An advance-fee scam is a form of fraud and is one of the most common types of confidence tricks. The scam typically involves promising the victim a significant share of a large sum of money, in return for a small up-front payment, which the fraudster claims will be used to obtain the large sum. If a victim makes the payment, the fraudster either invents a series of further fees for the victim to pay or simply disappears.

A Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, this type of scheme misleads investors by either falsely suggesting that profits are derived from legitimate business activities, or by exaggerating the extent and profitability of the legitimate business activities, leveraging new investments to fabricate or supplement these profits. A Ponzi scheme can maintain the illusion of a sustainable business as long as investors continue to contribute new funds, and as long as most of the investors do not demand full repayment or lose faith in the non-existent assets they are purported to own.

A pyramid scheme is a business model which earns primarily by enrolling others into the scheme, however rather than earning income by sale of legitimate products to an end consumer, it mainly earns by recruiting new members with the promise of payments. As recruiting multiplies, the process quickly becomes increasingly difficult until it is impossible, and most members are unable to profit; as such, pyramid schemes are unsustainable and often illegal.

Bait-and-switch is a form of fraud used in retail sales but also employed in other contexts. First, customers are "baited" by merchants' advertising products or services at a low price, but then, when they visit the store, those customers discover that the advertised goods are not available and are pressured by salespeople to purchase similar but higher-priced products ("switching").

Affiliate marketing is a marketing arrangement in which affiliates receive a commission for each visit, signup or sale they generate for a merchant. This arrangement allows businesses to outsource part of the sales process. It is a form of performance-based marketing where the commission acts as an incentive for the affiliate; this commission is usually a percentage of the price of the product being sold, but can also be a flat rate per referral.

Pay-per-click (PPC) is an internet advertising model used to drive traffic to websites, in which an advertiser pays a publisher when the ad is clicked.

Email fraud is intentional deception for either personal gain or to damage another individual using email as the vehicle. Almost as soon as email became widely used, it began to be used as a means to defraud people, just as telephony and paper mail were used by previous generations.

Cost per action (CPA), also sometimes misconstrued in marketing environments as cost per acquisition, is an online advertising measurement and pricing model referring to a specified action, for example, a sale, click, or form submit.

Online advertising, also known as online marketing, Internet advertising, digital advertising or web advertising, is a form of marketing and advertising that uses the Internet to promote products and services to audiences and platform users. Online advertising includes email marketing, search engine marketing (SEM), social media marketing, many types of display advertising, and mobile advertising. Advertisements are increasingly being delivered via automated software systems operating across multiple websites, media services and platforms, known as programmatic advertising.

An advertising campaign is a series of advertisement messages that share a single idea and theme which make up an integrated marketing communication (IMC). An IMC is a platform in which a group of people can group their ideas, beliefs, and concepts into one large media base. Advertising campaigns utilize diverse media channels over a particular time frame and target identified audiences.

A matrix scheme is a business model involving the exchange of money for a certain product with a side bonus of being added to a waiting list for a product of greater value than the amount given. Matrix schemes are also sometimes considered similar to Ponzi or pyramid schemes. They have been called "unsustainable" by the United Kingdom's Office of Fair Trading. A matrix scheme is also an example of an 'exploding queue' in queueing theory.

Mortgage fraud refers to an intentional misstatement, misrepresentation, or omission of information relied upon by an underwriter or lender to fund, purchase, or insure a loan secured by real property.

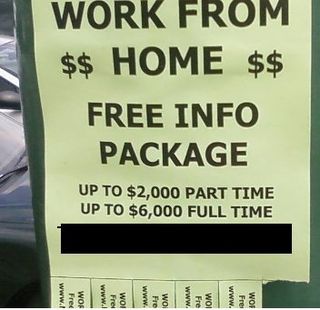

Employment fraud is the attempt to defraud people seeking employment by giving them false hope of better employment, offering better working hours, more respectable tasks, future opportunities, or higher wages. They often advertise at the same locations as genuine employers and may ask for money in exchange for the opportunity to apply for a job.

Marketing effectiveness is the measure of how effective a given marketer's go to market strategy is toward meeting the goal of maximizing their spending to achieve positive results in both the short- and long-term. It is also related to marketing ROI and return on marketing investment (ROMI). In today's competitive business environment, effective marketing strategies play a pivotal role in promoting products or services to target audiences. The advent of digital platforms has further intensified competition among businesses, making it imperative for companies to employ innovative and impactful marketing techniques. This essay examines how various types of advertising methods can be utilized effectively to reach out to potential consumers

A work-at-home scheme is a get-rich-quick scam in which a victim is lured by an offer to be employed at home, very often doing some simple task in a minimal amount of time with a large amount of income that far exceeds the market rate for the type of work. The true purpose of such an offer is for the perpetrator to extort money from the victim, either by charging a fee to join the scheme, or requiring the victim to invest in products whose resale value is misrepresented.

Fine print, small print, or mouseprint is less noticeable print smaller than the more obvious larger print it accompanies that advertises or otherwise describes or partially describes a commercial product or service. The larger print that is used in conjunction with fine print by the merchant often has the effect of deceiving the consumer into believing the offer is more advantageous than it really is. This may satisfy a legal technicality which requires full disclosure of all terms or conditions, but does not specify the manner of disclosure. There is strong evidence that suggests the fine print is not read by the majority of consumers.

Multi-level marketing (MLM), also called network marketing or pyramid selling, is a controversial marketing strategy for the sale of products or services in which the revenue of the MLM company is derived from a non-salaried workforce selling the company's products or services, while the earnings of the participants are derived from a pyramid-shaped or binary compensation commission system.

In economics and finance, market manipulation is a type of market abuse where there is a deliberate attempt to interfere with the free and fair operation of the market; the most blatant of cases involve creating false or misleading appearances with respect to the price of, or market for, a product, security or commodity.

Website monetization is the process of converting existing traffic being sent to a particular website into revenue. The most popular ways of monetizing a website are by implementing pay per click (PPC) and cost per impression (CPI/CPM) advertising. Various ad networks facilitate a webmaster in placing advertisements on pages of the website to benefit from the traffic the site is experiencing.