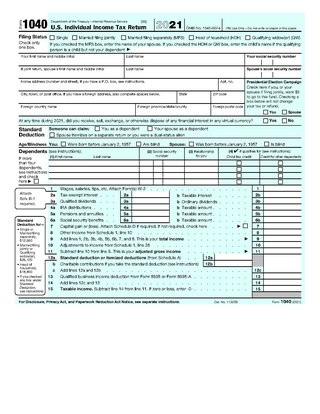

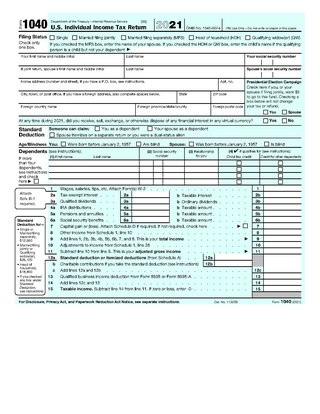

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey.

The Tax Reform Act of 1986 (TRA) was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22, 1986.

Under United States tax law, the standard deduction is a dollar amount that non-itemizers may subtract from their income before income tax is applied. Taxpayers may choose either itemized deductions or the standard deduction, but usually choose whichever results in the lesser amount of tax payable. The standard deduction is available to individuals who are US citizens or resident aliens. The standard deduction is based on filing status and typically increases each year, based on inflation measurements from the previous year. It is not available to nonresident aliens residing in the United States. Additional amounts are available for persons who are blind and/or are at least 65 years of age.

Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in calculating taxable income and consequently federal income tax. In 2017, the personal exemption amount was $4,050, though the exemption is subject to phase-out limitations. The personal exemption amount is adjusted each year for inflation. The Tax Cuts and Jobs Act of 2017 eliminates personal exemptions for tax years 2018 through 2025.

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes.

The Economic Growth and Tax Relief Reconciliation Act of 2001 was a major piece of tax legislation passed by the 107th United States Congress and signed by President George W. Bush. It is also known by its abbreviation EGTRRA, and is often referred to as one of the two "Bush tax cuts".

Tax brackets are the divisions at which tax rates change in a progressive tax system. Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate.

The Tax Reform Act of 1969 was a United States federal tax law signed by President Richard Nixon in 1969. Its largest impact was creating the Alternative Minimum Tax, which was intended to tax high-income earners who had previously avoided incurring tax liability due to various exemptions and deductions.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An Alternative Minimum Tax (AMT) applies at the federal and some state levels.

The Volunteer Income Tax Assistance (VITA) grant program is an Internal Revenue Service (IRS) initiative in the United States that supports free tax preparation service for the underserved through various partner organizations.

The Tax Increase Prevention and Reconciliation Act of 2005 is an American law, which was enacted on May 17, 2006.

Head of Household is a filing status for individual United States taxpayers. It provides preferential tax rates and a larger standard deduction for single people caring for qualifying dependents.

The United States Internal Revenue Service uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

The marriage penalty in the United States refers to the higher taxes required from some married couples with both partners earning income that would not be required by two otherwise identical single people with exactly the same incomes. There is also a marriage bonus that applies in other cases. Multiple factors are involved, but in general, in the current U.S. system, single-income married couples usually benefit from filing as a married couple, while dual-income married couples are often penalized. The percentage of couples affected has varied over the years, depending on shifts in tax rates.

The kiddie tax rule exists in the United States of America and can be found in Internal Revenue Code § 1(g), which "taxes certain unearned income of a child at the parent's marginal rate, no matter whether the child can be claimed as a dependent on the parent's return".

The United States federal earned income tax credit or earned income credit is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.

In general, the United States federal income tax is progressive, as rates of tax generally increase as taxable income increases, at least with respect to individuals that earn wage income. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government.

The United States federal child tax credit (CTC) is a partially-refundable tax credit for parents with dependent children. It provides $2,000 in tax relief per qualifying child, with up to $1,400 of that refundable (subject to a refundability threshold, phase-in and phase-out). In 2021, following the passage of the American Rescue Plan Act of 2021, it was temporarily raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17; it was also made fully-refundable and half was paid out as monthly benefits. This reverted back to the previous in 2022. The CTC is scheduled to revert to a $1,000 credit after 2025.