Finance is the study and discipline of money, currency and capital assets. It is related to but distinct from economics, which is the study of the production, distribution, and consumption of goods and services. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance.

Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities.

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as floating, or going public, a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded.

An economic bubble is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth, and/or by the belief that intrinsic valuation is no longer relevant when making an investment. They have appeared in most asset classes, including equities, commodities, real estate, and even esoteric assets. Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles, are attributed to central banking liquidity.

In economics, a public good is a good that is both non-excludable and non-rivalrous. Use by one person neither prevents access by other people, nor does it reduce availability to others. Therefore, the good can be used simultaneously by more than one person. This is in contrast to a common good, such as wild fish stocks in the ocean, which is non-excludable but rivalrous to a certain degree. If too many fish were harvested, the stocks would deplete, limiting the access of fish for others. A public good must be valuable to more than one user, otherwise, its simultaneous availability to more than one person would be economically irrelevant.

In economics, internationalization or internationalisation is the process of increasing involvement of enterprises in international markets, although there is no agreed definition of internationalization. Internationalization is a crucial strategy not only for companies that seek horizontal integration globally but also for countries that addresses the sustainability of its development in different manufacturing as well as service sectors especially in higher education which is a very important context that needs internationalization to bridge the gap between different cultures and countries. There are several internationalization theories which try to explain why there are international activities.

In economics, insurance, and risk management, adverse selection is a market situation where buyers and sellers have different information. The result is the unequal distribution of benefits to both parties, with the party having the key information benefiting more.

Allocative efficiency is a state of the economy in which production is aligned with the preferences of consumers and producers; in particular, the set of outputs is chosen so as to maximize the social welfare of society. This is achieved if every produced good or service has a marginal benefit equal to the marginal cost of production.

Variable universal life insurance is a type of life insurance that builds a cash value. In a VUL, the cash value can be invested in a wide variety of separate accounts, similar to mutual funds, and the choice of which of the available separate accounts to use is entirely up to the contract owner. The 'variable' component in the name refers to this ability to invest in separate accounts whose values vary—they vary because they are invested in stock and/or bond markets. The 'universal' component in the name refers to the flexibility the owner has in making premium payments. The premiums can vary from nothing in a given month up to maximums defined by the Internal Revenue Code for life insurance. This flexibility is in contrast to whole life insurance that has fixed premium payments that typically cannot be missed without lapsing the policy.

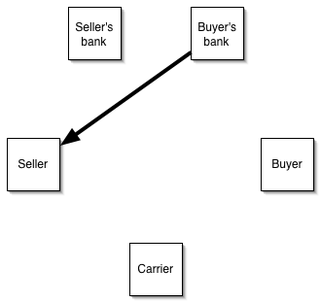

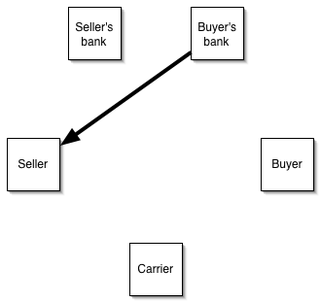

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

The theory of the firm consists of a number of economic theories that explain and predict the nature of the firm, company, or corporation, including its existence, behaviour, structure, and relationship to the market. Firms are key drivers in economics, providing goods and services in return for monetary payments and rewards. Organisational structure, incentives, employee productivity, and information all influence the successful operation of a firm in the economy and within itself. As such major economic theories such as transaction cost theory, managerial economics and behavioural theory of the firm will allow for an in-depth analysis on various firm and management types.

Government failure, in the context of public economics, is an economic inefficiency caused by a government intervention, if the inefficiency would not exist in a true free market. The costs of the government intervention are greater than the benefits provided. It can be viewed in contrast to a market failure, which is an economic inefficiency that results from the free market itself, and can potentially be corrected through government regulation. However, Government failure often arises from an attempt to solve market failure. The idea of government failure is associated with the policy argument that, even if particular markets may not meet the standard conditions of perfect competition required to ensure social optimality, government intervention may make matters worse rather than better.

A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through a stock exchange. Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets or in some instances in equity crowdfunding platforms.

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services to buyers in exchange for money. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emerges more or less spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale.

Stocks consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

In economics, implicit contracts refer to voluntary and self-enforcing long term agreements made between two parties regarding the future exchange of goods or services. Implicit contracts theory was first developed to explain why there are quantity adjustments (layoffs) instead of price adjustments in the labor market during recessions.

The credit channel mechanism of monetary policy describes the theory that a central bank's policy changes affect the amount of credit that banks issue to firms and consumers for purchases, which in turn affects the real economy.

Financial law is the law and regulation of the commercial banking, capital markets, insurance, derivatives and investment management sectors. Understanding financial law is crucial to appreciating the creation and formation of banking and financial regulation, as well as the legal framework for finance generally. Financial law forms a substantial portion of commercial law, and notably a substantial proportion of the global economy, and legal billables are dependent on sound and clear legal policy pertaining to financial transactions. Therefore financial law as the law for financial industries involves public and private law matters. Understanding the legal implications of transactions and structures such as an indemnity, or overdraft is crucial to appreciating their effect in financial transactions. This is the core of financial law. Thus, financial law draws a narrower distinction than commercial or corporate law by focusing primarily on financial transactions, the financial market, and its participants; for example, the sale of goods may be part of commercial law but is not financial law. Financial law may be understood as being formed of three overarching methods, or pillars of law formation and categorised into five transaction silos which form the various financial positions prevalent in finance.