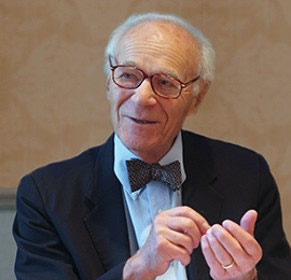

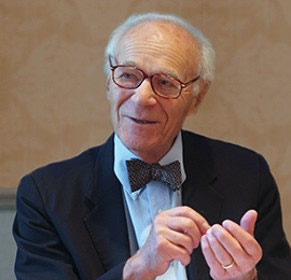

Lawrence Robert Klein was an American economist. For his work in creating computer models to forecast economic trends in the field of econometrics in the Department of Economics at the University of Pennsylvania, he was awarded the Nobel Memorial Prize in Economic Sciences in 1980 specifically "for the creation of econometric models and their application to the analysis of economic fluctuations and economic policies." Due to his efforts, such models have become widespread among economists. Harvard University professor Martin Feldstein told the Wall Street Journal that Klein "was the first to create the statistical models that embodied Keynesian economics," tools still used by the Federal Reserve Bank and other central banks.

Econometrica is a peer-reviewed academic journal of economics, publishing articles in many areas of economics, especially econometrics. It is published by Wiley-Blackwell on behalf of the Econometric Society. The current editor-in-chief is Guido Imbens.

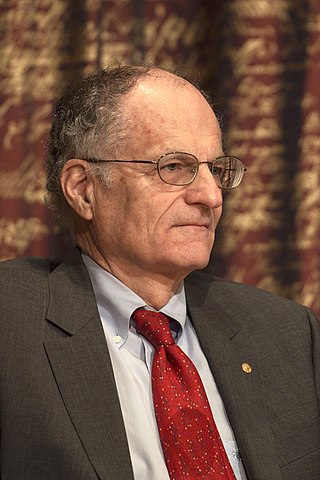

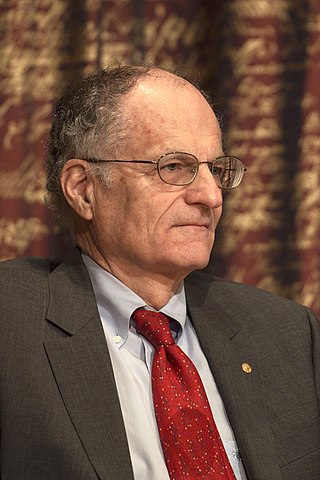

Edward Christian Prescott was an American economist. He received the Nobel Memorial Prize in Economics in 2004, sharing the award with Finn E. Kydland, "for their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles". This research was primarily conducted while both Kydland and Prescott were affiliated with the Graduate School of Industrial Administration at Carnegie Mellon University. According to the IDEAS/RePEc rankings, he was the 19th most widely cited economist in the world in 2013. In August 2014, Prescott was appointed an Adjunct Distinguished Economic Professor at the Australian National University (ANU) in Canberra, Australia. Prescott died of cancer on November 6, 2022, at the age of 81.

John Brian Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University, and the George P. Shultz Senior Fellow in Economics at Stanford University's Hoover Institution.

Thomas John Sargent is an American economist and the W.R. Berkley Professor of Economics and Business at New York University. He specializes in the fields of macroeconomics, monetary economics, and time series econometrics. As of 2020, he ranks as the 29th most cited economist in the world. He was awarded the Nobel Memorial Prize in Economics in 2011 together with Christopher A. Sims for their "empirical research on cause and effect in the macroeconomy".

Financial econometrics is the application of statistical methods to financial market data. Financial econometrics is a branch of financial economics, in the field of economics. Areas of study include capital markets, financial institutions, corporate finance and corporate governance. Topics often revolve around asset valuation of individual stocks, bonds, derivatives, currencies and other financial instruments.

In econometrics and statistics, the generalized method of moments (GMM) is a generic method for estimating parameters in statistical models. Usually it is applied in the context of semiparametric models, where the parameter of interest is finite-dimensional, whereas the full shape of the data's distribution function may not be known, and therefore maximum likelihood estimation is not applicable.

Kenneth Jan Singleton is an American economist. He is a leading figure in empirical financial economics, and a faculty member at Stanford University. As the Adams Distinguished Professor of Management, Emeritus at Stanford Graduate School of Business, Singleton teaches a variety of degree courses in finance.

Christopher Albert Sims is an American econometrician and macroeconomist. He is currently the John J.F. Sherrerd '52 University Professor of Economics at Princeton University. Together with Thomas Sargent, he won the Nobel Memorial Prize in Economic Sciences in 2011. The award cited their "empirical research on cause and effect in the macroeconomy".

The Frisch Medal is an award in economics given by the Econometric Society. It is awarded every two years for empirical or theoretical applied research published in Econometrica during the previous five years. The award was named in honor of Ragnar Frisch, first co-recipient of the Nobel prize in economics and editor of Econometrica from 1933 to 1954. In the opinion of Rich Jensen, Gilbert F. Schaefer Professor of Economics and chairperson of the Department of Economics of the University of Notre Dame, "The Frisch medal is not only one of the top three prizes in the field of economics, but also the most prestigious 'best article' award in the profession". Five Frisch medal winners have also won the Nobel Prize.

Sir David Forbes Hendry, FBA CStat is a British econometrician, currently a professor of economics and from 2001 to 2007 was head of the economics department at the University of Oxford. He is also a professorial fellow at Nuffield College, Oxford.

Dynamic stochastic general equilibrium modeling is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis, explaining historical time-series data, as well as future forecasting purposes. DSGE econometric modelling applies general equilibrium theory and microeconomic principles in a tractable manner to postulate economic phenomena, such as economic growth and business cycles, as well as policy effects and market shocks.

The Sargan–Hansen test or Sargan's test is a statistical test used for testing over-identifying restrictions in a statistical model. It was proposed by John Denis Sargan in 1958, and several variants were derived by him in 1975. Lars Peter Hansen re-worked through the derivations and showed that it can be extended to general non-linear GMM in a time series context.

The Erwin Plein Nemmers Prize in Economics is an academic prize awarded biennially by Northwestern University. It was initially endowed along with a companion prize, the Frederic Esser Nemmers Prize in Mathematics. Both are part a $14 million donation from the Nemmers brothers, who envisioned creating an award that would be as prestigious as the Nobel prize. Nine out of the past 15 Nemmers economics prize winners have gone on to win a Nobel Prize : Peter Diamond, Thomas J. Sargent, Robert Aumann, Daniel McFadden, Edward C. Prescott, Lars Peter Hansen, Jean Tirole, Paul R. Milgrom and, most recently, Claudia Goldin. Those who already have won a Nobel Prize are ineligible to receive a Nemmers prize. The Nemmers prizes are given in recognition of major contributions to new knowledge or the development of significant new modes of analysis in the respective disciplines. As of 2023, the prize carries a $300,000 stipend, among the largest monetary awards in the United States for outstanding achievements in economics.

Jacques H. Drèze was a Belgian economist noted for his contributions to economic theory, econometrics, and economic policy as well as for his leadership in the economics profession. Drèze was the first President of the European Economic Association in 1986 and was the President of the Econometric Society in 1970.

Pietro Balestra was a Swiss economist specializing in econometrics. He was born in Lugano and earned a B.A. in economics from the University of Fribourg. Balestra moved for graduate work to the University of Kansas and Stanford University. He was awarded the Ph.D. in Economics by Stanford University in 1965.

Jan Kmenta was a Czech-American economist. He was the Professor Emeritus of Economics and Statistics at the University of Michigan and Visiting Professor at CERGE-EI in Prague, until summer 2016.

John Denis Sargan, FBA was a British econometrician who specialized in the analysis of economic time-series.

Manuel Arellano is a Spanish economist specialising in econometrics and empirical microeconomics. Together with Stephen Bond, he developed the Arellano–Bond estimator, a widely used GMM estimator for panel data. This estimator is based on the earlier article by Arellano's PhD supervisor, John Denis Sargan, and Alok Bhargava. RePEc lists the paper about the Arellano-Bond estimator as the most cited article in economics.

Michael Patrick Keane is an American-born economist; he is the Wm. Polk Carey Distinguished Professor at Johns Hopkins University. Keane was previously a professor at the University of New South Wales and the Nuffield Professor of Economics at the University of Oxford. He is considered one of the world's leading experts in the fields of Choice Modelling, structural modelling, simulation estimation, and panel data econometrics.