Economic data or economic statistics are data describing an actual economy, past or present. These are typically found in time-series form, that is, covering more than one time period or in cross-sectional data in one time period. Data may also be collected from surveys of for example individuals and firms or aggregated to sectors and industries of a single economy or for the international economy. A collection of such data in table form comprises a data set.

The Survey of Income and Program Participation (SIPP) is a statistical survey conducted by the United States Census Bureau.

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or economic heterogeneity.

The British Household Panel Survey (BHPS), carried out at the Institute for Social and Economic Research of the University of Essex, is a survey for social and economic research. A sample of British households was drawn and first interviewed in 1991. The members of these original households have since been followed and annually interviewed. The resulting data base is very popular among social scientists for quantitative analyses of social and economic change. One of the most important precursors of the BHPS is the Panel Study of Income Dynamics (PSID), established in the 1960s at the University of Michigan, Ann Arbor (US). The initial BHPS sample consisted of 10,300 individuals across Great Britain. Additional samples were recruited in Scotland and Wales in 1999 and the study was extended to Northern Ireland in 2001.

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting. Stated otherwise, national accounts as systems may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy is a social accounting matrix with accounts in each respective row-column entry.

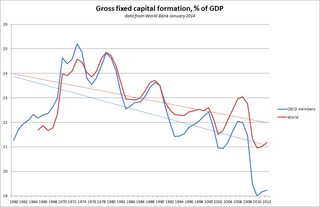

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

The GermanSocio-Economic Panel is a longitudinal panel dataset of the population in Germany. It is a household based study which started in 1984 and which reinterviews adult household members annually. Additional samples have been taken from time to time. In 2015, there will be about 14,000 households, and more than 30,000 adult persons sampled. Some of the many topics surveyed include household composition, occupation, employment, earnings, health and life satisfaction. The annual surveys are conducted by the German Institute for Economic Research and the Kantar Group. The survey is funded by the German Federal Government and the State of Berlin via the «Bund-Länder-Kommission» for Educational Planning and Research Promotion.

Raymond W. Goldsmith was an American economist specialising in historical data on national income, saving, financial intermediation, and financial assets and liabilities.

The Survey of Consumer Finances (SCF) is a triennial statistical survey of the balance sheet, pension, income and other demographic characteristics of families in the United States; the survey also gathers information on the use of financial institutions.

Understanding Society, the UK Household Longitudinal Study (UKHLS), is one of the largest panel survey in the world, supporting social and economic research. Its sample size is 40,000 households from the United Kingdom or approximately 100,000 individuals.

China Family Panel Studies is a nationally representative, biennial longitudinal general social survey project designed to document changes in Chinese society, economy, population, education, and health. The CFPS was launched in 2010 by the Institute of Social Science Survey (ISSS) of Peking University, China. The data were collected at the individual, family, and community levels and are targeted for use in academic research and public policy analysis. CFPS focuses on the economic and non-economic well-being of the Chinese people, and covers topics such as economic activities, educational attainment, family relationships and dynamics, migration, and physical and mental health. The themes cover social, economic, education, health and so forth.

The Panel Study of Income Dynamics (PSID) is a longitudinal panel survey of American families, conducted by the Survey Research Center at the University of Michigan.

Professor Wei-Jun Jean Yeung is a Taiwanese sociologist and demographer, now is the professor of Asia Research Institute, National University of Singapore. She chairs the Family, Children, and Youth Research Cluster in the Faculty of Arts and Social Sciences in NUS.

SAVE is a representative data collection about private households’ saving behaviour in Germany. The survey was conducted in 2001 for the first time.

Precautionary saving is saving that occurs in response to uncertainty regarding future income. The precautionary motive to delay consumption and save in the current period rises due to the lack of completeness of insurance markets. Accordingly, individuals will not be able to insure against some bad state of the economy in the future. They anticipate that if this bad state is realized, they will earn lower income. To avoid adverse effects of future income fluctuations and retain a smooth path of consumption, they set aside a precautionary reserve, called precautionary savings, by consuming less in the current period, and resort to it in case the bad state is realized in the future.

The Polish Panel Survey is a program of panel surveys of the population of Poland carried out by the Research Team on Comparative Social Inequality at the Institute of Philosophy and Sociology of the Polish Academy of Sciences. The study started in 1988 and is repeated in five-year intervals. The focus of the Polish Panel Survey is to describe Poland's social structure and its change.

The Household Finance and Consumption Survey (HFCS) is a statistical survey conducted by the Central Statistics Office (CSO) on behalf of the Central Bank of Ireland as part of the European Central Bank (ECB) Household Finance and Consumption Network (HFCN).

The Household, Income and Labour Dynamics in Australia (HILDA) survey is an Australian household-based panel study which began in 2001. It has been used for examining issues such as the incidence of persistent poverty; assets and income in the transition to retirement; the correlates and impact of changes in physical and mental health; and an international comparison of wealth and happiness. The survey is widely used by Australian and international researchers in the fields of economics, social science and social policy and by the Australian Government. The HILDA survey is managed by a small team from the Melbourne Institute of Applied Economic and Social Research at the University of Melbourne and the national fieldwork is carried out by ACNielsen and Roy Morgan Research. The survey is funded by the Australian Government through the Department of Social Services.

Mariacristina De Nardi is an economist who was born in Treviso, Italy. She is the Thomas Sargent Professor at the University of Minnesota since 2019. In 2013, De Nardi was appointed professor of economics at University College London; since September 2018, she has been a senior scholar at the Opportunity and Inclusive Growth Institute of the Federal Reserve Bank of Minneapolis. Her research interests include macroeconomics, public economics, wealth distribution, savings, social-insurance reform, social security, household economics, health shocks, medical expenses, fertility and human capital.

Karen M. Pence is an American economist who is Deputy Associate Director of the Research and Statistics Section of the Federal Reserve Board of Governors, responsible for the Survey of Consumer Finances, and Chair of the Board of the Panel Study of Income Dynamics. She is a vice president of the American Real Estate and Urban Economics Association.