Franklin Christenson "Chris" Ware is an American cartoonist known for his Acme Novelty Library series and the graphic novels Jimmy Corrigan, the Smartest Kid on Earth (2000), Building Stories (2012) and Rusty Brown (2019). His works explore themes of social isolation, emotional torment and depression. He tends to use a vivid color palette and realistic, meticulous detail. His lettering and images are often elaborate and sometimes evoke the ragtime era or another early 20th-century American design style.

Irrational Exuberance is a book by American economist Robert J. Shiller of Yale University, published March 2000. The book examines economic bubbles in the 1990s and early 2000s, and is named after Federal Reserve Chairman Alan Greenspan's famed 1996 comment about "irrational exuberance" warning of such a possible bubble.

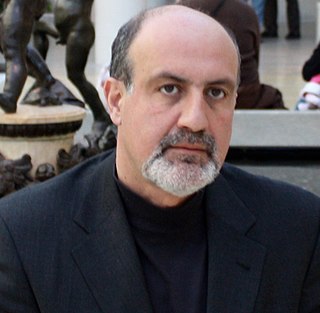

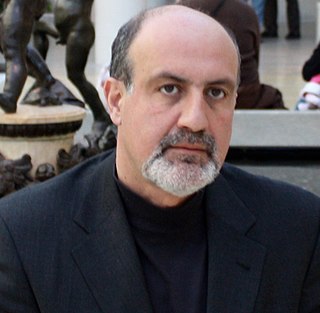

Nassim Nicholas Taleb is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. The Sunday Times called his 2007 book The Black Swan one of the 12 most influential books since World War II.

Michiko Kakutani is an American writer and retired literary critic, best known for reviewing books for The New York Times from 1983 to 2017. In that role, she won the Pulitzer Prize for Criticism in 1998.

Rolf Dobelli born in Luzern, Switzerland, is a Swiss author and entrepreneur.

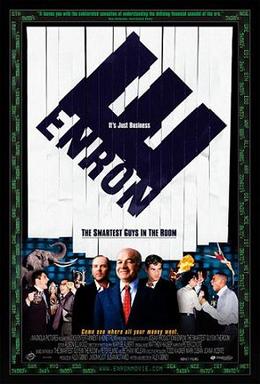

Enron: The Smartest Guys in the Room is a 2005 American documentary film based on the best-selling 2003 book of the same name by Fortune reporters Bethany McLean and Peter Elkind, who are credited as writers of the film alongside the director, Alex Gibney. It examines the 2001 collapse of the Enron Corporation, which resulted in criminal trials for several of the company's top executives during the ensuing Enron scandal, and contains a section about the involvement of Enron traders in the 2000-01 California electricity crisis. Archival footage is used alongside new interviews with McLean and Elkind, several former Enron executives and employees, stock analysts, reporters, and former Governor of California Gray Davis.

Victor Niederhoffer is an American hedge fund manager, champion squash player, bestselling author and statistician.

The Iowa gambling task (IGT) is a psychological task thought to simulate real-life decision making. It was introduced by Antoine Bechara, Antonio Damasio, Hanna Damasio and Steven Anderson, then researchers at the University of Iowa. It has been brought to popular attention by Antonio Damasio in his best-selling book Descartes' Error.

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient saying that presumed black swans did not exist – a saying that became reinterpreted to teach a different lesson after they were discovered in Australia.

The Black Swan: The Impact of the Highly Improbable is a 2007 book by Nassim Nicholas Taleb, who is a former options trader. The book focuses on the extreme impact of rare and unpredictable outlier events—and the human tendency to find simplistic explanations for these events, retrospectively. Taleb calls this the Black Swan theory.

The ludic fallacy, proposed by Nassim Nicholas Taleb in his book The Black Swan (2007), is "the misuse of games to model real-life situations". Taleb explains the fallacy as "basing studies of chance on the narrow world of games and dice". The adjective ludic originates from the Latin noun ludus, meaning "play, game, sport, pastime".

"Croesus and Fate" is a short story by Leo Tolstoy that is a retelling of a Greek legend, classically told by Herodotus, and Plutarch, about the king Croesus. It was first published in 1886 by Tolstoy's publishing company The Intermediary. Tolstoy's version is shorter than that by Herodotus, and Tolstoy's characterization of Croesus was designed to parallel the title character in his 1886 novella The Death of Ivan Ilych.

In economics and finance, a Taleb distribution is the statistical profile of an investment which normally provides a payoff of small positive returns, while carrying a small but significant risk of catastrophic losses. The term was coined by journalist Martin Wolf and economist John Kay to describe investments with a "high probability of a modest gain and a low probability of huge losses in any period."

Empirica Capital LLC was a hedge fund founded in 1999 by Nassim Nicholas Taleb in partnership with Mark Spitznagel, that used Taleb's black swan strategy. The firm closed in 2005 as Taleb took time off for health reasons.

Epilogism is a style of inference used by the ancient Empiric school of medicine. It is a theory-free method that looks at history through the accumulation of facts without major generalization and with consideration of the consequences of making causal claims. Epilogism is an inference which moves entirely within the domain of visible and evident things, it tries not to invoke unobservables.

The Bed of Procrustes: Philosophical and Practical Aphorisms is a philosophy book by Nassim Nicholas Taleb written in the aphoristic style. It was first released on November 30, 2010 by Random House. An updated edition was released on October 26, 2016 that includes fifty percent more material than the 2010 edition. According to Taleb, the book "contrasts the classical values of courage, elegance, and erudition against the modern diseases of nerdiness, philistinism, and phoniness." The title refers to Procrustes, a figure from Greek mythology who abducted travelers and stretched or chopped their bodies to fit the length of his bed.

Antifragile: Things That Gain From Disorder is a book by Nassim Nicholas Taleb published on November 27, 2012, by Random House in the United States and Penguin in the United Kingdom. This book builds upon ideas from his previous works including Fooled by Randomness (2001), The Black Swan (2007–2010), and The Bed of Procrustes (2010–2016), and is the fourth book in the five-volume philosophical treatise on uncertainty titled Incerto. Some of the ideas are expanded in Taleb's fifth book Skin in the Game: Hidden Asymmetries in Daily Life (2018).

Robert Daniel Menaker was an American fiction writer and editor. He worked with the MFA program at Stony Brook Southampton and as a consultant for Barnes & Noble Bookstores.

The Lindy effect is a theorized phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age. Thus, the Lindy effect proposes the longer a period something has survived to exist or be used in the present, the longer its remaining life expectancy. Longevity implies a resistance to change, obsolescence or competition and greater odds of continued existence into the future. Where the Lindy effect applies, mortality rate decreases with time. Mathematically, the Lindy effect corresponds to lifetimes following a Pareto probability distribution.

Skin in the Game: Hidden Asymmetries in Daily Life is a 2018 nonfiction book by Nassim Nicholas Taleb, a former options trader with a background in the mathematics of probability and statistics.