Related Research Articles

A pension is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement.

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income.

The economy of the Netherlands is the 17th largest in the world in 2021 according to the World Bank and the International Monetary Fund. Its GDP per capita was estimated at $57,101 in the fiscal year 2019/20, which makes it one of the highest-earning nations in the world. Between 1996 and 2000, annual economic growth (GDP) averaged over 4%, well above the European average of 2.5% at the time. Growth slowed considerably in 2001–05 as part of the early 2000s recession. The years 2006 and 2007 however showed economic growth of 3-4% per annum. The Dutch economy was hit considerably by the financial crisis of 2007–2008, and the ensuing European sovereign-debt crisis.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

Taxation in France is determined by the yearly budget vote by the French Parliament, which determines which kinds of taxes can be levied and which rates can be applied.

Social security is divided by the French government into five branches: illness; old age/retirement; family; work accident; and occupational disease. From an institutional point of view, French social security is made up of diverse organismes. The system is divided into three main Regimes: the General Regime, the Farm Regime, and the Self-employed Regime. In addition there are numerous special regimes dating from prior to the creation of the state system in the mid-to-late 1940s.

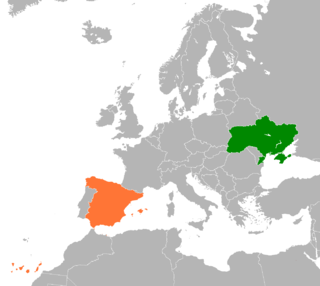

Relations between Spain and Ukraine were established in January 1992, some time after the Ukrainian independence.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone member states were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis, it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country.

Pensions in France fall into five major divisions;

Pensions in Germany are based on a “three pillar system”.

Pensions in Spain consist of a mandatory state pension scheme, and voluntary company and individual pension provision.

The National Social Security Administration is a decentralized Argentine Government social insurance agency managed under the aegis of the Ministry of Health and Social Development. The agency is the principal administrator of social security and other social benefits in Argentina, including family and childhood subsidies, and unemployment insurance.

The French Pension Reserve Fund is a public entity created by law n°2001-624 dated 17 July 2001. Its mission is to invest monies entrusted to it by the public authorities on behalf of the community with the aim of financing the pension system. Its investment policy is to optimize returns on the investments it makes as prudently as possible. Its policy must be consistent with those collective values that are designed to promote balanced economic, social and environmental development.

The Toledo Pact was an ambitious reform of the Spanish social security system approved by the Spanish parliament on 6 April 1995, aimed at streamlining and guaranteeing the future of the Spanish social security system. The background to the reform was a series of recommendations by the World Bank in 1987 and the Delors White Paper in 1993.

The Ministry of Labour, Employment and Social Security is a ministry of the Argentine Government tasked with overseeing the country's public policies on labour conditions, employment and social security.

The Guatemalan Institute of Social Security is the branch of the Guatemalan Ministry of Work and Social Provision that provides Hospital and Clinical services; pensions and income protection benefits, and employment counseling for salaried employees in Guatemala.

The Nicaraguan Social Security Institute oversees the Nicaraguan social security system. It was legally established in 1956 and first implemented in 1957.

José Luis Escrivá Belmonte is a Spanish economist currently serving as minister of Inclusion, Social Security and Migration within the Second Cabinet of Pedro Sánchez.

References

- ↑ http://www.tt.mtin.es/periodico/documentos/Recomen%20Pacto%20Toledo.htm Archived 1 October 2011 at the Wayback Machine (Spanish)

- ↑ http://www.seg-social.es/prdi00/groups/public/documents/binario/130893.pdf [ bare URL PDF ]

- ↑ "Seguridad social 2010". Archived from the original on 23 June 2011. Retrieved 19 November 2013.

- ↑ "Revista Seguridad Social Activa - las cifras claras". Archived from the original on 26 December 2013. Retrieved 19 November 2013.

- ↑ "El Fondo de Reserva de la Seguridad Social costeará el 10% del gasto en pensiones contributivas en 2014". 3 October 2013.

- ↑ Web Seguridad Social - Report to Parliament 2018