Environmental finance is a field within finance that employs market-based environmental policy instruments to improve the ecological impact of investment strategies. The primary objective of environmental finance is to regress the negative impacts of climate change through pricing and trading schemes. The field of environmental finance was established in response to the poor management of economic crises by government bodies globally. Environmental finance aims to reallocate a businesses resources to improve the sustainability of investments whilst also retaining profit margins.

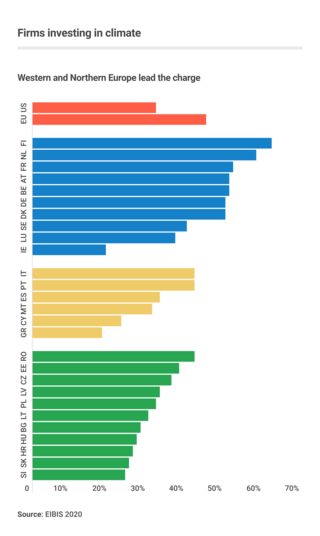

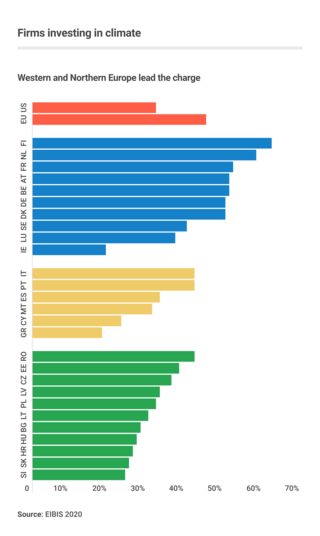

The European Investment Bank (EIB) is the European Union's investment bank and is owned by the 27 member states. It is the largest multilateral financial institution in the world. The EIB finances and invests both through equity and debt solutions companies and projects that achieve the policy aims of the European Union through loans, equity and guarantees.

A green economy is an economy that aims at reducing environmental risks and ecological scarcities, and that aims for sustainable development without degrading the environment. It is closely related with ecological economics, but has a more politically applied focus. The 2011 UNEP Green Economy Report argues "that to be green, an economy must not only be efficient, but also fair. Fairness implies recognizing global and country level equity dimensions, particularly in assuring a Just Transition to an economy that is low-carbon, resource efficient, and socially inclusive."

Business action on climate change is a topic which since 2000 includes a range of activities relating to climate change, and to influencing political decisions on climate change-related regulation, such as the Kyoto Protocol. Major multinationals have played and to some extent continue to play a significant role in the politics of climate change, especially in the United States, through lobbying of government and funding of climate change deniers. Business also plays a key role in the mitigation of climate change, through decisions to invest in researching and implementing new energy technologies and energy efficiency measures.

Clean technology, also called cleantech or climatetech, is any process, product, or service that reduces negative environmental impacts through significant energy efficiency improvements, the sustainable use of resources, or environmental protection activities. Clean technology includes a broad range of technology related to recycling, renewable energy, information technology, green transportation, electric motors, green chemistry, lighting, grey water, and more. Environmental finance is a method by which new clean technology projects can obtain financing through the generation of carbon credits. A project that is developed with concern for climate change mitigation is also known as a carbon project.

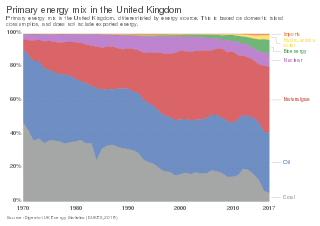

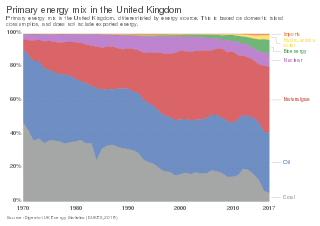

The energy policy of the United Kingdom refers to the United Kingdom's efforts towards reducing energy intensity, reducing energy poverty, and maintaining energy supply reliability. The United Kingdom has had success in this, though energy intensity remains high. There is an ambitious goal to reduce carbon dioxide emissions in future years, but it is unclear whether the programmes in place are sufficient to achieve this objective. Regarding energy self-sufficiency, UK policy does not address this issue, other than to concede historic energy security is currently ceasing to exist.

The Climate Investment Funds (CIF) were established in 2008 as a multilateral climate fund in order to finance pilot projects in developing countries at the request of the G8 and G20. The CIF administers a collection of programs with a view of helping nations fight the impacts of climate change and accelerate their shift to a low-carbon economy.

Rachel Jane Reeves is a British politician, who is currently serving as the Chancellor of the Exchequer since July 2024. A member of the Labour Party, she has been Member of Parliament (MP) for Leeds West and Pudsey, formerly Leeds West, since 2010.

The economics of climate change mitigation is a contentious part of climate change mitigation – action aimed to limit the dangerous socio-economic and environmental consequences of climate change.

Green Investment Group Limited (GIG), formerly the UK Green Investment Bank, is a specialist in green infrastructure principal investment, project delivery and the management of portfolio assets and related services. It is owned by the Macquarie Group.

Climate finance is an umbrella term for financial resources such as loans, grants, or domestic budget allocations for climate change mitigation, adaptation or resiliency. Finance can come from private and public sources. It can be channeled by various intermediaries such as multilateral development banks or other development agencies. Those agencies are particularly important for the transfer of public resources from developed to developing countries in light of UN Climate Convention obligations that developed countries have.

The National Infrastructure Commission is the executive agency responsible for providing expert advice to the UK Government on infrastructure challenges facing the UK.

Green industrial policy (GIP) is strategic government policy that attempts to accelerate the development and growth of green industries to transition towards a low-carbon economy. Green industrial policy is necessary because green industries such as renewable energy and low-carbon public transportation infrastructure face high costs and many risks in terms of the market economy. Therefore, they need support from the public sector in the form of industrial policy until they become commercially viable. Natural scientists warn that immediate action must occur to lower greenhouse gas emissions and mitigate the effects of climate change. Social scientists argue that the mitigation of climate change requires state intervention and governance reform. Thus, governments use GIP to address the economic, political, and environmental issues of climate change. GIP is conducive to sustainable economic, institutional, and technological transformation. It goes beyond the free market economic structure to address market failures and commitment problems that hinder sustainable investment. Effective GIP builds political support for carbon regulation, which is necessary to transition towards a low-carbon economy. Several governments use different types of GIP that lead to various outcomes. The Green Industry plays a pivotal role in creating a sustainable and environmentally responsible future; By prioritizing resource efficiency, renewable energy, and eco-friendly practices, this industry significantly benefits society and the planet at large.

National Investment and Infrastructure Fund Limited (NIIFL) is an Indian public sector company which maintains infrastructure investments funds for international and Indian investors anchored by the Government of India. The objective behind creating this organisation was to catalyse capital into the country and support its growth needs across sectors of importance.

Gareth Mark Davies is a British politician who is the Member of Parliament (MP) for the constituency of Grantham and Bourne. He was previously the MP for Grantham and Stamford from the 2019 general election until the seat's abolition in 2024.

The European Green Deal, approved in 2020, is a set of policy initiatives by the European Commission with the overarching aim of making the European Union (EU) climate neutral in 2050. The plan is to review each existing law on its climate merits, and also introduce new legislation on the circular economy (CE), building renovation, biodiversity, farming and innovation.

Green recovery packages are proposed environmental, regulatory, and fiscal reforms to rebuild prosperity in the wake of an economic crisis, such as the COVID-19 pandemic or the Global Financial Crisis (GFC). They pertain to fiscal measures that intend to recover economic growth while also positively benefitting the environment, including measures for renewable energy, efficient energy use, nature-based solutions, sustainable transport, green innovation and green jobs, amongst others.

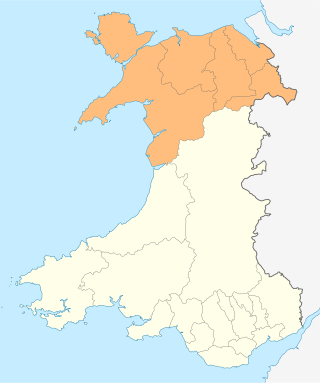

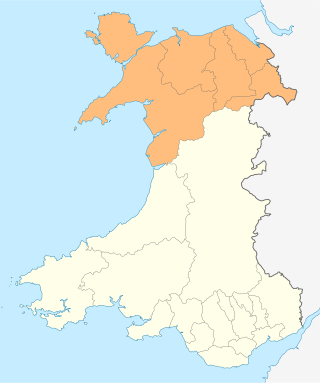

Ambition North Wales is a joint committee and decision-making body overseeing the North Wales Growth Deal, a regional economic growth deal covering the North Wales region. It is a partnership between the six local authorities of Conwy County Borough, Denbighshire, Flintshire, Gwynedd, Isle of Anglesey, and Wrexham County Borough, and other local partners in the region, including Bangor University, Wrexham University, Grŵp Llandrillo Menai, Coleg Cambria, and various private sector representatives.

Regional economy in Wales is centred on four regional economic boards in Wales. Each board oversees a city or growth deal, signed between 2016 and 2022, lasting 10–15 years. Two of the deals are city deals signed and proposed by their respective economic boards, and their areas are described as "city regions"; the Cardiff Capital Region and Swansea Bay City Region. Whereas in North Wales, the North Wales Economic Ambition Board negotiated a North Wales growth deal signed in 2020, and in Mid Wales, the Growing Mid Wales Partnership, led negotiations for a Mid Wales growth deal signed in 2022. The programmes are based on the City deal and Growth deal initiatives set up by the Coalition UK Government in 2012, to promote the decentralisation of the UK economy, by stimulating local economic growth.

Rachel Reeves became Chancellor of the Exchequer on 5 July 2024, upon her appointment by Prime Minister Keir Starmer, following Labour's victory in the 2024 general election. She succeeded Conservative chancellor Jeremy Hunt, and became the first woman to hold the office of Chancellor in its 708-year history.