Related Research Articles

The affordability of housing in the UK reflects the ability to rent or buy property. There are various ways to determine or estimate housing affordability. One commonly used metric is the median housing affordability ratio; this compares the median price paid for residential property to the median gross annual earnings for full-time workers. According to official government statistics, housing affordability worsened between 2020 and 2021, and since 1997 housing affordability has worsened overall, especially in London. The most affordable local authorities in 2021 were in the North West, Wales, Yorkshire and The Humber, West Midlands and North East.

The 2000s United States housing bubble or house price boom or 2000shousing cycle was a sharp run up and subsequent collapse of house asset prices affecting over half of the U.S. states. In many regions a real estate bubble, it was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller home price index reported the largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States.

A real-estate bubble or property bubble is a type of economic bubble that occurs periodically in local or global real estate markets, and it typically follows a land boom. A land boom is a rapid increase in the market price of real property such as housing until they reach unsustainable levels and then declines. This period, during the run-up to the crash, is also known as froth. The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance, are answered differently by schools of economic thought, as detailed below.

The YIMBY movement is a pro-infrastructure development movement mostly focusing on public housing policy, real estate development, public transportation, and pedestrian safety in transportation planning, in contrast and in opposition to the NIMBY movement that generally opposes most forms of urban development in order to maintain the status quo. As a popular organized movement in the United States, it began in the San Francisco Bay Area in the 2010s amid a major housing affordability crisis and has subsequently become a potent political force in state and local politics across the United States.

Affordable housing is housing which is deemed affordable to those with a household income at or below the median as rated by the national government or a local government by a recognized housing affordability index. Most of the literature on affordable housing refers to mortgages and a number of forms that exist along a continuum – from emergency homeless shelters, to transitional housing, to non-market rental, to formal and informal rental, indigenous housing, and ending with affordable home ownership.

The Spanish property bubble is the collapsed overshooting part of a long-term price increase of Spanish real estate prices. This long-term price increase has happened in various stages from 1985 up to 2008. The housing bubble can be clearly divided in three periods: 1985–1991, in which the price nearly tripled; 1992–1996, in which the price remained somewhat stable; and 1996–2008, in which prices grew astonishingly again. Coinciding with the financial crisis of 2007–08, prices began to fall. In 2013, Raj Badiani, an economist at IHS Global Insight in London, estimated that the value of residential real estate has dropped more than 30 percent since 2007 and that house prices would fall at least 50 percent from the peak by 2015. Alcidi and Gros note; “If construction were to continue at the still relatively high rate of today, the process of absorption of the bubble would take more than 30 years”.

Real estate investing involves the purchase, management and sale or rental of real estate for profit. Someone who actively or passively invests in real estate is called a real estate entrepreneur or a real estate investor. Some investors actively develop, improve or renovate properties to make more money from them.

Workforce housing is a term that is increasingly used by planners, government, and organizations concerned with housing policy or advocacy. It is gaining cachet with realtors, developers and lenders. Workforce housing can refer to any form of housing, including ownership of single or multi-family homes, as well as occupation of rental units. Workforce housing is generally understood to mean affordable housing for households with earned income that is insufficient to secure quality housing in reasonable proximity to the workplace.

A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word mortgage is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of a collateral for a benefit (loan)".

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions of people losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

Housing prices peaked in early 2005, began declining in 2006.

Observers and analysts have attributed the reasons for the 2001–2006 housing bubble and its 2007–10 collapse in the United States to "everyone from home buyers to Wall Street, mortgage brokers to Alan Greenspan". Other factors that are named include "Mortgage underwriters, investment banks, rating agencies, and investors", "low mortgage interest rates, low short-term interest rates, relaxed standards for mortgage loans, and irrational exuberance" Politicians in both the Democratic and Republican political parties have been cited for "pushing to keep derivatives unregulated" and "with rare exceptions" giving Fannie Mae and Freddie Mac "unwavering support".

This article provides background information regarding the subprime mortgage crisis. It discusses subprime lending, foreclosures, risk types, and mechanisms through which various entities involved were affected by the crisis.

Affordable housing in Canada is living spaces that are deemed financially accessible to those with a median household income in Canada. The property ladder continuum of affordable housing in Canada includes market, non-market, and government-subsidized housing.

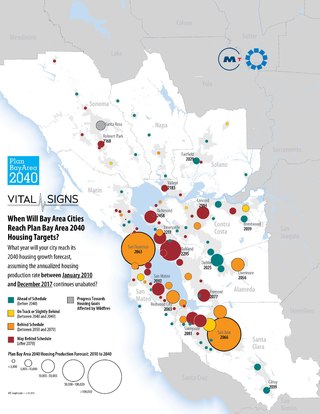

Starting in the 1990s, the city of San Francisco and the surrounding San Francisco Bay Area have faced a serious housing shortage. Such is that in October 2015, San Francisco had the highest rents of any major US city. San Francisco has the slowest permitting process of any large city in the United States. The first stage can take an average of 450 calendar days, and the second stage taking 630 days for typical multi-family housing, or 860 days for a single-family house, and the second-most expensive construction costs in the world.

The property bubble in New Zealand is a major national economic and social issue. Since the early 1990s, house prices in New Zealand have risen considerably faster than incomes, putting increasing pressure on public housing providers as fewer households have access to housing on the private market. The property bubble has produced significant impacts on inequality in New Zealand, which now has one of the highest homelessness rate in the OECD and a record-high waiting list for public housing. Government policies have attempted to address the crisis since 2013, but have produced limited impacts to reduce prices or increase the supply of affordable housing. However, prices started falling in 2022 in response to tightening of mortgage availability and supply increasing. Some areas saw drops as high as around 9% - albeit from very high prices.

Since about 1970, California has been experiencing an extended and increasing housing shortage, such that by 2018, California ranked 49th among the states of the U.S. in terms of housing units per resident. This shortage has been estimated to be 3-4 million housing units as of 2017. Experts say that California needs to double its current rate of housing production to keep up with expected population growth and prevent prices from further increasing, and needs to quadruple the current rate of housing production over the next seven years in order for prices and rents to decline.

Affordable housing is housing that is deemed affordable to those with a median household income as rated by the national government or a local government by a recognized housing affordability index. A general rule is no more than 30% of gross monthly income should be spent on housing, to be considered affordable as the challenges of promoting affordable housing varies by location.

For many decades, the New York metropolitan area has suffered from an increasing shortage of housing, as housing supply has not met housing demand. As a result, New York City has the highest rents of any city in the United States.

Housing in the United States comes in a variety of forms and tenures. The rate of homeownership in the United States, as measured by the fraction of units that are owner-occupied, was 64% as of 2017. This rate is less than the rates in other large countries such as China (90%), Russia (89%) Mexico (80%), or Brazil (73%).

References

- ↑ Rudy, Melissa (2020-11-25). "'Housing Crisis' Can Take On Different Meanings: Here Are 5 Examples". HomeLight Blog. Retrieved 2023-12-30.

- 1 2 Menendian, Stephen (November 30, 2022). "Deconstructing the 'Housing Crisis'". belonging.berkeley.edu. Retrieved 2023-12-30.

- 1 2 Hilber; Schöni (May 2022). "Housing policy and affordable housing" (PDF). London School of Economics: Centre for Economic Performance, Occasional Paper (56).

- ↑ "What Can Be Done About the Global Housing Crisis? Plenty". Wired. 2022-04-24. Archived from the original on 2022-04-24. Retrieved 2023-12-30.

- ↑ Fulton, B. (2020, January 12). Houston doesn’t have zoning, but there are workarounds.

- ↑ "The Anglosphere needs to learn to love apartment living". www.ft.com. Retrieved 2023-12-30.

- 1 2 Glaeser, Edward L. (2020). "The Closing of America's Urban Frontier". Cityscape. 22 (2): 6. ISSN 1936-007X. JSTOR 26926891.

- ↑ Smith, Jennifer (2023-10-30). "Kenzie Bok says Boston housing shortage no accident". CommonWealth Beacon. Retrieved 2023-12-30.

- ↑ Bahney, Anna (2023-03-08). "The US housing market is short 6.5 million homes". CNN Business. Retrieved 2023-12-30.

- ↑ "Supply Skepticism Revisited: What New Research Shows About the Impact of Supply on Affordability". furmancenter.org. Retrieved 2023-12-30.

- ↑ Gregg Colburn; Clayton Page Aldern (2022-03-16). "Homelessness Is a Housing Problem". Sightline Institute. Retrieved 2023-12-29.

- ↑ Laurel Wamsley (April 18, 2024). "Many baby boomers own homes that are too big. Can they be enticed to sell them?". NPR.

- ↑ "Why Is America Still Falling Short on Affordable Housing?". Architectural Digest. 2023-12-28. Retrieved 2023-12-29.

- ↑ "Permanent Supportive Housing as a Solution to Homelessness: The Critical Role of Long-Term Operating Subsidies" (PDF).

- ↑ "Mississippi has problems, but it's handling homelessness better than L.A." Los Angeles Times. 2023-08-23. Retrieved 2023-12-30.

- ↑ George Fernandez (2023-04-21). "It's National Fair Housing Month. And no one's paying attention". Pennsylvania Capital-Star (Opinion). Retrieved 2023-12-30.

- ↑ Hatherley, Owen (2014-02-14). "All That Is Solid: The Great Housing Disaster by Danny Dorling – review". The Guardian. ISSN 0261-3077 . Retrieved 2023-12-30.

- ↑ Garriga; Hedlund (July 2019). "Crises in the Housing Market: Causes, Consequences, and Policy Lessons" (PDF). St. Louis Fed. Oxford Research Encyclopedia, Economics and Finance.

- ↑ "Foreclosures Can Amplify Downward Spirals of House Prices". NBER. Retrieved 2023-12-30.

- ↑ Chodorow-Reich; Guren; McQuade (April 2023). "The 2000s Housing Cycle with 2020 Hindsight". The Review of Economic Studies. doi:10.1093/restud/rdad045. Archived (PDF) from the original on 2023-12-30.