A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. Among these portfolio techniques are short selling and the use of leverage and derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals.

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends.

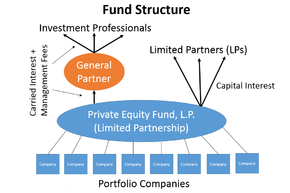

In the field of finance, private equity (PE) is capital stock in a private company that does not offer stock to the general public. Private equity is offered instead to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage, "private equity" can refer to these investment firms rather than the companies that they invest in.

An investor is a person who allocates financial capital with the expectation of a future return (profit) or to gain an advantage (interest). Through this allocated capital the investor usually purchases some species of property. Types of investments include equity, debt, securities, real estate, infrastructure, currency, commodity, token, derivatives such as put and call options, futures, forwards, etc. This definition makes no distinction between the investors in the primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns stock is a shareholder.

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

A "fund of funds" (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. This type of investing is often referred to as multi-manager investment. A fund of funds may be "fettered", meaning that it invests only in funds managed by the same investment company, or "unfettered", meaning that it can invest in external funds run by other managers.

An offshore fund is generally a collective investment scheme domiciled in an offshore jurisdiction. Like the term "offshore company", the term is more descriptive than definitive, and both the words 'offshore' and 'fund' may be construed differently.

Social venture capital is a form of investment funding that is usually funded by a group of social venture capitalists or an impact investor to provide seed-funding investment, usually in a for-profit social enterprise, in return to achieve an outsized gain in financial return while delivering social impact to the world. There are various organizations, such as Venture Philanthropy (VP) companies and nonprofit organizations, that deploy a simple venture capital strategy model to fund nonprofit events, social enterprises, or activities that deliver a high social impact or a strong social causes for their existence. There are also regionally focused organizations that target a specific region of the world, to help build and support the local community in a social cause.

A private equity fund is a collective investment scheme used for making investments in various equity securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years. At inception, institutional investors make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors' point of view, funds can be traditional or asymmetric.

Film finance is an aspect of film production that occurs during the development stage prior to pre-production, and is concerned with determining the potential value of a proposed film.

A blocker corporation is a type of C Corporation in the United States that has been used by tax exempt individuals to protect their investments from taxation when they participate in private equity or with hedge funds. In addition to tax exempt individuals, foreign investors have also used blocker corporations.

In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate.

Private equity funds and hedge funds are private investment vehicles used to pool investment capital, usually for a small group of large institutional or wealthy individual investors. They are subject to favorable regulatory treatment in most jurisdictions from which they are managed, which allows them to engage in financial activities that are off-limits for more regulated companies. Both types of fund also take advantage of generally applicable rules in their jurisdictions to minimize the tax burden on their investors, as well as on the fund managers. As media coverage increases regarding the growing influence of hedge funds and private equity, these tax rules are increasingly under scrutiny by legislative bodies. Private equity and hedge funds choose their structure depending on the individual circumstances of the investors the fund is designed to attract.

A private equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or operating companies through a variety of loosely affiliated investment strategies including leveraged buyout, venture capital, and growth capital. Often described as a financial sponsor, each firm will raise funds that will be invested in accordance with one or more specific investment strategies.

A Business Development Company ("BDC") is a form of unregistered closed-end investment company in the United States that invests in small and mid-sized businesses. This form of company was created by the US Congress in 1980 in the amendments to the Investment Company Act of 1940. Publicly filing firms may elect regulation as BDCs if they meet certain requirements of the Investment Company Act.

Taxation in Norway is levied by the central government, the county municipality and the municipality. In 2012 the total tax revenue was 42.2% of the gross domestic product (GDP). Many direct and indirect taxes exist. The most important taxes – in terms of revenue – are VAT, income tax in the petroleum sector, employers' social security contributions and tax on "ordinary income" for persons. Most direct taxes are collected by the Norwegian Tax Administration and most indirect taxes are collected by the Norwegian Customs and Excise Authorities.

The Abgeltungsteuer is a flat tax on private income from capital. It is used in Germany, Austria, and Luxembourg.

A royalty fund is a category of private equity fund that specializes in purchasing consistent revenue streams deriving from the payment of royalties. One growing subset of this category is the healthcare royalty fund, in which a private equity fund manager purchases a royalty stream paid by a pharmaceutical company to a patent holder. The patent holder can be another company, an individual inventor, or some sort of institution, such as a research university.

Enterprise Value Tax was a tax proposal considered by the United States Congress. It passed in the US House of Representatives in 2010 as part of "H.R. 4213: American Jobs and Closing Tax Loopholes Act". The bill was not passed by the Senate, and hence did not become law. Nonetheless the concept of the tax has recurred in succeeding years, most recently as a speculation over Donald Trump's promise to do "something huge".

An Irish Section 110 special purpose vehicle (SPV) or section 110 company is an Irish tax resident company, which qualifies under Section 110 of the Irish Taxes Consolidation Act 1997 (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties.