Punjab National Bank is an Indian public sector bank based in New Delhi.It was founded in May 1894 and is the third-largest public sector bank in India in terms of its business volumes, with over 180 million customers, 12,248 branches, and 13,000+ ATMs.

Housing Development Finance Corporation was an Indian private sector mortgage lender based in Mumbai. It was the biggest housing finance company in India. It also had a presence in banking, life and general insurance, asset management, venture capital and deposits through its associate and subsidiary companies.

Reliance Capital Limited is an Indian diversified financial services holding company promoted by Reliance Anil Dhirubhai Ambani Group. Reliance Capital, a constituent of Nifty Midcap 50 and MSCI Global Small Cap Index, is a part of the Reliance Group. It is amongst India's leading and most valuable financial services companies in the private sector. As on 31 March 2017, the net worth of the company stood at ₹16,548 crore, while its total assets as on the date stood at ₹82,209 crore. In Fortune India 500 list of 2018, Reliance Capital was ranked as the 77th largest corporation in India with 5th rank in 'Non-Banking Finance' category.

Life Insurance Corporation of India (LIC) is an Indian multinational public sector life insurance company headquartered in Mumbai. It is India's largest insurance company as well as the largest institutional investor with total assets under management worth ₹49.24 trillion (US$620 billion) as of March 2023. It is under the ownership of Government of India and administrative control of the Ministry of Finance.

Chennai Petroleum Corporation Limited (CPCL), formerly known as Madras Refineries Limited (MRL), is a subsidiary of Indian Oil Corporation Limited which is under the ownership of Ministry of Petroleum and Natural Gas of the Government of India. It is headquartered in Chennai, India. It was formed as a joint venture in 1965 between the Government of India (GOI), Amoco and National Iranian Oil Company (NIOC), having a shareholding in the ratio 74%: 13%: 13% respectively. From the grassroots stage CPCL Refinery was set up with an installed capacity of 2.5 million tonnes per year in a record time of 27 months at a cost of ₹430 million (US$5.4 million) without any time or cost overrun.

The New India Assurance Co. Ltd. (NIA) is an Indian public sector insurance company owned by the Government of India and administered by the Ministry of Finance. Headquartered in Mumbai, it is the largest nationalised general insurance company of India based on gross premium collection inclusive of foreign operations. It was founded by Sir Dorabji Tata in 1919, and was nationalised in 1973.

Coal India Limited (CIL) is an Indian central public sector undertaking under the ownership of the Ministry of Coal, Government of India. It is headquartered at Kolkata. It is the largest government-owned-coal-producer in the world. It is also the ninth largest employer in India with nearly 272,000 employees.

Jiban Bima Corporation (JBC) is the state-run life insurance corporation in Bangladesh under the provisions of the Insurance Act 1938, Insurance Rules 1958, and related other laws enforceable in Bangladesh in Bangladesh Corporation Act 1973. The JBC started on 14 May 1973 with assets and liabilities worth TK. 157 million of defunct 37 life Insurance companies.

ICICI Lombard General Insurance Company Limited is a general insurance company in India. It is engaged in general insurance, reinsurance, insurance claims management and investment management.

Axis Bank Limited, formerly known as UTI Bank (1993–2007), is an Indian multinational banking and financial services company headquartered in Mumbai, Maharashtra. It is India's third largest private sector bank by assets and Fourth largest by Market capitalisation. It sells financial services to large and mid-size companies, SMEs and retail businesses.

General Insurance Corporation of India Limited, abbreviated as GIC Re, is an Indian public sector reinsurance company which has its registered office and headquarters in Mumbai. It was incorporated on 22 November 1972 under Companies Act, 1956. It was the sole nationalised reinsurance company in the Indian insurance market until the insurance market was open to foreign reinsurance players by late 2016 including companies from Germany, Switzerland and France. GIC Re's shares are listed on BSE Limited and National Stock Exchange of India Ltd.

Ageas Federal Life Insurance Co Ltd. is a joint-venture of Federal Bank, which is a private sector banks in India and Ageas.

IndiaFirst Life Insurance Company is an Indian life insurance company headquartered in Mumbai. It is a joint venture between Bank of Baroda, Union Bank of India, and Carmel Point Investments India, and has a paid-up share capital of ₹754.37 crore (US$94 million).

SBI Life Insurance Company Limited is an Indian life insurance company which was started as a joint venture between State Bank of India (SBI) and French financial institution BNP Paribas Cardif. SBI has a 55.50% stake in the company and BNP Paribas Cardif owns a 0.22% stake. Other investors are Value Line Pte. Ltd. and MacRitchie Investments Pte. Ltd., holding a 1.95% stake each while the remaining 12% is free float stake with public investors.It has Assets under management(AuM) worth ₹352,422 crore (US$44 billion) and a Gross Written Premium(GWP) of ₹67,320 crore (US$8.4 billion) as of March 2023. SBI Life has an authorized capital of ₹20 billion (US$250 million) and a paid up capital of ₹10 billion (US$130 million).

National Insurance Company Limited (NICL) is an Indian public sector insurance company owned by the Government of India and administered by the Ministry of Finance. It is headquartered at Kolkata and was established in 1906 by Gordhandas Dutia and Jeevan Das Dutia. National Insurance company and Asian Insurance company was nationalised in 1972. Its portfolio consists of a multitude of general insurance policies, offered to a wide arena of clients encompassing different sectors of the economy. Apart from being a leading insurance provider in India, NICL also serves in Nepal.

The Insurance Regulatory and Development Authority of India (IRDAI) is a statutory body under the jurisdiction of Ministry of Finance, Government of India and is tasked with regulating and licensing the insurance and re-insurance industries in India. It was constituted by the Insurance Regulatory and Development Authority Act, 1999, an Act of Parliament passed by the Government of India. The agency's headquarters are in Hyderabad, Telangana, where it moved from Delhi in 2001.

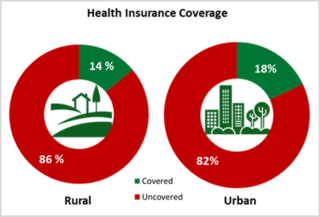

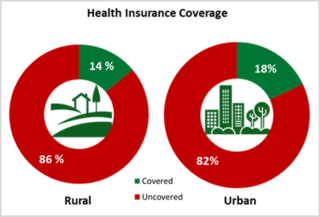

Health insurance in India is a growing segment of India's economy. The Indian healthcare system is one of the largest in the world, with the number of people it concerns: nearly 1.3 billion potential beneficiaries. The healthcare industry in India has rapidly become one of the most important sectors in the country in terms of income and job creation. In 2018, one hundred million Indian households do not benefit from health coverage. In 2011, 3.9% of India's gross domestic product was spent in the health sector.

United India Insurance Company (UIIC) is an Indian public sector insurance company owned by the Government of India and administered by the Ministry of Finance. Headquartered in Chennai, Tamil Nadu, the company has 30 regional offices and more than 1,400 operating offices nationwide, including 511 micro offices, as of 31 March 2023. It also had underwriting operations in Hong Kong that ceased effective 1 April 2002, following which the New India Assurance Company Limited, Hong Kong, has taken over the run-off portfolio. This foreign operation had three outstanding claims as of 31 March 2023. The company was incorporated on 18 February 1938 and nationalized in 1972. The Company recorded a gross direct premium income of ₹17,644 in the financial year 2022-23, registering a growth of 12.23% over the previous year.

Canara HSBC Life Insurance is an Indian life insurance company, headquartered in Gurugram. Established in 2008, Canara HSBC Life Insurance was a joint venture between Canara Bank (51%), HSBC Insurance Holdings Limited (26%) and Punjab National Bank (23%). On 15 June 2022, the company renamed itself as Canara HSBC Life Insurance after the exit of its third partner, Punjab National Bank.

ICICI Prudential Life Insurance Company Limited is an Indian life insurance company in India. Established as a joint venture between ICICI Bank Limited and Prudential Corporation Holdings Limited, ICICI Prudential Life is engaged in life insurance and asset management business. In 2016, the company became the first insurance company in India to be listed in the domestic stock exchanges.