Related Research Articles

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

The Foreign Corrupt Practices Act of 1977 (FCPA) is a United States federal law that prohibits U.S. citizens and entities from bribing foreign government officials to benefit their business interests.

Securities regulation in the United States is the field of U.S. law that covers transactions and other dealings with securities. The term is usually understood to include both federal and state-level regulation by governmental regulatory agencies, but sometimes may also encompass listing requirements of exchanges like the New York Stock Exchange and rules of self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA).

A financial adviser or financial advisor is a professional who provides financial services to clients based on their financial situation. In many countries, financial advisors must complete specific training and be registered with a regulatory body in order to provide advice.

A registered investment adviser (RIA) is a firm that is an investment adviser in the United States, registered as such with the Securities and Exchange Commission (SEC) or a state's securities agency. The numerous references to RIAs within the Investment Advisers Act of 1940 popularized the term, which is closely associated with the term investment adviser. An investment adviser is defined by the Securities and Exchange Commission as an individual or a firm that is in the business of giving advice about securities. However, an RIA is the actual firm, while the employees of the firm are called Investment Adviser Representatives (IARs).

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

The Canadian Securities Administrators is an umbrella organization of Canada's provincial and territorial securities regulators whose objective is to improve, coordinate, and harmonize regulation of the Canadian capital markets.

Orlando Joseph Jett is an American former securities trader, known for his role in the Kidder Peabody trading loss in 1994. At the time of the loss it was the largest trading fraud in history.

A fairness opinion is a professional evaluation by an investment bank or other third party as to whether the terms of a merger, acquisition, buyback, spin-off, or privatization are fair. It is rendered for a fee. They are typically issued when a public company is being sold, merged or divested of all or a substantial division of their business. They can also be required in private transactions not involving a company that is traded on a public exchange, as well as in circumstances other than mergers, such as a corporation exchanging debt for equity. Some of the specific functions of a fairness opinion are to aid in decision-making, mitigate risk, and enhance communication.

Linda Chatman Thomsen was the director of the Division of Enforcement for the U.S. Securities and Exchange Commission from 2005 until early 2009. Since arriving at the SEC in 1995, she worked under four SEC Chairmen: Arthur Levitt, Harvey Pitt, William H. Donaldson, and Christopher Cox. William Donaldson named her director of the Division of Enforcement on May 12, 2005. She is the first woman to serve as director of the Division of Enforcement. Thomsen is known for her role in the suits by the SEC against Enron and Martha Stewart, and for not having investigated Bernard Madoff. She succeeded Stephen M. Cutler. She is now a senior counsel at Davis Polk & Wardwell.

Egan-Jones Ratings Company is a nationally recognized statistical rating organization (NRSRO) that was founded in 1995 to provide "timely, accurate credit ratings." Egan-Jones rates the credit worthiness of issuers looking to raise capital in private credit markets across a range of asset classes.

Selling away in the U.S. securities brokerage industry is the inappropriate practice of an investment professional who sells, or solicits the sale of, securities not held or offered by the brokerage firm with which he is associated (affiliated). An example of the term expressed in a sentence is, "The broker was selling investments away from the firm." Brokers marketing securities must have obtained the appropriate securities licenses for various types of investments. Brokers in the U.S. may be "associated" with one or more Brokerage firms and must obtain licenses by passing standardized Financial Industry Regulatory Authority (FINRA) exams such as the Series 6 or Series 7 exam. See List of Securities Examinations for types of securities licenses in the U.S.

Robert S. Khuzami was the Deputy U.S. Attorney for the United States Attorney's Office for the Southern District of New York until March 22, 2019. He previously was a United States federal prosecutor and Assistant United States Attorney for the office, and a former director of the Division of Enforcement of the U.S. Securities and Exchange Commission. He was previously a partner at law firm Kirkland & Ellis. and general counsel of Deutsche Bank AG.

An FDA warning letter is an official message from the United States Food and Drug Administration (FDA) to a manufacturer or other organization that has violated some rule in a federally regulated activity.

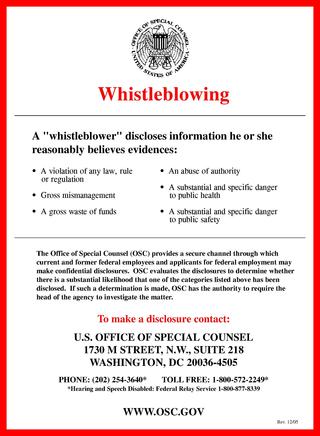

A whistleblower is a person who exposes any kind of information or activity that is deemed illegal, unethical, or not correct within an organization that is either private or public. The Whistleblower Protection Act was made into federal law in the United States in 1989.

The U.S. Securities and Exchange Commission (SEC) whistleblower program went into effect on July 21, 2010, when the President signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act. The same law also established a whistleblower incentive program at the Commodity Futures Trading Commission to incentivize reporting of violations of the Commodity Exchange Act, which is run by former senior SEC enforcement attorney Christopher C. Ehrman. The SEC Whistleblower Program rewards people who submit tips related to violations of the federal securities laws. The program offers robust employment protections, monetary awards and the ability to report anonymously. SEC whistleblowers are entitled to awards ranging from 10 to 30 percent of the monetary sanctions collected, which are paid from a replenishing Investor Protection Fund. Since 2011, whistleblower tips have enabled the SEC to recover over $4.8 billion in financial penalties from wrongdoers. The SEC has awarded more than $1 billion to whistleblowers. The largest SEC whistleblower awards to date are $114 million, $110 million, and $50 million.

The Telecommunications Amendment Act 2015(Cth) is an Act of the Parliament of Australia that amends the Telecommunications Act 1979 and the Telecommunications Act 1997 to introduce a statutory obligation for Australian telecommunication service providers (TSPs) to retain, for a period of two years, particular types of telecommunications data (metadata) and introduces certain reforms to the regimes applying to the access of stored communications and telecommunications data under the original Act.

The Philippine Competition Commission (PhCC) is an independent, quasi-judicial body formed to implement the Philippine Competition Act (Republic Act No. 10667). The PhCC aims to promote and maintain market competition within the Philippines by regulating anti-competition behavior. The main role of the PhCC is to promote economic efficiency within the Philippine economy, ensuring fair and healthy market competition.

Bradley J. Bondi is an American lawyer, law professor and partner at Cahill Gordon & Reindel, where he is the Chair of the firm's White Collar and Government Investigations Practice Group. He has also served on the executive staff of the Securities and Exchange Commission (SEC) and he was appointed to the Financial Crisis Inquiry Commission (FCIC) in the wake of the 2007-2008 financial crisis to investigate its causes.

References

- 1 2 Betman, Ronald S. (March 1, 2016). "Trends in SEC Enforcement: What CPAs Need to Know". The CPA Journal.

- 1 2 US Securities and Exchange Commission (October 22, 2014). "Investor Bulletin: SEC Investigations". SEC.Gov.

- 1 2 3 Mark J. Astarita, Esq. (n.d.). "The Wells Notice in SEC/FINRA Investigations". seclaw.com (operated by VGIS Communications, LLC). Retrieved October 6, 2017.

- ↑ Eaglesham, Jean (Oct 9, 2013) "SEC Drops 20% of Probes After 'Wells Notice '". The Wall Street Journal .

- ↑ "Joshua A. Naftalis, "Wells Submissions" to the SEC as Offers of Settlement under Federal Rule of Evidence 408 and Their Protection from Third-Party Discovery, 102 Colum. L. Rev. 1912 (2002)". JSTOR 1123663.

- ↑ Koba, Mark (November 28, 2012). "Wells notice—CNBC Explains". CNBC.