State defaults in the 1840s (in the United States) were defaults by U.S. states that took place in Arkansas, Illinois, Indiana, Louisiana, Maryland, Michigan, Mississippi, Pennsylvania, and the territory of Florida. The end of an inflationary period from 1834 to 1839 and the Panic of 1837 led to a tightening of credit lending from the Bank of England. By 1841, nineteen of the twenty-six U.S. states and two of the three territories had issued bonds and incurred state debt. [1] Of these, the aforementioned states and territory were forced to default on payments. Four states ultimately repudiated all or part of their debts, and three went through substantial renegotiations. [2]

It is important to distinguish state defaults and bankruptcies. [3] A default is a breach of obligations under a debt contract, which a sovereign is entitled to do, [3] especially before the passage of the 14th Amendment. [4] The 1933 Arkansas Default, after the 14th Amendment was passed, would prove much more difficult for the state, because of the increased power of federal court over states. [4] By contrast, a bankruptcy is a legal process, under federal law, to systematically sort out debt obligations under the supervision of a judge. [3] There are no provisions in U.S. bankruptcy law that authorizes a state to declare bankruptcy. [3]

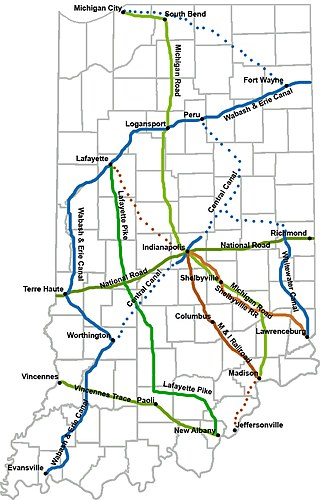

The states were borrowing to fund transportation investments as well as raising capital to start new banks. Northern states, such as Pennsylvania and Maryland, incurred debt through the building of canals to connect the Midwest to ports on the Atlantic Ocean. Midwest states, including Ohio, Indiana, Illinois, and Michigan, built railroads and canals throughout the region, while Southern States raised capital to fund new banks to improve a weakened banking system. The majority of state debt was owed to parties outside the U.S., primarily Europe. [5] State debts were largely paid off in full by the late 1840s, although no direct sanctions were enacted to force repayment. The state defaults inspired the enactment of the Bankruptcy Act of 1841, although the Act did not apply to the states themselves, [6] and was soon repealed in 1843. [7]

The years from 1834 to 1837 leading up to the State defaults were inflationary until the Panic of 1837. Prices for cotton and other exports sent overseas were rising. Through trade and state-backed bonds, the United States had a strong inflow of capital from the Bank of England and other European parties. Large infrastructure investments were being made domestically with the excess inflow of monetary value to the U.S. Much of the westward expansion of the United States was brought about from overseas funding for railroads and canals. Increasing the efficiency of transportation made it easier for people to move away from the large ports on the East coast. [8]

Pennsylvania and Maryland had viewed the success of the Erie Canal in connecting rural New York and the Midwest to the ports on the Atlantic Ocean. [5] The investment in building a new canal was costly but well compensated in trade opportunities further down the road. Both Pennsylvania and Maryland began borrowing from European groups to fund the construction of similar transportation infrastructure. By 1841, Maryland had amassed a total debt of a little over $12 million with more than $11 million used for transportation purposes. Pennsylvania had a lower proportion of transportation to other uses debt ratio compared to Maryland but had a total debt that was nearly three times that of Maryland's. Transportation investment debt reached over $30 million in Pennsylvania by 1841. [9]

The Midwest states were also borrowing to increase transportation infrastructure, similar to the Northern States, but railroads were the prime mode of transportation in the Midwest in this period. Canals were also being established at this time. Nearly all of the Mid-western state debts were incurred for transportation uses. The Midwest states borrowed on a much smaller scale than Pennsylvania and Maryland, reaching about $37 million, total, between Illinois, Indiana, Michigan, and Ohio. [9]

The Southern states were much different in the means of borrowing compared to the rest of the nation. At the time, the Southern banking system was small and insignificant compared to that in the North. United States bonds were issued to both foreign and domestic parties to raise capital. The raised capital was used to fund new banks and to allow already established banks the capital to grow upon. [9]

In 1836, the Bank of England decided to tighten the loaning of credit both domestically and to foreign parties to help increase dwindling reserves of monetary value held in the banks. Due to an open free trade economy domestic banks were forced to follow the interest rate changes made in England in fear of falling behind in competition. [10] Demand for cotton plummeted, by early 1837 the price of cotton was down 25%. Much of the nation, especially the South, was heavily dependent on trade of agriculture. Unstable crop prices had devastating effects in the South at the time. [8] Overall the tightening of credit had a widespread devastating effect in the United States because the infrastructure investment projects, brought about by large inflows of capital from Europe, were left unfinished and without further funding.

The tightening of credit from European parties led to many unfinished and unfunded infrastructure investment projects in the United States. Canals in Pennsylvania and Maryland were unfinished along with many railroads in the Midwest. Southern banks soon failed and bonds were unable to be paid back in full across the country.

Both Pennsylvania and Maryland borrowed heavily from European sources to fund canals connecting their ports to the Midwest and both could not make the interest payments early in the 1840s, due to the Panic of 1837, and had to declare defaults. Both states were well populated and relatively wealthy for the time so after a few tries they were able to raise their taxes to a point sustainable and were able to continue payment on loans relatively quickly. [8] [11]

The Midwest states including Ohio, Illinois, Indiana, and Michigan borrowed funds to build transportation infrastructure in the form of railroads and canals. With the tightening of funding from foreign sources most investment opportunities collapsed and only Ohio was able to avoid defaulting on loans. Indiana and Illinois were able to reach agreements with lenders to continue funding of the projects if payments were still met along with some speculations. Illinois deeded the Illinois and Michigan canal to their creditors as payment and Indiana agreed to pay half the debts while the Wabash and Erie canals were held in trust to pay the rest. Michigan followed similar procedures as Illinois and Indiana but agreements forced them to only pay a fraction of the total debts. [8] [11]

Most Southern states felt similar effects causing defaults in 1841. The many banks that had been established as a means of expanding Southern banking failed at an alarmingly high rate. Courts ruled that the states were not responsible for bonds issued to banks but were responsible for any bonds issued directly by the states. Many banks had large sums of debt and no way to pay for it. Quite often bonds issued and backed by banks were done outside of regulation standards giving banks a means to repudiate their debts. Debt repayment or repudiation was split among the states. Some states such as Louisiana and Arkansas liquidated the banks to pay off debts while states like Mississippi and Florida refused to pay their debts in full. [8] [11]

The International Bank for Reconstruction and Development (IBRD) is an international financial institution, established in 1944 and headquartered in Washington, D.C., United States, it is the lending arm of World Bank Group. The IBRD offers loans to middle-income developing countries. It is the first of five member institutions that compose the World Bank Group. The initial mission of the IBRD in 1944, was to finance the reconstruction of European nations devastated by World War II. The IBRD and its concessional lending arm, the International Development Association (IDA), are collectively known as the World Bank as they share the same leadership and staff.

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories.

A credit rating agency is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may rate the creditworthiness of issuers of debt obligations, of debt instruments, and in some cases, of the servicers of the underlying debt, but not of individual consumers.

The Panic of 1837 was a financial crisis in the United States that began a major depression, which lasted until the mid-1840s. Profits, prices, and wages dropped, westward expansion was stalled, unemployment rose, and pessimism abounded.

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments to the seller and, in exchange, may expect to receive a payoff if the asset defaults.

Shadrach Bond was a representative from the Illinois Territory to the United States Congress. In 1818, he was elected Governor of Illinois, becoming the new state's first chief executive. In an example of American politics during the Era of Good Feelings, Bond was elected to both positions without opposition.

Distressed securities are securities over companies or government entities that are experiencing financial or operational distress, default, or are under bankruptcy. As far as debt securities, this is called distressed debt. Purchasing or holding such distressed-debt creates significant risk due to the possibility that bankruptcy may render such securities worthless.

Sukuk is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds. Sukuk are defined by the AAOIFI as "securities of equal denomination representing individual ownership interests in a portfolio of eligible existing or future assets." The Fiqh academy of the OIC legitimized the use of sukuk in February 1988.

The bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

A vulture fund is a hedge fund, private-equity fund or distressed debt fund, that invests in debt considered to be very weak or in default, known as distressed securities. Investors in the fund profit by buying debt at a discounted price on a secondary market and then using numerous methods to subsequently sell the debt for a larger amount than the purchasing price. Debtors include companies, countries, and individuals.

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full when due. Cessation of due payments may either be accompanied by that government's formal declaration that it will not pay its debts (repudiation), or it may be unannounced. A credit rating agency will take into account in its gradings capital, interest, extraneous and procedural defaults, and failures to abide by the terms of bonds or other debt instruments.

The state Bank of Indiana was a government chartered banking institution established in 1833 in response to the state's shortage of capital caused by the closure of the Second Bank of the United States by the administration of President Andrew Jackson. The bank operated for twenty-six years and allowed the state to finance its internal improvements, stabilized the state's currency problems, and encouraged greater private economic growth. The bank closed in 1859. The profits were then split between the shareholders, allowing depositors to exchange their bank notes for federal notes, and the bank's buildings and infrastructure were sold and reincorporated as the privately owned Second Bank of Indiana.

The Indiana Mammoth Internal Improvement Act was a law passed by the Indiana General Assembly and signed by Whig Governor Noah Noble in 1836 that greatly expanded the state's program of internal improvements. It added $10 million to spending and funded several projects, including turnpikes, canals, and later, railroads. The following year the state economy was adversely affected by the Panic of 1837 and the overall project ended in a near total disaster for the state, which narrowly avoided total bankruptcy from the debt.

The Chicago real estate bubble of the 1830s was a real estate bubble, during which time the per acre prices in the future Chicago Loop increased from $800 in 1830 to $327,000 in 1836, before falling to $38,000 per acre by 1841. The Bank of Illinois began foreclosing on large amounts of real estate in the aftermath of the bust before it declared bankruptcy in 1842.

Alfred Kelley was a banker, canal builder, lawyer, railroad executive, and state legislator in the state of Ohio in the United States. He is considered by historians to be one of the most prominent commercial, financial, and political Ohioans of the first half of the 19th century.

The corporate debt bubble is the large increase in corporate bonds, excluding that of financial institutions, following the financial crisis of 2007–08. Global corporate debt rose from 84% of gross world product in 2009 to 92% in 2019, or about $72 trillion. In the world's eight largest economies—the United States, China, Japan, the United Kingdom, France, Spain, Italy, and Germany—total corporate debt was about $51 trillion in 2019, compared to $34 trillion in 2009. Excluding debt held by financial institutions—which trade debt as mortgages, student loans, and other instruments—the debt owed by non-financial companies in early March 2020 was $13 trillion worldwide, of which about $9.6 trillion was in the U.S.

State defaults in the United States are instances of states within the United States defaulting on their debt. The last instance of such a default took place during the Great Depression, in 1933, when the state of Arkansas defaulted on its highway bonds, which had long-lasting consequences for the state. Current U.S. bankruptcy law, an area governed by federal law, does not allow a state to file for bankruptcy under the Bankruptcy Code. Certain politicians and scholars have argued that the law should be amended to allow states to file for bankruptcy.

{{cite journal}}: Cite journal requires |journal= (help)CS1 maint: multiple names: authors list (link)