Citigroup Inc. or Citi is an American multinational investment bank and financial services corporation incorporated in Delaware and headquartered in New York City. The company was formed by the merger of Citicorp, the bank holding company for Citibank, and Travelers in 1998; Travelers was spun off from the company in 2002.

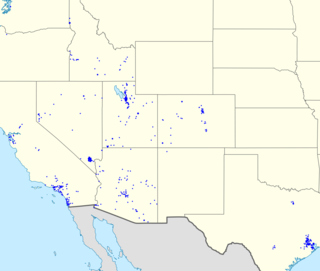

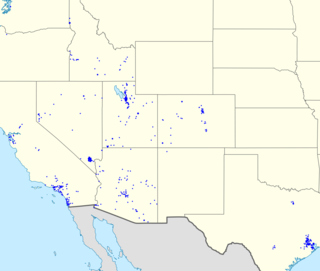

Washington Federal, Inc.,, is an American bank based in Seattle, Washington. It operates 235 branches throughout Washington, Oregon, Idaho, Nevada, Utah, Arizona, New Mexico, and Texas.

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina, with investment banking and auxiliary headquarters in Manhattan. The bank was founded in San Francisco, California. It is the second-largest banking institution in the United States, after JPMorgan Chase, and the second-largest bank in the world by market capitalization. Bank of America is one of the Big Four banking institutions of the United States. It serves approximately 10.73% of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services revolve around commercial banking, wealth management, and investment banking.

Capital One Financial Corporation is an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, headquartered in McLean, Virginia with operations primarily in the United States. It is on the list of largest banks in the United States, is the third largest issuer of Visa and Mastercard credit cards and is one of the largest car finance companies in the United States.

Bank of America Home Loans is the mortgage unit of Bank of America. In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion. In 2006, Countrywide financed 20% of all mortgages in the United States, at a value of about 3.5% of the United States GDP, a proportion greater than any other single mortgage lender.

Daniel Andrew Beal is an American banker, businessman, investor, and amateur mathematician. He is a Dallas-based businessman who accumulated wealth in real estate and banking. Born and raised in Lansing, Michigan, Beal is founder and chairman of Beal Bank and Beal Bank USA, as well as other affiliated companies. According to Bloomberg Billionaires Index, Beal has an estimated worth of US$9.49 billion as of December 2021.

First Horizon Corporation, formerly First Tennessee Bank, is a financial services company, founded in 1864, and based in Memphis, Tennessee. Through its banking subsidiary First Horizon Bank, it provides financial services through locations in 12 states across the Southeast, a region in which it is the fourth largest regional bank.

The Bank of Hawaii Corporation is a regional commercial bank headquartered in Honolulu, Hawaii. It is Hawaii's second oldest bank and its largest locally owned bank in that the majority of the voting stockholders reside within the state. Bank of Hawaii has the most accounts, customers, branches, and ATMs of any financial institution in the state. The bank consists of four business segments: retail banking, commercial banking, investment services, and treasury. The bank is currently headed by chairman, president and chief executive officer, Peter S. Ho.

Regions Financial Corporation is an American bank holding company headquartered in the Regions Center in Birmingham, Alabama. The company provides retail banking and commercial banking, trust, stockbrokerage, and mortgage services. Its banking subsidiary, Regions Bank, operates 1,952 automated teller machines and 1,454 branches in 16 states in the Southern and Midwestern United States.

Beal Bank is an American bank, which was founded by Texas-based entrepreneur D. Andrew "Andy" Beal. It includes two separately chartered banks, Beal Bank and Beal Bank USA. Each entity is insured by the Federal Deposit Insurance Corporation (FDIC).

First Interstate Bancorp was a bank holding company based in the United States that was taken over in 1996 by Wells Fargo. Headquartered in Los Angeles, it was the nation's eighth largest banking company.

Zions Bancorporation is a national bank headquartered in Salt Lake City, Utah. It operates as a national bank rather than as a bank holding company and does business under the following seven brands: Zions Bank, Amegy Bank of Texas, California Bank and Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and The Commerce Bank of Washington. It has 416 branches and over 1 million customers. It was founded by The Church of Jesus Christ of Latter-day Saints in 1873, although the church divested itself of its interest in the bank in 1960.

Mercantile Bancorporation was the largest bank holding company in Missouri when it was acquired by Firstar Corporation in 1999.

Silver State Bank was a failed Nevada commercial bank with 17 branches in the Las Vegas and Phoenix metropolitan areas and loan operations across the western United States. The bank's assets were acquired by Zions Bancorporation, a bank holding corporation with $2 billion in assets.

Nevada State Bank, a division of Zions Bancorporation, N.A. Member FDIC, is a full-service bank with branches statewide. Founded in 1959, Nevada State Bank serves 20 communities across the state of Nevada. Zions Bancorporation, N.A. operates in nearly 500 local financial centers across 11 Western states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington and Wyoming. Zions Bancorporation, N.A. is included in the S&P 500 and NASDAQ Financial 100 indices.

Axos Financial is a bank holding company based in Las Vegas, Nevada and is the parent of Axos Bank, a direct bank.

Glacier Bancorp, Inc. is a regional multi-bank holding company headquartered in Kalispell, Montana, United States. It is a successor corporation to the Delaware corporation originally incorporated in 1990. The company provides personal and commercial banking services from 221 locations in Montana, Idaho, Utah, Washington, Wyoming, Colorado, Arizona, and, Nevada.

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

Ameris Bancorp is a bank holding company headquartered in Atlanta, Georgia. Through its bank subsidiary, Ameris Bank, the company operates full-service branches in Georgia, Alabama, Florida, North Carolina and South Carolina, and mortgage-only locations in Georgia, Alabama, Florida, North Carolina, South Carolina, Virginia, Maryland, and Tennessee.