Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services . Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance.

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors.

William Forsyth Sharpe is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University's Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences.

D. E. Shaw & Co., L.P. is a multinational investment management firm founded in 1988 by David E. Shaw and based in New York City. The company is known for developing complicated mathematical models and sophisticated computer programs to exploit anomalies in the financial market. As of June 1, 2021, D. E. Shaw manages $55 billion in AUM, $35 billion of which are alternative investments and the remaining $20 billion long-oriented investments. In 2018, Institutional Investor reported that among hedge funds, D. E. Shaw had delivered the fifth-highest returns in the world since its inception.

In finance, a portfolio is a collection of investments.

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs.

A "fund of funds" (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. This type of investing is often referred to as multi-manager investment. A fund of funds may be "fettered", meaning that it invests only in funds managed by the same investment company, or "unfettered", meaning that it can invest in external funds run by other managers.

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to the investor's risk tolerance, goals and investment time frame. The focus is on the characteristics of the overall portfolio. Such a strategy contrasts with an approach that focuses on individual assets.

Joel Greenblatt is an American academic, hedge fund manager, investor, and writer. He is a value investor, alumnus of the Wharton School of the University of Pennsylvania, and adjunct professor at the Columbia University Graduate School of Business. He runs Gotham Asset Management with his partner, Robert Goldstein. He is the former chairman of the board of Alliant Techsystems (1994–1995) and founder of the New York Securities Auction Corporation. He was a director at Pzena Investment Management, a firm specializing in value investing and asset management for high-net worth clients.

Robert D. Arnott is an American businessman, investor, and writer who focuses on articles about quantitative investing.

Tactical asset allocation (TAA) is a dynamic investment strategy that actively adjusts a portfolio's asset allocation. The goal of a TAA strategy is to improve the risk-adjusted returns of passive management investing.

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding stocks, bonds, and cash. The term is a relatively loose one and includes tangible assets such as precious metals, collectibles and some financial assets such as real estate, commodities, private equity, distressed securities, hedge funds, exchange funds, carbon credits, venture capital, film production, financial derivatives, cryptocurrencies, non-fungible tokens, and Tax Receivable Agreements. Investments in real estate, forestry and shipping are also often termed "alternative" despite the ancient use of such real assets to enhance and preserve wealth. Alternative investments are to be contrasted with traditional investments.

A portfolio manager (PM) is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested individuals or institutions. Clients invest their money into the PM's investment policy for future growth, such as a retirement fund, endowment fund, or education fund. PMs work with a team of analysts and researchers and are responsible for establishing an investment strategy, selecting appropriate investments, and allocating each investment properly towards an investment fund or asset management vehicle.

Edwin Elton is a Nomura Professor of Finance at New York University Stern School of Business and Academic Director of the Stern Doctoral Program. Professor Elton also teaches for the Master of Science in Global Finance (MSGF), which is a joint program between Stern and the Hong Kong University of Science and Technology.

Risk parity is an approach to investment management which focuses on allocation of risk, usually defined as volatility, rather than allocation of capital. The risk parity approach asserts that when asset allocations are adjusted to the same risk level, the risk parity portfolio can achieve a higher Sharpe ratio and can be more resistant to market downturns than the traditional portfolio. Risk parity is vulnerable to significant shifts in correlation regimes, such as observed in Q1 2020, which led to the significant underperformance of risk-parity funds in the Covid-19 sell-off.

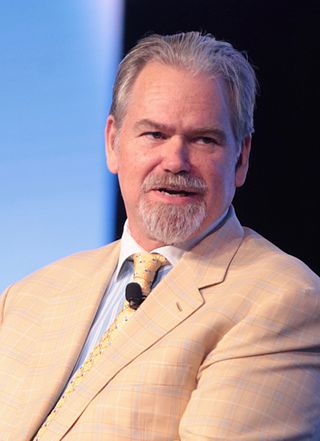

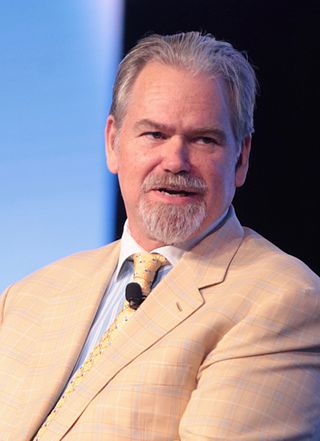

Gregg S. Fisher, CFA, is an American investment manager. In 2019, he founded Quent Capital and serves as Portfolio Manager for the asset management firm which features a global small company long/short equity investment strategy. He was also the Founder and Head of Quantitative Research and Portfolio Strategy of Gerstein Fisher, an investment management and advisory firm that became part of People’s United Bank in 2016.

The Financial Analysts Journal is a quarterly peer-reviewed academic journal covering investment management, published by Routledge on behalf of the CFA Institute. It was established in 1945 and as of August 2022, the editor-in-chief is William N. Goetzmann.

AQR Capital Management is a global investment management firm based in Greenwich, Connecticut, United States. The firm, which was founded in 1998 by Cliff Asness, David Kabiller, John Liew, and Robert Krail, offers a variety of quantitatively driven alternative and traditional investment vehicles to both institutional clients and financial advisors. The firm is primarily owned by its founders and principals. AQR has additional offices in Boston, Chicago, Los Angeles, Bangalore, Hong Kong, London, Sydney, and Tokyo.

David C. Blitz is a Dutch econometrician and quantitative researcher on financial markets. He is a founding researcher of Robeco Quantitative Investments.

Pim van Vliet is a Dutch fund manager and head of conservative equities at Robeco.