Related Research Articles

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations etc. The recipient incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed.

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries.

A payday loan is a short-term unsecured loan, often characterized by high interest rates.

The Federal Home Loan Mortgage Corporation (FHLMC), known as Freddie Mac, is a public government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia. Freddie Mac is ranked No. 41 on the 2020 Fortune 500 list of the largest United States corporations by total revenue, and has $2.063 trillion in assets under management.

Bill Dedman is a Pulitzer Prize-winning American journalist, an investigative reporter for Newsday, and co-author of the biography of reclusive heiress Huguette Clark, Empty Mansions: The Mysterious Life of Huguette Clark and the Spending of a Great American Fortune.

College tuition in the United States is the privately borne cost of higher education collected by educational institutions in the United States. This does not include the portion that is paid through taxes or from other government funds or that is paid from university endowment funds or gifts through scholarships or grants. Tuition for college has increased as the value, quality, and quantity of education have also increased. These increases have occasionally been controversial.

The Higher Education Act of 1965 (HEA) was legislation signed into United States law on November 8, 1965, as part of President Lyndon Johnson's Great Society domestic agenda. Johnson chose Texas State University, his alma mater, as the signing site. The law was intended "to strengthen the educational resources of our colleges and universities and to provide financial assistance for students in postsecondary and higher education". It increased federal money given to universities, created scholarships, gave low-interest loans for students, and established a National Teachers Corps. The "financial assistance for students" is covered in Title IV of the HEA.

Gary Gensler is an American former investment banker, and former government official who is now the chairman of the U.S. Securities and Exchange Commission. Gensler previously led the Biden–Harris transition's Federal Reserve, Banking and Securities Regulators agency review team. He is also a professor in the practice at the MIT Sloan School of Management.

A private student loan is a financing option for higher education in the United States that can supplement, but should not replace, federal loans, such as Stafford loans, Perkins loans and PLUS loans. Private loans, which are heavily advertised, do not have the forbearance and deferral options available with federal loans. In contrast with federal subsidized loans, interest accrues while the student is in college, although repayment may not begin until after graduation. While unsubsidized federal loans do have interest charges while the student is studying, private student loan rates are often higher, sometimes much higher. Fees vary greatly, and legal cases have reported collection charges reaching 50% of amount of the loan. Since 2011, most private student loans are offered with zero fees, effectively rolling the fees into the interest rates.

Peer-to-peer lending, also abbreviated as P2P lending, is the practice of lending money to individuals or businesses through online services that match lenders with borrowers. Peer-to-peer lending companies often offer their services online, and attempt to operate with lower overhead and provide their services more cheaply than traditional financial institutions. As a result, lenders can earn higher returns compared to savings and investment products offered by banks, while borrowers can borrow money at lower interest rates, even after the P2P lending company has taken a fee for providing the match-making platform and credit checking the borrower. There is the risk of the borrower defaulting on the loans taken out from peer-lending websites.

Mortgage fraud refers to an intentional misstatement, misrepresentation, or omission of information relied upon by an underwriter or lender to fund, purchase, or insure a loan secured by real property.

Kiva is a 501(c)(3) non-profit organization headquartered in San Francisco, California that allows people to lend money via the Internet to low-income entrepreneurs and students in 77 countries. Kiva's mission is "to expand financial access to help underserved communities thrive."

A title loan is a type of secured loan where borrowers can use their vehicle title as collateral. Borrowers who get title loans must allow a lender to place a lien on their car title, and temporarily surrender the hard copy of their vehicle title, in exchange for a loan amount. When the loan is repaid, the lien is removed and the car title is returned to its owner. If the borrower defaults on their payments then the lender is liable to repossess the vehicle and sell it to repay the borrowers’ outstanding debt.

Student loans are a form of financial aid used to help students access higher education. Student loan debt in the United States has grown rapidly since 2006. The debt was ~$1.6 trillion in 2019 which was ~7.5% of 2019 GDP. By July 2021, the debt had risen to $1.73 trillion.

Consumer Action is a nonprofit, consumer education and advocacy center, serving consumers in the United States. Founded in 1971, the mission of Consumer Action is to help individual consumers assert their rights in the marketplace and to advance pro-consumer industry-wide change for the benefit of all. Consumer Action primarily achieves that mission by providing multi-lingual education, outreach, and advocacy services.

The higher education bubble in the United States is a highly controversial claim that excessive investment in higher education could have negative repercussions in the broader economy. According to the claim, generally associated with fiscal conservatives, although college tuition payments are rising, the supply of college graduates in many fields of study is exceeding the demand for their skills, which aggravates graduate unemployment and underemployment while increasing the burden of student loan defaults on financial institutions and taxpayers. The claim has generally been used to justify cuts to public higher education spending, tax cuts, or a shift of government spending towards the criminal justice system and the Department of Defense.

A payday loan is a small, short-term unsecured loan, "regardless of whether repayment of loans is linked to a borrower's payday." The loans are also sometimes referred to as "cash advances," though that term can also refer to cash provided against a prearranged line of credit such as a credit card. Payday advance loans rely on the consumer having previous payroll and employment records. Legislation regarding payday loans varies widely between different countries and, within the United States, between different states.

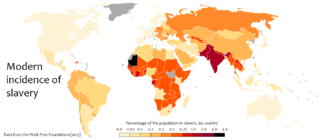

Debt bondage in India or Bandhua Mazdoori was legally abolished in 1976 but remains prevalent due to weak enforcement by the government. Bonded labour is a system in which lenders force their borrowers to repay loans through labor. Additionally, these debts often take a large amount of time to pay off and are unreasonably high, propagating a cycle of generational inequality. This is due to the typically high interest rates on the loans given out by employers. Although debt bondage is considered to be a voluntary form of labor, people are forced into this system by social situations.

Navient is a U.S. corporation based in Wilmington, Delaware, whose operations include servicing and collecting student loans. Managing nearly $300 billion in student loans for more than 12 million debtors, the company was formed in 2014 by the split of Sallie Mae into two distinct entities: Sallie Mae Bank and Navient. Navient employs 6,000 individuals at offices across the U.S. As of 2018, Navient services 25% of student loans in the United States.

The Paycheck Protection Program (PPP) is a $953-billion business loan program established by the United States federal government in 2020 through the Coronavirus Aid, Relief, and Economic Security Act to help certain businesses, self-employed workers, sole proprietors, certain nonprofit organizations, and tribal businesses continue paying their workers.

References

- ↑ Glater, Jonathan D. (August 23, 2008). "That Student Loan, So Hard to Shake (Published 2008)" – via NYTimes.com.

- ↑ Archive.org, retrieved 10-21-2020

- ↑ "Archive.org, retrieved 10-21-2020". Archived from the original on 2020-06-02. Retrieved 2020-06-02.

- ↑ "StudentLoanJustice.Org - The Problem".

- ↑ "Student Loan Relief". CareConnect USA.

- ↑ "StudentLoanJustice.Org - Thank You".

- ↑ Clinton, Hillary Rodham (May 26, 2006). "S.3255 - 109th Congress (2005-2006): Student Borrower Bill of Rights Act of 2006". www.congress.gov.

- ↑ "StudentLoanJustice.Org - SLJ in the Media".

- ↑ "Heroes and Zeros - Hero: Alan Collinge (5) - CNNMoney.com". money.cnn.com.

- ↑ "The Student Loan Scam: The Most Oppressive Debt in U.S. History and How We Can Fight Back (Paperback – February 1, 2010)". Amazon.com.