The gambler's fallacy, also known as the Monte Carlo fallacy or the fallacy of the maturity of chances, is the belief that, if an event has occurred more frequently than expected, it is less likely to happen again in the future. The fallacy is commonly associated with gambling, where it may be believed, for example, that the next dice roll is more than usually likely to be six because there have recently been fewer than the expected number of sixes.

The law of averages is the commonly held belief that a particular outcome or event will, over certain periods of time, occur at a frequency that is similar to its probability. Depending on context or application it can be considered a valid common-sense observation or a misunderstanding of probability. This notion can lead to the gambler's fallacy when one becomes convinced that a particular outcome must come soon simply because it has not occurred recently.

Value at risk (VaR) is a measure of the risk of loss of investment/Capital. It estimates how much a set of investments might lose, given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses.

Minimum Description Length (MDL) is a model selection principle where the shortest description of the data is the best model. MDL methods learn through a data compression perspective and are sometimes described as mathematical applications of Occam's razor. The MDL principle can be extended to other forms of inductive inference and learning, for example to estimation and sequential prediction, without explicitly identifying a single model of the data.

Bayesian statistics is a theory in the field of statistics based on the Bayesian interpretation of probability, where probability expresses a degree of belief in an event. The degree of belief may be based on prior knowledge about the event, such as the results of previous experiments, or on personal beliefs about the event. This differs from a number of other interpretations of probability, such as the frequentist interpretation, which views probability as the limit of the relative frequency of an event after many trials. More concretely, analysis in Bayesian methods codifies prior knowledge in the form of a prior distribution.

Decision theory is a branch of applied probability theory and analytic philosophy concerned with the theory of making decisions based on assigning probabilities to various factors and assigning numerical consequences to the outcome.

Coin flipping, coin tossing, or heads or tails is the practice of throwing a coin in the air and checking which side is showing when it lands, in order to randomly choose between two alternatives, heads or tails, sometimes used to resolve a dispute between two parties. It is a form of sortition which inherently has two possible outcomes. The party who calls the side that is facing up when the coin lands wins.

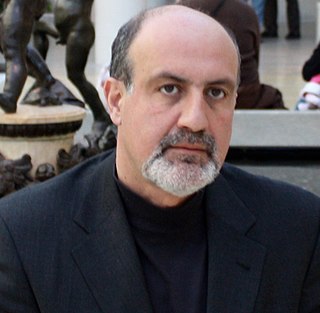

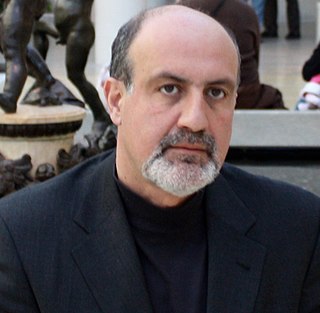

Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets is a book by Nassim Nicholas Taleb that deals with the fallibility of human knowledge. It was first published in 2001. Updated editions were released a few years later. The book is the first part of Taleb's multi-volume philosophical essay on uncertainty, titled the Incerto, which also includes The Black Swan (2007–2010), The Bed of Procrustes (2010–2016), Antifragile (2012), and Skin in the Game (2018).

Nassim Nicholas Taleb is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty.

In statistics, the question of checking whether a coin is fair is one whose importance lies, firstly, in providing a simple problem on which to illustrate basic ideas of statistical inference and, secondly, in providing a simple problem that can be used to compare various competing methods of statistical inference, including decision theory. The practical problem of checking whether a coin is fair might be considered as easily solved by performing a sufficiently large number of trials, but statistics and probability theory can provide guidance on two types of question; specifically those of how many trials to undertake and of the accuracy of an estimate of the probability of turning up heads, derived from a given sample of trials.

Credibility theory is a branch of actuarial mathematics concerned with determining risk premiums. To achieve this, it uses mathematical models in an effort to forecast the (expected) number of insurance claims based on past observations. Technically speaking, the problem is to find the best linear approximation to the mean of the Bayesian predictive density, which is why credibility theory has many results in common with linear filtering as well as Bayesian statistics more broadly.

A fat-tailed distribution is a probability distribution that exhibits a large skewness or kurtosis, relative to that of either a normal distribution or an exponential distribution. In common usage, the terms fat-tailed and heavy-tailed are sometimes synonymous; fat-tailed is sometimes also defined as a subset of heavy-tailed. Different research communities favor one or the other largely for historical reasons, and may have differences in the precise definition of either.

Financial risk modeling is the use of formal mathematical and econometric techniques to measure, monitor and control the market risk, credit risk, and operational risk on a firm's balance sheet, on a bank's trading book, or re a fund manager's portfolio value; see Financial risk management. Risk modeling is one of many subtasks within the broader area of financial modeling.

Probabilistic logic involves the use of probability and logic to deal with uncertain situations. Probabilistic logic extends traditional logic truth tables with probabilistic expressions. A difficulty of probabilistic logics is their tendency to multiply the computational complexities of their probabilistic and logical components. Other difficulties include the possibility of counter-intuitive results, such as in case of belief fusion in Dempster–Shafer theory. Source trust and epistemic uncertainty about the probabilities they provide, such as defined in subjective logic, are additional elements to consider. The need to deal with a broad variety of contexts and issues has led to many different proposals.

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient Roman saying expressing the European presumption that black swans did not exist until Dutch mariners saw them in Australia in 1697, and the term was then reinterpreted to mean an unforeseen and consequential event.

The Black Swan: The Impact of the Highly Improbable is a 2007 book by Nassim Nicholas Taleb, who is a former options trader. The book focuses on the extreme impact of rare and unpredictable outlier events—and the human tendency to find simplistic explanations for these events, retrospectively. Taleb calls this the Black Swan theory.

In economics and finance, a Taleb distribution is the statistical profile of an investment which normally provides a payoff of small positive returns, while carrying a small but significant risk of catastrophic losses. The term was coined by journalist Martin Wolf and economist John Kay to describe investments with a "high probability of a modest gain and a low probability of huge losses in any period."

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets.

Antifragile: Things That Gain From Disorder is a book by Nassim Nicholas Taleb published on November 27, 2012, by Random House in the United States and Penguin in the United Kingdom. This book builds upon ideas from his previous works including Fooled by Randomness (2001), The Black Swan (2007–2010), and The Bed of Procrustes (2010–2016), and is the fourth book in the five-volume philosophical treatise on uncertainty titled Incerto. Some of the ideas are expanded on in Taleb's fifth book Skin in the Game: Hidden Asymmetries in Daily Life (2018).

The Lindy effect is a theorized phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age. Thus, the Lindy effect proposes the longer a period something has survived to exist or be used in the present, the longer its remaining life expectancy. Longevity implies a resistance to change, obsolescence, or competition, and greater odds of continued existence into the future. Where the Lindy effect applies, mortality rate decreases with time. Mathematically, the Lindy effect corresponds to lifetimes following a Pareto probability distribution.