term borrowed from the military environment, is also used in the same sense.

Material requirements planning (MRP) is a production planning, scheduling, and inventory control system used to manage manufacturing processes. Most MRP systems are software-based, but it is possible to conduct MRP by hand as well.

Embezzlement is the act of withholding assets for the purpose of conversion of such assets, by one or more persons to whom the assets were entrusted, either to be held or to be used for specific purposes. Embezzlement is a type of financial fraud. For example, a lawyer might embezzle funds from the trust accounts of their clients; a financial advisor might embezzle the funds of investors; and a husband or a wife might embezzle funds from a bank account jointly held with the spouse.

In economics, the word cargo refers in particular to goods or produce being conveyed—generally for commercial gain—by water, air or land. "Freight" is the money paid to carry cargo. Cargo was originally a shipload. Cargo now covers all types of freight, including that carried by rail, van, truck, or intermodal container. The term cargo is also used in case of goods in the cold-chain, because the perishable inventory is always in transit towards a final end-use, even when it is held in cold storage or other similar climate-controlled facility. The term freight is commonly used to describe the movements of flows of goods being transported by any mode of transportation.

FOB is a term in international commercial law specifying at what point respective obligations, costs, and risk involved in the delivery of goods shift from the seller to the buyer under the Incoterms standard published by the International Chamber of Commerce. FOB is only used in non-containerized sea freight or inland waterway transport. As with all Incoterms, FOB does not define the point at which ownership of the goods is transferred.

Cheque fraud, or check fraud, refers to a category of criminal acts that involve making the unlawful use of cheques in order to illegally acquire or borrow funds that do not exist within the account balance or account-holder's legal ownership. Most methods involve taking advantage of the float to draw out these funds. Specific kinds of cheque fraud include cheque kiting, where funds are deposited before the end of the float period to cover the fraud, and paper hanging, where the float offers the opportunity to write fraudulent cheques but the account is never replenished.

Retail loss prevention is a set of practices employed by retail companies to preserve profit. Profit preservation is any business activity specifically designed to reduce preventable losses. A preventable loss is any business cost caused by deliberate or inadvertent human actions, colloquially known as "shrinkage". Loss prevention is mainly found within the retail sector but also can be found within other business environments.

The Fair and Accurate Credit Transactions Act of 2003 is a United States federal law, passed by the United States Congress on November 22, 2003, and signed by President George W. Bush on December 4, 2003, as an amendment to the Fair Credit Reporting Act. The act allows consumers to request and obtain a free credit report once every 12 months from each of the three nationwide consumer credit reporting companies. In cooperation with the Federal Trade Commission, the three major credit reporting agencies set up the web site AnnualCreditReport.com to provide free access to annual credit reports.

Less-than-truckload shipping or less than load (LTL) is the transportation of relatively small freight. The alternatives to LTL carriers are parcel carriers or full truckload carriers. Parcel carriers usually handle small packages and freight that can be broken down into units less than 150 pounds (68 kg). Full truckload carriers move freight that is loaded into a semi-trailer. Semi-trailers are typically between 26 and 53 feet and require a substantial amount of freight to make such transportation economical.

A chargeback is a return of money to a payer of some transaction, especially a credit card transaction.

An overdraft occurs when money is withdrawn in excess of what is on the current account. In this situation the account is said to be "overdrawn". If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

An air waybill (AWB) or air consignment note is a receipt issued by an international airline for goods and an evidence of the contract of carriage. It is not a document of title to the goods. The air waybill is non-negotiable.

In accounting, inventory shrinkage occurs when a retailer has fewer items in stock than in the inventory list due to clerical error, goods being damaged, lost, or stolen between the point of manufacture and the point of sale. This affects profit: if shrinkage is large, profits decrease. This leads retailers to increase prices to make up for losses, passing the cost of shrinkage onto customers.

Unreported employment, also known as money under the table, working under the table, off the books, cash-in-hand, or illicit work is illegal employment that is not reported to the government. The employer or the employee often does so for tax evasion or avoiding and violating other laws such as obtaining unemployment benefits while being employed. The working contract is made without social security costs, and does typically not provide health insurance, paid parental leave, paid vacation or pension funds. It is a part of what has been called the underground economy, shadow economy, black market or the non-observed economy.

Order processing is the process or work-flow associated with the picking, packing and delivery of the packed items to a shipping carrier and is a key element of order fulfillment. Order processing operations or facilities are commonly called "distribution centers" or "DC's". There are wide variances in the level of automation associating to the "pick-pack-and-ship" process, ranging from completely manual and paper-driven to highly automated and completely mechanized; computer systems overseeing this process are generally referred to as Warehouse Management Systems or "WMS".

A shipping container is a container with strength suitable to withstand shipment, storage, and handling. Shipping containers range from large reusable steel boxes used for intermodal shipments to the ubiquitous corrugated boxes. In the context of international shipping trade, "container" or "shipping container" is virtually synonymous with "intermodal freight container," a container designed to be moved from one mode of transport to another without unloading and reloading.

Memory gaps and errors refer to the incorrect recall, or complete loss, of information in the memory system for a specific detail and/or event. Memory errors may include remembering events that never occurred, or remembering them differently from the way they actually happened. These errors or gaps can occur due to a number of different reasons, including the emotional involvement in the situation, expectations and environmental changes. As the retention interval between encoding and retrieval of the memory lengthens, there is an increase in both the amount that is forgotten, and the likelihood of a memory error occurring.

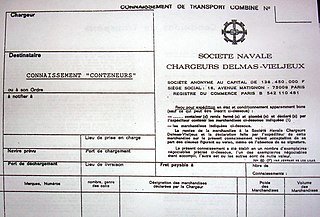

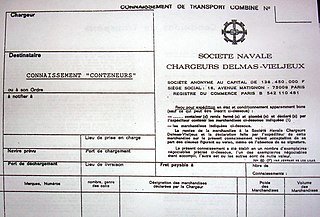

A bill of lading is a document issued by a carrier to acknowledge receipt of cargo for shipment. Although the term historically related only to carriage by sea, a bill of lading may today be used for any type of carriage of goods. Bills of lading are one of three crucial documents used in international trade to ensure that exporters receive payment and importers receive the merchandise. The other two documents are a policy of insurance and an invoice. Whereas a bill of lading is negotiable, both a policy and an invoice are assignable. In international trade outside the United States, bills of lading are distinct from waybills in that the latter are not transferable and do not confer title. Nevertheless, the UK Carriage of Goods by Sea Act 1992 grants "all rights of suit under the contract of carriage" to the lawful holder of a bill of lading, or to the consignee under a sea waybill or a ship's delivery order.

A shock detector or impact monitor is a device which indicates whether a physical shock or impact has occurred. These usually have a binary output (go/no-go) and are sometimes called shock overload devices. Shock detectors can be used on shipments of fragile valuable items to indicate whether a potentially damaging drop or impact may have occurred. They are also used in sports helmets to help estimate if a dangerous impact may have occurred.