Related Research Articles

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories.

Fiona Ma is an American politician and Certified Public Accountant who has been serving as the California State Treasurer since January 7, 2019. She previously served as a member of the California Board of Equalization from 2015 to 2019, the California State Assembly (2006–2012), and the San Francisco Board of Supervisors (2002–2006).

Municipalization is the transfer of private entities, assets, service providers, or corporations to public ownership by a municipality, including a city, county, or public utility district ownership. The transfer may be from private ownership or from other levels of government. It is the opposite of privatization and is different from nationalization. The term municipalization largely refers to the transfer of ownership of utilities from Investor Owned Utilities (IOUs) to public ownership, and operation, by local government whether that be at the city, county or state level. While this is most often applied to electricity it can also refer to solar energy, water, sewer, trash, natural gas or other services.

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike general obligation bonds, only the revenues specified in the legal contract between the bond holder and bond issuer are required to be used for repayment of the principal and interest of the bonds; other revenues and the general credit of the issuing agency are not so encumbered. Because the pledge of security is not as great as that of general obligation bonds, revenue bonds may carry a slightly higher interest rate than G.O. bonds; however, they are usually considered the second-most secure type of municipal bonds.

Community Choice Aggregation (CCA), also known as Community Choice Energy, municipal aggregation, governmental aggregation, electricity aggregation, and community aggregation, is an alternative to the investor owned utility energy supply system in which local entities in the United States aggregate the buying power of individual customers within a defined jurisdiction in order to secure alternative energy supply contracts. The CCA chooses the power generation source on behalf of the consumers.

A power purchase agreement (PPA), or electricity power agreement, is a contract between two parties, one which generates electricity and one which is looking to purchase electricity. The PPA defines all of the commercial terms for the sale of electricity between the two parties, including when the project will begin commercial operation, schedule for delivery of electricity, penalties for under delivery, payment terms, and termination. A PPA is the principal agreement that defines the revenue and credit quality of a generating project and is thus a key instrument of project finance. There are many forms of PPA in use today and they vary according to the needs of buyer, seller, and financing counter parties.

Yingli, formally Yingli Green Energy Holding Company Limited -. Yingli Green Energy Holding Company Limited, known as "Yingli Solar," is a solar panel manufacturer. Yingli Green Energy's manufacturing covers the photovoltaic value chain from ingot casting and wafering through solar cell production and solar panel assembly. Yingli's photovoltaic module capacity is 4 GWs.

Sopogy was a solar thermal technology supplier founded in 2002 at the Honolulu, Hawaii-based clean technology incubator known as Energy Laboratories. The company began its research on concentrating solar thermal energy to produce solar steam and thermal heat for absorption chillers or industrial process heat. The company has also developed applications that incorporate its solar collectors to generate electricity and desalination. Sopogy's name origin comes from industry key words "So" from solar "po" from power and "gy" from energy and technology. The company has its OEM and IPP sales teams along with research and development located in Honolulu, and in 2006 expanded its manufacturing, C&I and oil and gas sales teams in its Silicon Valley facility. Pacific Business News and Greentech Media reported that the VC-funded micro-concentrator solar power firm was shutting down operations based on statements from its President David Fernandez, however Hitachi Power Systems acquired Sopogy in a private transaction in 2014.

Conservation finance is the practice of raising and managing capital to support land, water, and resource conservation. Conservation financing options vary by source from public, private, and nonprofit funders; by type from loans, to grants, to tax incentives, to market mechanisms; and by scale ranging from federal to state, national to local.

SolarCity Corporation was a publicly traded company headquartered in Fremont, California that sold and installed solar energy generation systems as well as other related products and services to residential, commercial and industrial customers. The company was founded on July 4, 2006, by Peter and Lyndon Rive, the cousins of Tesla, Inc. CEO Elon Musk. Tesla acquired SolarCity in 2016, at a cost of approximately $2.6 billion and reorganized its solar business into Tesla Energy.

California Proposition 7, would have required California utilities to procure half of their power from renewable resources by 2025. In order to make that goal, levels of production of solar, wind and other renewable energy resources would more than quadruple from their current output of 10.9%. It would also require California utilities to increase their purchase of electricity generated from renewable resources by 2% annually to meet Renewable Portfolio Standard (RPS) requirements of 40% in 2020 and 50% in 2025. Current law AB32 requires an RPS of 20% by 2010.

PACE financing is a means used in the United States of America of financing energy efficiency upgrades, disaster resiliency improvements, water conservation measures, or renewable energy installations of residential, commercial, and industrial property owners. Depending on state legislation, PACE financing can be used to finance building envelope energy efficiency improvements such as insulation and air sealing, cool roofs, water efficiency products, seismic retrofits, and hurricane preparedness measures. In some states, commercial PACE financing can also fund a portion of new construction projects, as long as the building owner agrees to build the new structure to exceed the local energy code.

Climate bonds are fixed-income financial instruments (bonds) which are used to fund projects that have positive environmental and/or climate benefits. They follow the Green Bond Principles stated by the International Capital Market Association (ICMA), and the proceeds from the issuance of which are to be used for the pre-specified types of projects.

CleanPowerSF is the City and County of San Francisco's Community Choice Aggregation (CCA) program, whose purpose is to significantly increase the proportion of electrical energy supplied to the San Francisco electrical grid from local renewable sources, decrease San Francisco's greenhouse gas (GHG) emissions, and help combat global climate change, while meeting or exceeding California's Renewable Portfolio Standard (RPS). The RPS requires that 33% of energy supplied by "investor-owned utilities, electric service providers, and community choice aggregators" should be from eligible renewable sources by 2020.

Willdan Group, Inc. (Willdan) is an American publicly traded company selling professional technical and consulting services to public and private utilities, public agencies at all levels of government, and commercial and industrial firms. The company operates offices in more than a dozen states, with its key operations in California and New York.

Sustainable Energy Utility (SEU) is a community-based model of development based on energy conservation and the use of renewables, seeking to permanently decrease the use of source materials, water, and energy. The model prescribes the creation of independent and financially self-sufficient non-profit entities for energy sustainability through conservation, efficiency, and end-user based decentralized renewable energy in an effort to address concerns about climate change, rising energy prices, inequity of energy availability, and a lack of community governance of energy development. The SEU model was developed by Dr. J. Byrne at the Center for Energy and Environmental Policy, University of Delaware. The Foundation for Renewable Energy and Environment (FREE) is implementing versions of the model.

Richard L. Kauffman is the first New York State "energy czar," officially referred to as the Chairman of Energy and Finance for New York in the administration of New York Governor Andrew Cuomo. In this role, Kauffman is New York State's most senior energy official, responsible for all aspects of energy policy and agency operation, and leads the state's "Reforming the Energy Vision" initiative.

A green bank is a financial institution, typically public or quasi-public, that uses innovative financing techniques and market development tools in partnership with the private sector to accelerate deployment of clean energy technologies. Green banks use public funds to leverage private investment in clean energy technologies that, despite being commercially viable, have struggled to establish a widespread presence in consumer markets. Green banks seek to reduce energy costs for ratepayers, stimulate private sector investment and economic activity, and expedite the transition to a low-carbon economy.

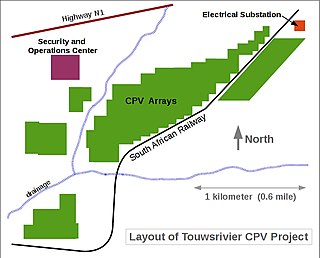

Touwsrivier CPV Solar Project is a 44 MWp (36 MWAC) concentrator photovoltaics (CPV) power station located 13 km outside the town of Touwsrivier in the Western Cape of South Africa. The installation reached full capacity in December 2014 and is the second largest operating CPV facility in the world. Electricity produced by the plant is fed into the national grid operated by Eskom under a 20-year power purchase agreement (PPA).

A consumer green energy program is a program that enables households to buy energy from renewable sources. By allowing consumers to purchase renewable energy, it simultaneously diverts the utilization of fossil fuels and promotes the use of renewable energy sources such as solar and wind.

References

- ↑ "LOCAL POWER: Text of San Francisco 'H Bond' Authority".

- ↑ "Financing Green Projects" . Retrieved 13 January 2014.

- ↑ "San Francisco's Green Power Plan Still Stalled by Corporate Interests a Decade Later" . Retrieved 13 January 2014.

- ↑ "The Bottom Line" . Retrieved 13 January 2014.

- ↑ "$1 Million RESCO Grant Approved for Energy Independence Projects" . Retrieved 13 January 2014.