Related Research Articles

Cost accounting is defined by the Institute of Management Accountants as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, allocating, aggregating and reporting such costs and comparing them with standard costs". Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future.

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions.

The historical cost of an asset at the time it is acquired or created is the value of the costs incurred in acquiring or creating the asset, comprising the consideration paid to acquire or create the asset plus transaction costs. Historical cost accounting involves reporting assets and liabilities at their historical costs, which are not updated for changes in the items' values. Consequently, the amounts reported for these balance sheet items often differ from their current economic or market values.

Inventory or stock refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation.

Cost of goods sold (COGS) is the carrying value of goods sold during a particular period.

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore, this model assigns more indirect costs (overhead) into direct costs compared to conventional costing.

In accounting and economics, fixed costs, also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be recurring, such as interest or rents being paid per month. These costs also tend to be capital costs. This is in contrast to variable costs, which are volume-related and unknown at the beginning of the accounting year. Fixed costs have an effect on the nature of certain variable costs.

Throughput accounting (TA) is a principle-based and simplified management accounting approach that provides managers with decision support information for enterprise profitability improvement. This approach that identifies factors which limit an organization's ability to reach its goals, and then focuses on simple measures that drive behavior in key areas towards reaching organizational goals. TA was proposed by Eliyahu M. Goldratt as an alternative to traditional cost accounting. As such, Throughput Accounting is neither cost accounting nor costing because it is cash focused and does not allocate all costs to products and services sold or provided by an enterprise. Considering the laws of variation, only costs that vary totally with units of output e.g. raw materials, are allocated to products and services which are deducted from sales to determine Throughput. Throughput Accounting is a management accounting technique used as the performance measure in the Theory of Constraints (TOC). It is the business intelligence used for maximizing profits, however, unlike cost accounting that primarily focuses on 'cutting costs' and reducing expenses to make a profit, Throughput Accounting primarily focuses on generating more throughput. Conceptually, Throughput Accounting seeks to increase the speed or rate at which throughput is generated by products and services with respect to an organization's constraint, whether the constraint is internal or external to the organization. Throughput Accounting is the only management accounting methodology that considers constraints as factors limiting the performance of organizations.

Contribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. "Contribution" represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. This concept is one of the key building blocks of break-even analysis.

In accounting and economics, a semi-variable cost is an expense which contains both a fixed-cost component and a variable-cost component. It is often used to project financial performance at different scales of production. It is related to the scale of production within the business where there is a fixed cost which remains constant across all scales of production while the variable cost increases proportionally to production levels.

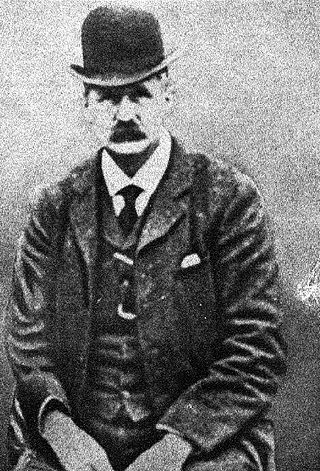

Alexander Hamilton Church was an English efficiency engineer, accountant and writer on accountancy and management, known for his seminal work of management and cost accounting.

The Accounting Principles Board (APB) is the former authoritative body of the American Institute of Certified Public Accountants (AICPA). It was created by the American Institute of Certified Public Accountants in 1959 and issued pronouncements on accounting principles until 1973, when it was replaced by the Financial Accounting Standards Board (FASB).

Total absorption costing (TAC) is a method of Accounting cost which entails the full cost of manufacturing or providing a service. TAC includes not just the costs of materials and labour, but also of all manufacturing overheads. The cost of each cost center can be direct or indirect. The direct cost can be easily identified with individual cost centers. Whereas indirect cost cannot be easily identified with the cost center. The distribution of overhead among the departments is called apportionment.

Management accounting principles (MAP) were developed to serve the core needs of internal management to improve decision support objectives, internal business processes, resource application, customer value, and capacity utilization needed to achieve corporate goals in an optimal manner. Another term often used for management accounting principles for these purposes is managerial costing principles. The two management accounting principles are:

- Principle of Causality and,

- Principle of Analogy.

Emile Oscar Garcke was a naturalised British electrical engineer, industrial, commercial and political entrepreneur managing director of the British Electric Traction Company (BET), and early author on accounting. who is noted for writing the earliest standard text on cost accounting in 1887.

Joseph Slater Lewis MICE FRSE was a British engineer, inventor, business manager, and early author on management and accounting, known for his pioneering work on cost accounting.

Jerome Lee Nicholson was an American accountant, industrial consultant, author and educator at the New York University and Columbia University, known as pioneer in cost accounting. He is considered in the United States to be the "father of cost accounting."

George Pepler Norton was a British accountant, known for the publication of his 1889 Textile Manufacturers' Bookkeeping, which contributed to the establishment of modern cost accounting.

John Whitmore was an American accountant, lecturer, and disciple of Alexander Hamilton Church, known for presenting "the first detailed description of a standard cost system."

George Charter Harrison was an Anglo-American management consultant and cost account pioneer, known for designing one of the earliest known complete standard cost systems.

References

- ↑ Richard Vangermeersch. "Control: Classic model," in: History of Accounting: An International Encyclopedia. Michael Chatfield, Richard Vangermeersch eds. 1996/2014. p. 174-75.

- ↑ Thomas Downie (1927). The mechanism of standard (or predetermined) cost accounting and efficiency records. p. 7, p. 54

- ↑ Adolph Matz (1962) Cost accounting. p. 584.

- ↑ Statler, Elaine; Grabel, Joyce (2016). "2016". The Master Guide to Controllers' Best Practices. 10 Paragon Drive, Suite 1, Montvale, NJ 07645-1760: The Association of Acccountants and Financial Professionals in Business. p. 352. ISBN 978-0-996-72932-1.

{{cite book}}: CS1 maint: location (link)". - ↑ Solomons, David. "Costing Pioneers: Some Links with the Past*." The Accounting Historians Journal 21.2 (1994): 136.

- ↑ Michael Chatfield. "Whitmore, John," in: History of Accounting: An International Encyclopedia. Michael Chatfield, Richard Vangermeersch eds. 1996/2014. p. 607-8.

- ↑ Michael Chatfield. "Harrison, G. Charter 1881-," in: Michael Chatfield, Richard Vangermeersch (eds.), The History of Accounting (RLE Accounting): An International Encyclopedia 2014. p. 291.