TaxPack is a booklet issued by the Australian Taxation Office to assist individuals complete their income tax return.

It comes in a different edition for each year entitled for example TaxPack 2007. An associated booklet is the TaxPack supplement with extra tax items not needed by 80% of taxpayers. Another version is called TaxPack for retirees.

It can take 8½ hours to read through the tax pack and complete the forms. [1]

4,800,000 copies of taxPack 2000 were produced along with 1,300,000 copies of the supplement. In 1998, 5,800,000 copies were printed. It had 124 pages with the 1997 edition having 140 pages. The 60 page supplement was split off in 1998 to reduce the size of TaxPack. Although TaxPack is still being produced[ when? ], it was being replaced by a PC software package called E-tax but has since been migrated to the online platform myGov.

The Oxford English Dictionary (OED) is the principal historical dictionary of the English language, published by Oxford University Press (OUP). It traces the historical development of the English language, providing a comprehensive resource to scholars and academic researchers, as well as describing usage in its many variations throughout the world.

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends.

Heroes of Might and Magic, known as Might & Magic Heroes since 2011, is a series of video games originally created and developed by Jon Van Caneghem through New World Computing.

A tax deduction is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax.

Arduin is a fictional universe and fantasy role-playing system created in the mid-1970s by David A. Hargrave. It was the first published "cross-genre" fantasy RPG, with everything from interstellar wars to horror and historical drama, although it was based primarily in the medieval fantasy genre.

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as determined on tax returns. PAYE may include withholding the employee portion of insurance contributions or similar social benefit taxes. In most countries, they are determined by employers but subject to government review. PAYE is deducted from each paycheck by the employer and must be remitted promptly to the government. Most countries refer to income tax withholding by other terms, including pay-as-you-go tax.

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such often remain "hidden" in the price of a product or service, rather than being listed separately.

The Australian Taxation Office (ATO) is an Australian statutory agency and the principal revenue collection body for the Australian Government. The ATO has responsibility for administering the Australian federal taxation system, superannuation legislation, and other associated matters. Responsibility for the operations of the ATO are within the portfolio of the Treasurer of Australia and the Treasury.

In addition to federal income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose an income tax, often based on state income tax calculations. Forty-two states and many localities in the United States impose an income tax on individuals. Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income. Forty-seven states and many localities impose a tax on the income of corporations.

The Income Tax Assessment Act 1936 (Cth) is an Act of the Parliament of Australia. It is one of the main statutes under which income tax is calculated. The Act is gradually being rewritten into the Income Tax Assessment Act 1997, and new matters are generally now added to the 1997 Act.

Fantasy Flight Games (FFG) is a game developer based in Roseville, Minnesota, United States, that creates and publishes role-playing, board, card, and dice games. As of 2014, it is a division of Asmodee North America.

Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year.

The history of the English fiscal system affords the best known example of continuous financial development in terms of both institutions and methods. Although periods of great upheaval occurred from the time of the Norman Conquest to the beginning of the 20th century, the line of connection is almost entirely unbroken. Perhaps, the most revolutionary changes occurred in the 17th century as a result of the Civil War and, later, the Glorious Revolution of 1688; though even then there was no real breach of continuity.

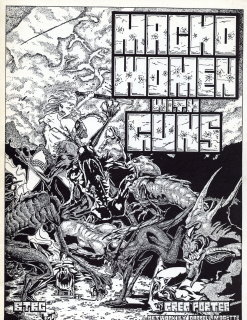

Macho Women with Guns (MWWG) is a comedy role-playing game created by Greg Porter and published by Blacksburg Tactical Research Center (BTRC). Nominally a science-fiction game, it parodies both action films and other role-playing games.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

The Lutheran Hymnal with Supplement is the second official hymnal of the Lutheran Church of Australia, first published in its present form in 1989.

The Dungeons & Dragons Basic Set is a set of rulebooks for the Dungeons & Dragons (D&D) fantasy role-playing game. First published in 1977, it saw a handful of revisions and reprintings. The first edition was written by J. Eric Holmes based on Gary Gygax and Dave Arneson's original work. Later editions were edited by Tom Moldvay, Frank Mentzer, Troy Denning, and Doug Stewart.

Regulatory risk differentiation is the process used by a regulatory authority to systemically treat entities differently based on the regulator's assessment of the risks of the entity's non-compliance.