Emissions trading is a market-based approach to controlling pollution by providing economic incentives for reducing the emissions of pollutants. The concept is also known as cap and trade (CAT) or emissions trading scheme (ETS). One prominent example is carbon emission trading for CO2 and other greenhouse gases which is a tool for climate change mitigation. Other schemes include sulfur dioxide and other pollutants.

Environmental finance is a field within finance that employs market-based environmental policy instruments to improve the ecological impact of investment strategies. The primary objective of environmental finance is to regress the negative impacts of climate change through pricing and trading schemes. The field of environmental finance was established in response to the poor management of economic crises by government bodies globally. Environmental finance aims to reallocate a businesses resources to improve the sustainability of investments whilst also retaining profit margins.

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more severe weather events. In this way, they are designed to reduce greenhouse gas emissions by increasing prices of the fossil fuels that emit them when burned. This both decreases demand for goods and services that produce high emissions and incentivizes making them less carbon-intensive. In its simplest form, a carbon tax covers only CO2 emissions; however, it could also cover other greenhouse gases, such as methane or nitrous oxide, by taxing such emissions based on their CO2-equivalent global warming potential. When a hydrocarbon fuel such as coal, petroleum, or natural gas is burned, most or all of its carbon is converted to CO

2. Greenhouse gas emissions cause climate change, which damages the environment and human health. This negative externality can be reduced by taxing carbon content at any point in the product cycle. Carbon taxes are thus a type of Pigovian tax.

The United Kingdom's Climate Change Programme was launched in November 2000 by the British government in response to its commitment agreed at the 1992 United Nations Conference on Environment and Development (UNCED). The 2000 programme was updated in March 2006 following a review launched in September 2004.

The European Union Emissions Trading System is a carbon emission trading scheme which began in 2005 and is intended to lower greenhouse gas emissions by the European Union countries. Cap and trade schemes limit emissions of specified pollutants over an area and allow companies to trade emissions rights within that area. The EU ETS covers around 45% of the EUs greenhouse gas emissions.

Flexible mechanisms, also sometimes known as Flexibility Mechanisms or Kyoto Mechanisms, refers to emissions trading, the Clean Development Mechanism and Joint Implementation. These are mechanisms defined under the Kyoto Protocol intended to lower the overall costs of achieving its emissions targets. These mechanisms enable Parties to achieve emission reductions or to remove carbon from the atmosphere cost-effectively in other countries. While the cost of limiting emissions varies considerably from region to region, the benefit for the atmosphere is in principle the same, wherever the action is taken.

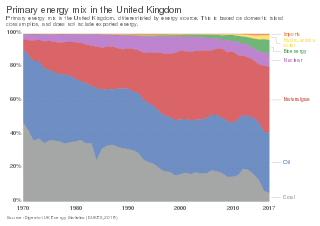

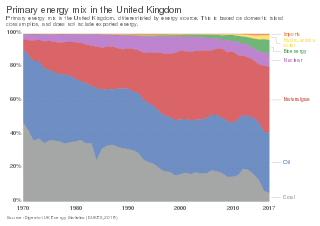

The energy policy of the United Kingdom refers to the United Kingdom's efforts towards reducing energy intensity, reducing energy poverty, and maintaining energy supply reliability. The United Kingdom has had success in this, though energy intensity remains high. There is an ambitious goal to reduce carbon dioxide emissions in future years, but it is unclear whether the programmes in place are sufficient to achieve this objective. Regarding energy self-sufficiency, UK policy does not address this issue, other than to concede historic energy security is currently ceasing to exist.

Carbon rationing, as a means of reducing CO2 emissions to contain climate change, could take any of several forms. One of them, personal carbon trading, is the generic term for a number of proposed carbon emissions trading schemes under which emissions credits would be allocated to adult individuals on a (broadly) equal per capita basis, within national carbon budgets. Individuals then surrender these credits when buying fuel or electricity. Individuals wanting or needing to emit at a level above that permitted by their initial allocation would be able to purchase additional credits in the personal carbon market from those using less, creating a profit for those individuals who emit at a level below that permitted by their initial allocation.

David Fleming was an economist, cultural historian and writer on environmental issues, based in London.

The CRC Energy Efficiency Scheme was a mandatory carbon emissions reduction scheme in the United Kingdom which applied to large energy-intensive organisations in the public and private sectors. It was estimated that the scheme would reduce carbon emissions by 1.2 million tonnes of carbon per year by 2020. In an effort to avoid dangerous climate change, the British Government first committed to cutting UK carbon emissions by 60% by 2050, and in October 2008 increased this commitment to 80%. The scheme has also been credited with driving up demand for energy-efficient goods and services.

The Carbon Pollution Reduction Scheme was a cap-and-trade emissions trading scheme for anthropogenic greenhouse gases proposed by the Rudd government, as part of its climate change policy, which had been due to commence in Australia in 2010. It marked a major change in the energy policy of Australia. The policy began to be formulated in April 2007, when the federal Labor Party was in Opposition and the six Labor-controlled states commissioned an independent review on energy policy, the Garnaut Climate Change Review, which published a number of reports. After Labor won the 2007 federal election and formed government, it published a Green Paper on climate change for discussion and comment. The Federal Treasury then modelled some of the financial and economic impacts of the proposed CPRS scheme.

Carbon emission trading (also called emission trading scheme (ETS) or cap and trade) is a type of emission trading scheme designed for carbon dioxide (CO2) and other greenhouse gases (GHG). It is a form of carbon pricing. Its purpose is to limit climate change by creating a market with limited allowances for emissions. This can lower competitiveness of fossil fuels and accelerate investments into low carbon sources of energy such as wind power and photovoltaics. Fossil fuels are the main driver for climate change. They account for 89% of all CO2 emissions and 68% of all GHG emissions.

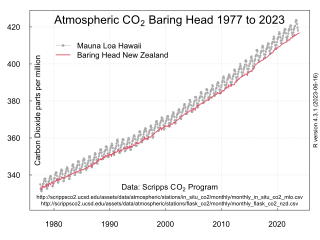

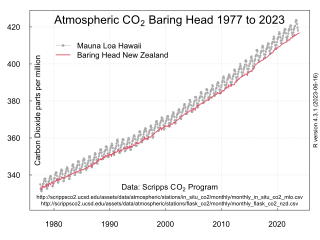

Climate change in New Zealand involves historical, current and future changes in the climate of New Zealand; and New Zealand's contribution and response to global climate change. Summers are becoming longer and hotter, and some glaciers have melted completely and others have shrunk. In 2021, the Ministry for the Environment estimated that New Zealand's gross emissions were 0.17% of the world's total gross greenhouse gas emissions. However, on a per capita basis, New Zealand is a significant emitter, the sixth highest within the Annex I countries, whereas on absolute gross emissions New Zealand is ranked as the 24th highest emitter.

The New Zealand Emissions Trading Scheme is an all-gases partial-coverage uncapped domestic emissions trading scheme that features price floors, forestry offsetting, free allocation and auctioning of emissions units.

The Climate Change Response Amendment Act 2008 was a statute enacted in September 2008 by the Fifth Labour Government of New Zealand that established the first version of the New Zealand Emissions Trading Scheme, a national all-sectors all-greenhouse gases uncapped and highly internationally linked emissions trading scheme.

In 2021, net greenhouse gas (GHG) emissions in the United Kingdom (UK) were 427 million tonnes (Mt) carbon dioxide equivalent, 80% of which was carbon dioxide itself. Emissions increased by 5% in 2021 with the easing of COVID-19 restrictions, primarily due to the extra road transport. The UK has over time emitted about 3% of the world total human caused CO2, with a current rate under 1%, although the population is less than 1%.

The Clean Energy Act 2011 was an Act of the Australian Parliament, the main Act in a package of legislation that established an Australian emissions trading scheme (ETS), to be preceded by a three-year period of fixed carbon pricing in Australia designed to reduce carbon dioxide emissions as part of efforts to combat global warming.

Dario Tamburrano is an Italian environmental activist and one of the first members of the Five Star Movement elected in the European Parliament.

Shaun Chamberlin is an author and activist, based in London, England. He is the author of The Transition Timeline, co-author of several other books including What We Are Fighting For, chair of the Ecological Land Co-operative, and was one of the earliest Extinction Rebellion arrestees.

The Interim Climate Change Committee is a ministerial advisory committee created by the New Zealand Government in mid–April 2018 to explore how New Zealand transitions to a net zero emissions economy by 2050. The Interim Committee was superseded and replaced by an independent Climate Change Commission under the Climate Change Response Amendment Act in November 2019.