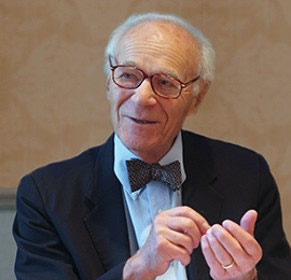

Free to Choose: A Personal Statement is a 1980 book by economists Milton and Rose D. Friedman, accompanied by a ten-part series broadcast on public television, that advocates free market principles. It was primarily a response to an earlier landmark book and television series The Age of Uncertainty, by the noted economist John Kenneth Galbraith. Milton Friedman won the Nobel Memorial Prize in Economics in 1976.

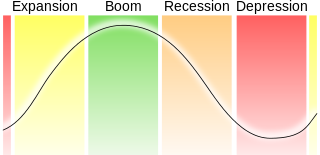

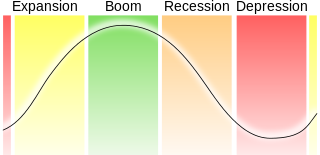

In economics, Kondratiev waves are hypothesized cycle-like phenomena in the modern world economy. The phenomenon is closely connected with the technology life cycle.

Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler and others, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students, young professors and academics who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, Thomas Sowell and Robert Lucas Jr.

Business cycles are intervals of expansion followed by recession in economic activity. They have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by applying a band pass filter to a broad economic indicator such as Real Gross Domestic Production. Here important problems may arise with a commonly used filter called the "ideal filter". For instance if a series is a purely random process without any cycle, an "ideal" filter, better called a block filter, a spurious cycle is produced as output. Fortunately methods such as [Harvey and Trimbur, 2003, Review of Economics and Statistics] have been designed so that the band pass filter may be adapted to the time series at hand.

Paul Anthony Samuelson was an American economist, who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "has done more than any other contemporary economist to raise the level of scientific analysis in economic theory". Economic historian Randall E. Parker has called him the "Father of Modern Economics", and The New York Times considers him to be the "foremost academic economist of the 20th century".

Lawrence Robert Klein was an American economist. For his work in creating computer models to forecast economic trends in the field of econometrics in the Department of Economics at the University of Pennsylvania, he was awarded the Nobel Memorial Prize in Economic Sciences in 1980 specifically "for the creation of econometric models and their application to the analysis of economic fluctuations and economic policies." Due to his efforts, such models have become widespread among economists. Harvard University professor Martin Feldstein told the Wall Street Journal that Klein "was the first to create the statistical models that embodied Keynesian economics," tools still used by the Federal Reserve Bank and other central banks.

The causes of the Great Depression in the early 20th century in the USA have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established. There was an initial stock market crash that triggered a "panic sell-off" of assets. This was followed by a deflation in asset and commodity prices, dramatic drops in demand and credit, and disruption of trade, ultimately resulting in widespread unemployment and impoverishment. However, economists and historians have not reached a consensus on the causal relationships between various events and government economic policies in causing or ameliorating the Depression.

Edward Russel Dewey (1895–1978) was an economist who studied cycles in economics and other fields.

Nikolai Dmitriyevich Kondratiev was a Russian Soviet economist and proponent of the New Economic Policy (NEP) best known for the business cycle theory known as Kondratiev waves.

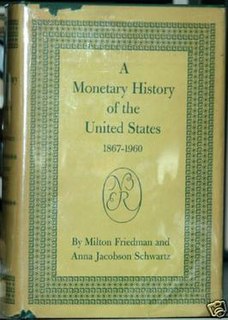

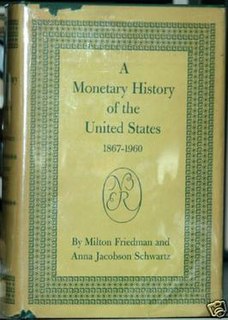

Anna Jacobson Schwartz was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for The New York Times. Paul Krugman has said that Schwartz is "one of the world's greatest monetary scholars."[1]

Raveendra Nath "Ravi" Batra is an Indian-American economist, author, and professor at Southern Methodist University. Batra is the author of six bestselling books, two of which appeared on The New York Times Best Seller list, with one reaching #1 in late 1987. His books center on his idea that financial capitalism breeds excessive inequality and political corruption which inevitably succumbs to financial crisis and economic depression. In his works, Batra proposes an equitable distribution system known as Progressive Utilization Theory (PROUT) as a means to not only ensure material welfare but also to secure the ability of all to develop a full personality.

Capitalism and Freedom is a book by Milton Friedman originally published in 1962 by the University of Chicago Press which discusses the role of economic capitalism in liberal society. It sold over 400,000 copies in the first eighteen years and more than half a million since 1962. It has been translated into eighteen languages.

Amity Ruth Shlaes is a conservative American author and newspaper and magazine columnist. Shlaes writes about politics and economics from a classical liberal perspective. Shlaes has authored five books, including three New York Times Bestsellers. She currently chairs the board of trustees of the Calvin Coolidge Presidential Foundation and serves as a Presidential Scholar at The King's College in New York City. She is a recipient of the Bastiat Prize.

Fred L. Block is an American sociologist, and Research Professor of Sociology at the University of California, Davis. Block is widely regarded as one of the world’s leading economic and political sociologists. His interests are wide ranging. He has been noted as an influential follower of Karl Polanyi.

The Shock Doctrine: The Rise of Disaster Capitalism is a 2007 book by the Canadian author and social activist Naomi Klein. In the book, Klein argues that neoliberal free market policies have risen to prominence in some developed countries because of a deliberate strategy of "shock therapy". This centers on the exploitation of national crises to establish controversial and questionable policies, while citizens are too distracted to engage and develop an adequate response, and resist effectively. The book suggests that some man-made events, such as the Iraq War, were undertaken with the intention of pushing through such unpopular policies in their wake.

A Monetary History of the United States, 1867–1960 is a book written in 1963 by Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz. It uses historical time series and economic analysis to argue the then-novel proposition that changes in the money supply profoundly influenced the U.S. economy, especially the behavior of economic fluctuations. The implication they draw is that changes in the money supply had unintended adverse effects, and that sound monetary policy is necessary for economic stability. Economic historians see it as one of the most influential economics books of the century. The chapter dealing with the causes of the Great Depression was published as a stand-alone book titled The Great Contraction, 1929–1933.

The Great Depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States. The timing of the Great Depression varied across the world; in most countries, it started in 1929 and lasted until the late 1930s. It was the longest, deepest, and most widespread depression of the 20th century. The Great Depression is commonly used as an example of how intensely the global economy can decline.

The Downfall of Capitalism and Communism is a book by Ravi Batra in the field of historical evolution, first published in 1978. The book's full title is The Downfall of Capitalism and Communism: A New Study of History. Following the collapse of Soviet Communism, a second edition was published in 1990 with the title The Downfall of Capitalism and Communism: Can Capitalism Be Saved?

Throughout modern history, a variety of perspectives on capitalism have evolved based on different schools of thought.