Related Research Articles

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The monetary policy of The United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

Stanley Fischer is an Israeli-American economist who served as the 20th vice chair of the Federal Reserve from 2014 to 2017. Fischer previously served as the 8th governor of the Bank of Israel from 2005 to 2013. Born in Northern Rhodesia, he holds dual citizenship in Israel and the United States. He previously served as First Deputy Managing Director of the International Monetary Fund and as Chief Economist of the World Bank. On January 10, 2014, President Barack Obama nominated Fischer to the position of Vice Chair of the Federal Reserve. He is a senior advisor at BlackRock. On September 6, 2017, Stanley Fischer announced that he was resigning as Vice-Chair for personal reasons effective October 13, 2017, two days before his 74th birthday.

Kenneth Saul Rogoff is an American economist and chess Grandmaster.

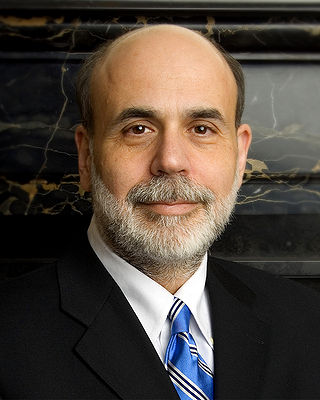

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the late-2000s financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

A primary dealer is a firm that buys government securities directly from a government, with the intention of reselling them to others, thus acting as a market maker of government securities. The government may regulate the behaviour and number of its primary dealers and impose conditions of entry. Some governments sell their securities only to primary dealers; some sell them to others as well. Governments that use primary dealers include Australia, Belgium, Brazil, Canada, China, France, Hong Kong, India, Ireland, Hungary, Italy, Japan, Pakistan, Singapore, Spain, Sweden, the United Kingdom, and the United States.

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the financial crisis of 2007–2008. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets.

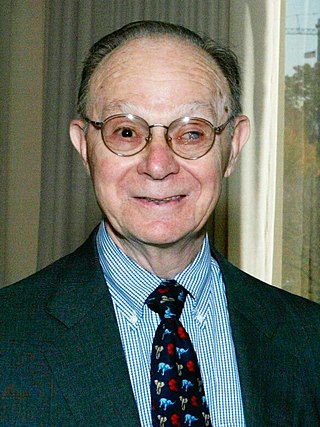

Allan H. Meltzer was an American economist and Allan H. Meltzer Professor of Political Economy at Carnegie Mellon University's Tepper School of Business and Institute for Politics and Strategy in Pittsburgh, Pennsylvania. Meltzer specialized on studying monetary policy and the US Federal Reserve System, and authored several academic papers and books on the development and applications of monetary policy, and about the history of central banking in the US. Together with Karl Brunner, he created the Shadow Open Market Committee: a monetarist council that deeply criticized the Federal Open Market Committee.

The Bank of New York Mellon Corporation, doing business as BNY, is an American banking and financial services corporation headquartered in New York City. The bank offers investment management, investment services, and wealth management services. BNY was formed from the merger of The Bank of New York and the Mellon Financial Corporation in 2007. Following the merger, it adopted the brand name The Bank of New York Mellon, which was later simplified to BNY Mellon and later again to BNY. It is the world's largest custodian bank and securities services company, with $2 trillion in assets under management and $48.8 trillion in assets under custody as of 2024. It is considered a systemically important bank by the Financial Stability Board.

The Greenspan put was a monetary policy response to financial crises that Alan Greenspan, former chair of the Federal Reserve, exercised beginning with the crash of 1987. Successful in addressing various crises, it became controversial as it led to periods of extreme speculation led by Wall Street investment banks overusing the put's repurchase agreements and creating successive asset price bubbles. The banks so overused Greenspan's tools that their compromised solvency in the global financial crisis of 2007–2008 required Fed chair Ben Bernanke to use direct quantitative easing. The term Yellen put was used to refer to Fed chair Janet Yellen's policy of perpetual monetary looseness.

Charles L. Evans is the former ninth president and chief executive officer of the Federal Reserve Bank of Chicago, serving from 2007 to 2023. In that capacity, he served on the Federal Open Market Committee (FOMC), the Federal Reserve System's monetary policy-making body.

This is a list of historical rate actions by the United States Federal Open Market Committee (FOMC). The FOMC controls the supply of credit to banks and the sale of treasury securities.

James Brian Bullard is the former chief executive officer and 12th president of the Federal Reserve Bank of St. Louis, a position he held from 2008 until August 14, 2023. In July 2023, he was named dean of the Mitchell E. Daniels Jr. School of Business at Purdue University.

Carmen M. Reinhart is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fellow at the Peterson Institute for International Economics and Professor of Economics and Director of the Center for International Economics at the University of Maryland. She is a research associate at the National Bureau of Economic Research, a Research Fellow at the Centre for Economic Policy Research, Founding Contributor of VoxEU, and a member of Council on Foreign Relations. She is also a member of American Economic Association, Latin American and Caribbean Economic Association, and the Association for the Study of the Cuban Economy. She became the subject of general news coverage when mathematical errors were found in a research paper she co-authored.

Narayana Rao Kocherlakota is an American economist and the Lionel W. McKenzie Professor of Economics at the University of Rochester. Previously, he served as the 12th president of the Federal Reserve Bank of Minneapolis until December 31, 2015. Appointed in 2009, he joined the Federal Open Markets Committee in 2011. In 2012, he was named one of the top 100 Global Thinkers by Foreign Policy magazine.

Richard Harris Clarida is an American economist who served as the 21st Vice Chair of the Federal Reserve from 2018 to 2022. Clarida resigned his post on January 14, 2022, to return from public service leave to teach at Columbia University for the spring term of 2022. He is the C. Lowell Harriss Professor of Economics and International Affairs at Columbia University and, from 2006 until September 2018 and from October 2022 to the present, a Global Strategic Advisor for PIMCO. He is notable for his contributions to dynamic stochastic general equilibrium theory and international monetary economics. He is a former Assistant Secretary of the Treasury for Economic Policy and is a recipient of the Treasury Medal. He also was a proponent of the theory that inflation was transitory during the COVID-19 pandemic.

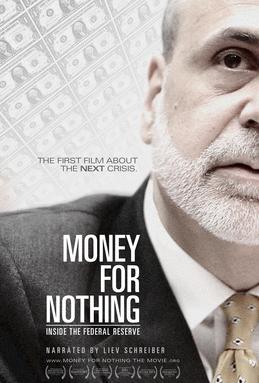

Money for Nothing: Inside the Federal Reserve is an independent feature-length American documentary about the Federal Reserve written and directed by Jim Bruce, and narrated by Liev Schreiber. It examines 100 years of the Federal Reserve's history, and discusses its actions and repercussions the US economy leading to the late-2000s financial crisis. Bruce believes "a more fully and accurately informed public will promote greater accountability and more effective policies from our central bank". The film features interviews with Paul Volcker and Janet Yellen as well as current and former Federal Reserve officials, top economists, financial historians, famous investors, and traders who provide insight on the Federal Reserve System.

Marvin Seth Goodfriend was an American economist. He held the Allan H. Meltzer Professorship in economics at Carnegie Mellon University; he was previously the director of research at the Federal Reserve Bank of Richmond. Following his 2017 nomination to the Federal Reserve Board of Governors, the White House decided to forgo renominating Goodfriend at the beginning of the new term.

Jason Cummins is an American economist. He is the Head of Research and Chief US Economist at Brevan Howard Asset Management, an international hedge fund management group. Cummins is the Chairman of the Treasury Borrowing Advisory Committee (TBAC), a government-appointed panel under The Securities Industry and Financial Markets Association (SIFMA). Cummins also serves as a trustee on the board of The Brookings Institution and director on the board of Peterson Institute for International Economics.

BNY Investments is the investment management division of BNY. It is one of the largest asset managers in the world.

References

- ↑ Standish Mellon Asset Management Names Vincent Reinhart Chief Economist. PR Newswire. Retrieved 14 March 2016.

- ↑ "Fed Rejects Geithner Request for Study of Governance, Structure", by Craig Torres and Robert Schmidt. Bloomberg, September 21, 2009 00:01 EDT. Footnote upgraded July 3, 2010.

- ↑ "Federal Reserve Made $47.4 Billion in 2009" "DealBook" blog, The New York Times, April 22, 2010, 2:21 am ET. Retrieved July 3, 2010.

- ↑ "The Dangers Ahead for Bernanke: Surprises in Store" section of "Room for Debate ... running commentary," five opinions on Fed Chairman's reappointment compiled by the editors, The New York Times, August 26, 2009, 11:55 am. Retrieved July 3, 2010.

- ↑ "Fallout From a Bailout: How the Bear Stearns Intervention Will Haunt the Fed", column by Vincent Reinhart, Washington Post, May 22, 2008. Footnote upgraded July 3, 2010.

- ↑ "Secretary Paulson Makes the Right Call", "Opinion" by Vincent Reinhart, The Wall Street Journal, Sept. 16, 2008 p. A23. Footnote upgraded July 3, 2010.