Marbury v. Madison, 5 U.S. 137 (1803), was a landmark decision of the U.S. Supreme Court that established the principle of judicial review in the United States, meaning that American courts have the power to strike down laws and statutes they find to violate the Constitution of the United States. Decided in 1803, Marbury is regarded as the single most important decision in American constitutional law. The Court established that the U.S. Constitution is actual law, not just a statement of political principles and ideals. It also helped define the boundary between the constitutionally separate executive and judicial branches of the federal government.

Article One of the Constitution of the United States establishes the legislative branch of the federal government, the United States Congress. Under Article One, Congress is a bicameral legislature consisting of the House of Representatives and the Senate. Article One grants Congress various enumerated powers and the ability to pass laws "necessary and proper" to carry out those powers. Article One also establishes the procedures for passing a bill and places various limits on the powers of Congress and the states from abusing their powers.

Article Six of the United States Constitution establishes the laws and treaties of the United States made in accordance with it as the supreme law of the land, forbids a religious test as a requirement for holding a governmental position, and holds the United States under the Constitution responsible for debts incurred by the United States under the Articles of Confederation.

United States v. Butler, 297 U.S. 1 (1936), is a U.S. Supreme Court case that held that the U.S. Congress has not only the power to lay taxes to the level necessary to carry out its other powers enumerated in Article I of the U.S. Constitution, but also a broad authority to tax and spend for the "general welfare" of the United States. The decision itself concerned whether the processing taxes instituted by the 1933 Agricultural Adjustment Act were constitutional.

The Necessary and Proper Clause, also known as the Elastic Clause, is a clause in Article I, Section 8 of the United States Constitution:

The Congress shall have Power... To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers, and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.

In the United States, implied powers are powers that, although not directly stated in the Constitution, are implied to be available based on previously stated powers.

The enumerated powers of the United States Congress are the powers granted to the federal government of the United States by the United States Constitution. Most of these powers are listed in Article I, Section 8.

The Taxing and Spending Clause, Article I, Section 8, Clause 1 of the United States Constitution, grants the federal government of the United States its power of taxation. While authorizing Congress to levy taxes, this clause permits the levying of taxes for two purposes only: to pay the debts of the United States, and to provide for the common defense and general welfare of the United States. Taken together, these purposes have traditionally been held to imply and to constitute the federal government's taxing and spending power.

Dual federalism, also known as layer-cake federalism or divided sovereignty, is a political arrangement in which power is divided between the federal and state governments in clearly defined terms, with state governments exercising those powers accorded to them without interference from the federal government. Dual federalism is defined in contrast to cooperative federalism, in which federal and state governments collaborate on policy.

The Marshall Court refers to the Supreme Court of the United States from 1801 to 1835, when John Marshall served as the fourth Chief Justice of the United States. Marshall served as Chief Justice until his death, at which point Roger Taney took office. The Marshall Court played a major role in increasing the power of the judicial branch, as well as the power of the national government.

D'Emden v Pedder was a significant Australian court case decided in the High Court of Australia on 26 April 1904. It directly concerned the question of whether salary receipts of federal government employees were subject to state stamp duty, but it touched on the broader issue within Australian constitutional law of the degree to which the two levels of Australian government were subject to each other's laws.

Nullification, in United States constitutional history, is a legal theory that a state has the right to nullify, or invalidate, any federal laws which they deem unconstitutional with respect to the United States Constitution. There are similar theories that any officer, jury, or individual may do the same. The theory of state nullification has never been legally upheld by federal courts, although jury nullification has.

United States v. Comstock, 560 U.S. 126 (2010), was a decision by the Supreme Court of the United States, which held that the federal government has authority under the Necessary and Proper Clause to require the civil commitment of individuals already in Federal custody. The practice, introduced by the Adam Walsh Child Protection and Safety Act, was upheld against a challenge that it fell outside the enumerated powers granted to Congress by the Constitution. The decision did not rule on any other aspect of the law's constitutionality, because only the particular issue of Congressional authority was properly before the Court.

Powers of the United States Congress are implemented by the United States Constitution, defined by rulings of the Supreme Court, and by its own efforts and by other factors such as history and custom. It is the chief legislative body of the United States. Some powers are explicitly defined by the Constitution and are called enumerated powers; others have been assumed to exist and are called implied powers.

In United States Constitutional Law, intergovernmental immunity is a doctrine that prevents the federal government and individual state governments from intruding on each other's sovereignty. It is also referred to as a Supremacy Clause immunity or simply federal immunity from state law.

The constitutional law of the United States is the body of law governing the interpretation and implementation of the United States Constitution. The subject concerns the scope of power of the United States federal government compared to the individual states and the fundamental rights of individuals. The ultimate authority upon the interpretation of the Constitution and the constitutionality of statutes, state and federal, lies with the Supreme Court of the United States.

The Supremacy Clause of the Constitution of the United States establishes that the Constitution, federal laws made pursuant to it, and treaties made under its authority, constitute the "supreme Law of the Land", and thus take priority over any conflicting state laws. It provides that state courts are bound by, and state constitutions subordinate to, the supreme law. However, federal statutes and treaties must be within the parameters of the Constitution; that is, they must be pursuant to the federal government's enumerated powers, and not violate other constitutional limits on federal power, such as the Bill of Rights—of particular interest is the Tenth Amendment to the United States Constitution, which states that the federal government has only those powers that are delegated to it by the Constitution.

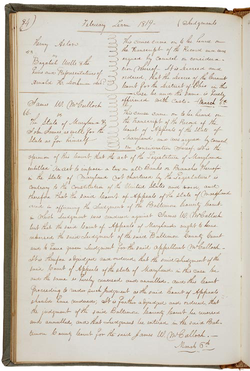

James W. McCulloh (1789–1861) was an American politician from Baltimore. He is known for being a party in the landmark U.S. Supreme Court case McCulloch v. Maryland (1819), which held that Congress has implied powers under the Necessary and Proper Clause, and its valid exercise of those powers are supreme over the states. The case refers to him as "McCulloch" because the court clerk misspelled his name.

Brown v. Maryland, 25 U.S. 419 (1827), was a significant United States Supreme Court case which interpreted the Import-Export and Commerce Clauses of the U.S. Constitution to prohibit discriminatory taxation by states against imported items after importation, rather than only at the time of importation. The state of Maryland passed a law requiring importers of foreign goods to obtain a license for selling their products. Brown was charged under this law and appealed. It was the first case in which the U.S. Supreme Court construed the Import-Export Clause. Chief Justice John Marshall delivered the opinion of the court, ruling that Maryland's statute violated the Import-Export and Commerce Clauses and the federal law was supreme. He alleged that the power of a state to tax goods did not apply if they remained in their "original package". A license tax on the importer was essentially the same as a tax on an import itself. Despite arguing the case for Maryland, future chief justice Roger Taney admitted that the case was correctly decided.