In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

A zero-coupon bond is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon and deep discount bonds are terms that are used interchangeably.

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

A Premium Bond is a lottery bond issued by the United Kingdom government since 1956. At present it is issued by the government's National Savings and Investments agency.

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

War bonds are debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an unpopular level. They are also a means to control inflation by removing money from circulation in a stimulated wartime economy. War bonds are either retail bonds marketed directly to the public or wholesale bonds traded on a stock market. Exhortations to buy war bonds have often been accompanied by appeals to patriotism and conscience. Retail war bonds, like other retail bonds, tend to have a yield which is below that offered by the market and are often made available in a wide range of denominations to make them affordable for all citizens.

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending in addition to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt.

In finance, the yield curve is a graph which depicts how the yields on debt instruments – such as bonds – vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. The vertical or y-axis depicts the annualized yield to maturity.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not: in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing.

A liberty bond or liberty loan was a war bond that was sold in the United States to support the Allied cause in World War I. Subscribing to the bonds became a symbol of patriotic duty in the United States and introduced the idea of financial securities to many citizens for the first time.

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, mergers & acquisitions, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of at least one year. Corporate debt instruments with maturity shorter than one year are referred to as commercial paper.

Daily inflation-indexed bonds are bonds where the principal is indexed to inflation or deflation on a daily basis. They are thus designed to hedge the inflation risk of a bond. The first known inflation-indexed bond was issued by the Massachusetts Bay Company in 1780. The market has grown dramatically since the British government began issuing inflation-linked Gilts in 1981. As of 2019, government-issued inflation-linked bonds comprise over $3.1 trillion of the international debt market. The inflation-linked market primarily consists of sovereign bonds, with privately issued inflation-linked bonds constituting a small portion of the market.

The Canada Savings Bond was an investment instrument offered by the Government of Canada from 1945 to 2017, sold between early October and December 1 of every year. It was issued by the Bank of Canada and was intended to offer a competitive interest rate, and had a guaranteed minimum interest rate.

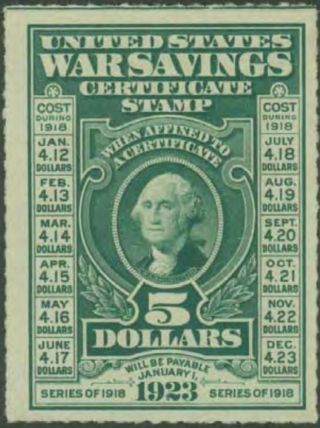

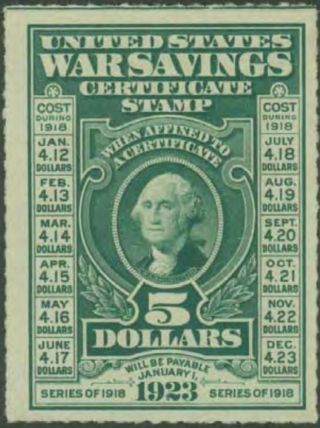

War savings stamps were issued by the United States Treasury Department to help fund participation in World War I and World War II. Although these stamps were distinct from the postal savings stamps issued by the United States Post Office Department, the Post Office nevertheless played a major role in promoting and distributing war savings stamps. In contrast to Liberty Bonds, which were purchased primarily by financial institutions, war savings stamps were principally aimed at common citizens. During World War I, 25-cent Thrift stamps were offered to allow individuals to accumulate enough over time to purchase the standard 5-dollar War Savings Certificate stamp. When the Treasury began issuing war savings stamps during World War II, the lowest denomination was a 10-cent stamp, enabling ordinary citizens to purchase them. In many cases, collections of war savings stamps could be redeemed for Treasury Certificates or War Bonds.

The real interest rate is the rate of interest an investor, saver or lender receives after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate.

TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase treasury securities, such as savings bonds, directly from the US government. It enables people to manage their investments online, including connecting their TreasuryDirect account to a bank account for deposits and withdrawals.

Series E United States Savings Bonds were government bonds marketed by the United States Department of the Treasury as war bonds during World War II from 1941 to 1945. After the war, they continued to be offered as retail investments until 1980, when they were replaced by other savings bonds.

Lottery bonds are a type of government bond in which some randomly selected bonds within the issue are redeemed at a higher value than the face value of the bond. Lottery bonds have been issued by public authorities in Belgium, Ireland, Pakistan, Sweden, New Zealand, the UK and other nations.

Singapore Savings Bonds (SSBs) are a type of Singapore Government Securities that are issued for investors who want to participate in the Singapore Government Securities (SGS) market but in smaller denominations.