Related Research Articles

The Federal Reserve System is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The Sarbanes–Oxley Act of 2002, also known as the "Public Company Accounting Reform and Investor Protection Act" and "Corporate and Auditing Accountability, Responsibility, and Transparency Act" and more commonly called Sarbanes–Oxley, Sarbox or SOX, is a United States federal law that set new or expanded requirements for all U.S. public company boards, management and public accounting firms. A number of provisions of the Act also apply to privately held companies, such as the willful destruction of evidence to impede a federal investigation.

In financial accounting, a balance sheet is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership, a corporation, private limited company or other organization such as government or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business' calendar year.

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations. Its sister organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. As of 2018, Fannie Mae is ranked number 21 on the Fortune 500 rankings of the largest United States corporations by total revenue.

A reverse mortgage is a mortgage loan, usually secured by a residential property, that enables the borrower to access the unencumbered value of the property. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Borrowers are still responsible for property taxes and homeowner's insurance. Reverse mortgages allow elders to access the home equity they have built up in their homes now, and defer payment of the loan until they die, sell, or move out of the home. Because there are no required mortgage payments on a reverse mortgage, the interest is added to the loan balance each month. The rising loan balance can eventually grow to exceed the value of the home, particularly in times of declining home values or if the borrower continues to live in the home for many years. However, the borrower is generally not required to repay any additional loan balance in excess of the value of the home.

Landsbanki, also commonly known as Landsbankinn which is now the name of the current rebuilt bank, was one of the largest Icelandic commercial banks that failed as part of the 2008–2011 Icelandic financial crisis when its subsidiary sparked the Icesave dispute. On October 7, 2008, the Icelandic Financial Supervisory Authority took control of Landsbanki and created a new bank for all the domestic operations called Nýi Landsbanki so that the domestic bank could continue to operate, the new bank continued to operate under the Landsbanki name in Iceland.

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:

The Federal Home Loan Mortgage Corporation (FHLMC), known as Freddie Mac, is a public government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia. Freddie Mac is ranked No. 41 on the 2020 Fortune 500 list of the largest United States corporations by total revenue, and has $2.063 trillion assets under management.

Credit is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately, but promises either to repay or return those resources at a later date. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people.

The debt-snowball method is a debt-reduction strategy, whereby one who owes on more than one account pays off the accounts starting with the smallest balances first, while paying the minimum payment on larger debts. Once the smallest debt is paid off, one proceeds to the next larger debt, and so forth, proceeding to the largest ones last. This method is sometimes contrasted with the debt stacking method, also called the "debt avalanche method", where one pays off accounts on the highest interest rate first.

Credit card interest is the principal way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously. The bank pays the payee and then charges the cardholder interest over the time the money remains borrowed. Banks suffer losses when cardholders do not pay back the borrowed money as agreed. As a result, optimal calculation of interest based on any information they have about the cardholder's credit risk is key to a card issuer's profitability. Before determining what interest rate to offer, banks typically check national, and international, credit bureau reports to identify the borrowing history of the card holder applicant with other banks and conduct detailed interviews and documentation of the applicant's finances.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

A mortgage loan or simply mortgage is a loan used either by purchasers of real property to raise funds to buy real estate, or alternatively by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word mortgage is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of a collateral for a benefit (loan)".

The Icesave dispute was a diplomatic dispute that began after the privately owned Icelandic bank Landsbanki was placed in receivership on 7 October 2008. As Landsbanki was one of three systemically important financial institutions in Iceland to go bankrupt within a few days, the Icelandic Depositors' and Investors' Guarantee Fund (Tryggingarsjóður) had no remaining funds to make good on deposit guarantees to foreign Landsbanki depositors who held savings in the Icesave branch of the bank.

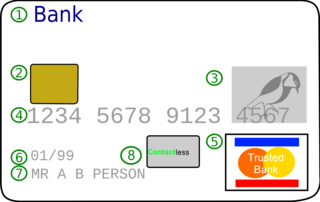

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's promise to the card issuer to pay them for the amounts plus the other agreed charges. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

The Emergency Economic Stabilization Act of 2008, often called the "bank bailout of 2008," was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and signed into law by President George W. Bush. The act became law as part of Public Law 110-343 on October 3, 2008, in the midst of the financial crisis of 2007–08. The law created the $700 billion Troubled Asset Relief Program (TARP) to purchase toxic assets from banks. The funds for purchase of distressed assets were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

The Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 is a federal statute passed by the United States Congress and signed by U.S. President Barack Obama on May 22, 2009. It is comprehensive credit card reform legislation that aims "...to establish fair and transparent practices relating to the extension of credit under an open end consumer credit plan, and for other purposes." The bill was passed with bipartisan support by both the House of Representatives and the Senate.

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

The Budget and Accounting Transparency Act of 2014 is a bill that would modify the budgetary treatment of federal credit programs. The bill would require that the cost of direct loans or loan guarantees be recognized in the federal budget on a fair-value basis using guidelines set forth by the Financial Accounting Standards Board. The bill would also require the federal budget to reflect the net impact of programs administered by Fannie Mae and Freddie Mac. The changes made by the bill would mean that Fannie Mae and Freddie Mac were counted on the budget instead of considered separately and would mean that the debt of those two programs would be included in the national debt. These programs themselves would not be changed, but how they are accounted for in the United States federal budget would be. The goal of the bill is to improve the accuracy of how some programs are accounted for in the federal budget.

References

- ↑ Mierzwinski, Edmund (17 April 2007). "Testimony of the U.S. Public Interest Research Group" (PDF). Legislative Hearing On HR 5244, the Credit Cardholders Bill of Rights: Before the Subcommittee On Financial Institutions and Consumer Credit Of the Financial Services Committee, U.S. House of Representatives Honorable Carolyn Maloney, Chair. United States House of Representatives. Archived from the original (pdf) on 2008-05-02. Retrieved 2008-01-27.