A pension is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement.

Michael Joseph Savage was a New Zealand politician who served as the 23rd prime minister of New Zealand, heading the First Labour Government from 1935 until his death in 1940.

Social services are a range of public services intended to provide support and assistance towards particular groups, which commonly include the disadvantaged. They may be provided by individuals, private and independent organisations, or administered by a government agency. Social services are connected with the concept of welfare and the welfare state, as countries with large welfare programs often provide a wide range of social services. Social services are employed to address the wide range of needs of a society. Prior to industrialisation, the provision of social services was largely confined to private organisations and charities, with the extent of its coverage also limited. Social services are now generally regarded globally as a 'necessary function' of society and a mechanism through which governments may address societal issues.

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed, as opposed to social assistance programs which provide support on the basis of need alone. The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

Sir Arnold Henry Nordmeyer was a New Zealand politician. He served as Minister of Finance (1957–1960) and later as Leader of the Labour Party and Leader of the Opposition (1963–1965).

Harold Wilson was appointed Prime Minister of the United Kingdom by Queen Elizabeth II on 16 October 1964 and formed the first Wilson ministry, a Labour government, which held office with a thin majority between 1964 and 1966. In an attempt to gain a workable majority in the House of Commons, Wilson called a new election for 31 March 1966, after which he formed the second Wilson ministry, a government which held office for four years until 1970.

The Old-Age Pensions Act 1908 is an Act of Parliament of the United Kingdom of Great Britain and Ireland, passed in 1908. The Act is often regarded as one of the foundations of modern social welfare in both the present-day United Kingdom and the Irish Republic and forms part of the wider social welfare reforms of the Liberal Government of 1906–1914.

Social welfare has long been an important part of New Zealand society and a significant political issue. It is concerned with the provision by the state of benefits and services. Together with fiscal welfare and occupational welfare, it makes up the social policy of New Zealand. Social welfare is mostly funded through general taxation. Since the 1980s welfare has been provided on the basis of need; the exception is universal superannuation.

The Liberal Government of New Zealand was the first responsible government in New Zealand politics organised along party lines. The government formed following the founding of the Liberal Party and took office on 24 January 1891, and governed New Zealand for over 21 years until 10 July 1912. To date, it is the longest-serving government in New Zealand's history. The government was also historically notable for enacting significant social and economic changes, such as the Old Age Pensions Act and women's suffrage. One historian described the policies of the government as "a revolution in the relationship between the government and the people".

The Ministry of Social Development (MSD) (Māori: Te Manatū Whakahiato Ora) is the public service department of New Zealand charged with advising the government on social policy, and providing social services.

The Third Labour Government of New Zealand was the government of New Zealand from 1972 to 1975. During its time in office, it carried out a wide range of reforms in areas such as overseas trade, farming, public works, energy generation, local government, health, the arts, sport and recreation, regional development, environmental protection, education, housing, and social welfare. Māori also benefited from revisions to the laws relating to land, together with a significant increase in a Māori and Island Affairs building programme. In addition, the government encouraged biculturalism and a sense of New Zealand identity. However, the government damaged relations between Pākehā and Pasifika New Zealanders by instituting the Dawn Raids on alleged overstayers from the Pacific Islands; the raids have been described as "the most blatantly racist attack on Pacific peoples by the New Zealand government in New Zealand’s history". The government lasted for one term before being defeated a year after the death of its popular leader, Norman Kirk.

The Second Labour Government of New Zealand was the government of New Zealand from 1957 to 1960. It was most notable for raising taxes on alcohol, cigarettes and petrol, a move which was probably responsible for the government lasting for only one term. It was headed by the Prime Minister Walter Nash.

The First Labour Government of New Zealand was the government of New Zealand from 1935 to 1949. Responsible for the realisation of a wide range of progressive social reforms during its time in office, it set the tone of New Zealand's economic and welfare policies until the 1980s, establishing a welfare state, a system of Keynesian economic management, and high levels of state intervention. The government came to power towards the end of, and as a result of, the Great Depression of the 1930s, and also governed the country throughout World War II.

Social security, in Australia, refers to a system of social welfare payments provided by Australian Government to eligible Australian citizens, permanent residents, and limited international visitors. These payments are almost always administered by Centrelink, a program of Services Australia. In Australia, most payments are means tested.

Social security in India includes a variety of statutory insurances and social grant schemes bundled into a formerly complex and fragmented system run by the Indian government at the federal and the state level and is divided into three categories: non-contributory and tax-payer-funded, employer-funded and lastly, joint-funded. The system has since been universalised with the passing of The Code on Social Security, 2020. These cover most of the Indian population with adequate social protection in various situations in their lives. The Indian social security system is considered to be one of the most generous in the world amongst developing countries. The Central Government of India's social security and welfare expenditures are a substantial portion of the official budget and as well as the budgets of social security bodies, and state and local governments play roles in developing and implementing social security policies. Additional welfare measure systems are also uniquely operated by various state governments. The government uses the unique identity number (Aadhar) that every Indian possesses to distribute welfare measures in India. The comprehensive social protection system of India can be categorised as the follows: social assistance and mandatory social security contributory schemes mostly related to employment. The Code on Social Security, 2020 is part of the Indian labor code that deals with employees' social security and have provisions on retirement pension and provident fund, healthcare insurance and medical benefits, sick pay and leaves, unemployment benefits and paid parental leaves. The largest social security programs backed by The Code on Social Security, 2020 are the Employees' Provident Fund Organisation for retirement pension, provident fund, life and disability insurance and the Employees' State Insurance for healthcare and unemployment benefits along with sick pays. There is also the National Pension System which is increasingly gaining popularity. These are funded through social insurance contributions on the payroll. While the National Food Security Act, 2013, that assures food security to all Indians, is funded through the general taxation. With the passing of the social security code by the Indian Parliament, the fragmented social security system was universalised, resembling the social security systems of most developed countries.

The Beveridge Report, officially entitled Social Insurance and Allied Services, is a government report, published in November 1942, influential in the founding of the welfare state in the United Kingdom. It was drafted by the Liberal economist William Beveridge – with research and publicity by his wife, mathematician Janet Beveridge – who proposed widespread reforms to the system of social welfare to address what he identified as "five giants on the road of reconstruction": "Want… Disease, Ignorance, Squalor and Idleness". Published in the midst of World War II, the report promised rewards for everyone's sacrifices. Overwhelmingly popular with the public, it formed the basis for the post-war reforms known as the welfare state, which include the expansion of National Insurance and the creation of the National Health Service.

The "Dancing Cossacks" television advertisement was a 1975 electoral advertisement for the New Zealand National Party, produced by advertising agency Colenso. The first half of the advertisement was animated by Hanna-Barbera, with the second half featuring National Party leader Robert Muldoon. The advert was produced to be highly critical of the governing New Zealand Labour Party's recently introduced compulsory superannuation scheme, implying the scheme would eventually turn New Zealand into a Soviet-style communist state, and urged people to vote for National in the upcoming general election.

The Department of Labour and Employment of state of Tamil Nadu is one of the Department of Government of Tamil Nadu

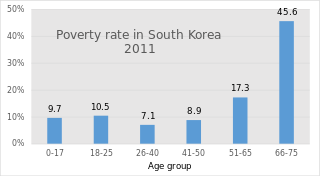

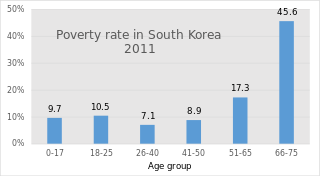

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.