Related Research Articles

Econophysics is a heterodox interdisciplinary research field, applying theories and methods originally developed by physicists in order to solve problems in economics, usually those including uncertainty or stochastic processes and nonlinear dynamics. Some of its application to the study of financial markets has also been termed statistical finance referring to its roots in statistical physics. Econophysics is closely related to social physics.

Édouard Brézin is a French theoretical physicist. He is professor at Université Paris 6, working at the laboratory for theoretical physics (LPT) of the École Normale Supérieure since 1986.

Amir Ordacgi Caldeira is a Brazilian physicist. He received his bachelor's degree in 1973 from the Pontifícia Universidade Católica do Rio de Janeiro, his M.Sc. degree in 1976 from the same university, and his Ph.D. in 1980 from University of Sussex. His Ph.D. advisor was the Physics Nobel Prize winner Anthony James Leggett. He joined the faculty at Universidade Estadual de Campinas (UNICAMP) in 1980. In 1984 he did post-doctoral work at the Kavli Institute for Theoretical Physics (KITP) at University of California, Santa Barbara and at the Thomas J. Watson Research Laboratory at IBM. In 1994–1995 he spent a sabbatical at the University of Illinois at Urbana-Champaign. He is currently a Full Professor at Universidade Estadual de Campinas. He was the recipient of the Wataghin Prize, from Universidade Estadual de Campinas, for his contributions to theoretical physics in 1986.

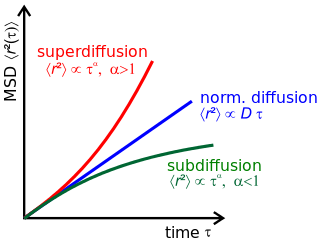

Anomalous diffusion is a diffusion process with a non-linear relationship between the mean squared displacement (MSD), , and time. This behavior is in stark contrast to Brownian motion, the typical diffusion process described by Einstein and Smoluchowski, where the MSD is a linear in time. Examples of anomalous diffusion in nature have been observed in biology in the cell nucleus, plasma membrane and cytoplasm.

Statistical finance, is the application of econophysics to financial markets. Instead of the normative roots of much of the field of finance, it uses a positivist framework including exemplars from statistical physics with an emphasis on emergent or collective properties of financial markets. The starting point for this approach to understanding financial markets are the empirically observed stylized facts.

The term R-matrix has several meanings, depending on the field of study.

Objective-collapse theories, also known as models of spontaneous wave function collapse or dynamical reduction models, were formulated as a response to the measurement problem in quantum mechanics, to explain why and how quantum measurements always give definite outcomes, not a superposition of them as predicted by the Schrödinger equation, and more generally how the classical world emerges from quantum theory. The fundamental idea is that the unitary evolution of the wave function describing the state of a quantum system is approximate. It works well for microscopic systems, but progressively loses its validity when the mass / complexity of the system increases.

Gunduz Caginalp is a mathematician whose research has also contributed over 100 papers to physics, materials science and economics/finance journals, including two with Michael Fisher and nine with Nobel Laureate Vernon Smith. He started Cornell University in 1970 and received an AB in 1973 "Cum Laude with Honors in All Subjects" and Phi Beta Kappa, Master's in 1976 and PhD in 1978. He has held positions at The Rockefeller University, Carnegie-Mellon University and the University of Pittsburgh, where he is currently Professor of Mathematics. He was born in Turkey, and spent his first seven years and ages 13–16 there, and the middle years in New York City.

Quantum dimer models were introduced to model the physics of resonating valence bond (RVB) states in lattice spin systems. The only degrees of freedom retained from the motivating spin systems are the valence bonds, represented as dimers which live on the lattice bonds. In typical dimer models, the dimers do not overlap.

The Feynman checkerboard, or relativistic chessboard model, was Richard Feynman’s sum-over-paths formulation of the kernel for a free spin-½ particle moving in one spatial dimension. It provides a representation of solutions of the Dirac equation in (1+1)-dimensional spacetime as discrete sums.

Francisco José Ynduráin Muñoz was a Spanish theoretical physicist. He founded the particle physics research group that became the Department of Theoretical Physics at the Autonomous University of Madrid, where he was a Professor. He was described by his colleagues as "a scientist that always searched for excellence in research".

Xiao-Gang Wen is a Chinese-American physicist. He is a Cecil and Ida Green Professor of Physics at the Massachusetts Institute of Technology and Distinguished Visiting Research Chair at the Perimeter Institute for Theoretical Physics. His expertise is in condensed matter theory in strongly correlated electronic systems. In Oct. 2016, he was awarded the Oliver E. Buckley Condensed Matter Prize.

Peter Hänggi is a theoretical physicist from Switzerland, Professor of Theoretical Physics at the University of Augsburg. He is best known for his original works on Brownian motion and the Brownian motor concept, stochastic resonance and dissipative systems. Other topics include, driven quantum tunneling, such as the discovery of coherent destruction of tunneling (CDT), phononics, relativistic statistical mechanics and the foundations of classical and quantum thermodynamics.

In quantum gravity, the phase space is infinite dimensional as we are dealing with a field theory. An approximation which is sometimes taken is to only consider the largest wavelength modes of the order of the size of the universe when studying cosmological models. This is the minisuperspace approximation. The validity of this approximation holds as long as the adiabatic approximation holds.

The toric code is a topological quantum error correcting code, and an example of a stabilizer code, defined on a two-dimensional spin lattice It is the simplest and most well studied of the quantum double models. It is also the simplest example of topological order—Z2 topological order (first studied in the context of Z2 spin liquid in 1991). The toric code can also be considered to be a Z2 lattice gauge theory in a particular limit. It was introduced by Alexei Kitaev.

Quantum finance is an interdisciplinary research field, applying theories and methods developed by quantum physicists and economists in order to solve problems in finance. It is a branch of econophysics.

A unified model for Diffusion Localization and Dissipation (DLD), optionally termed Diffusion with Local Dissipation, has been introduced for the study of Quantal Brownian Motion (QBM) in dynamical disorder. It can be regarded as a generalization of the familiar Caldeira-Leggett model.

In theoretical physics, the logarithmic Schrödinger equation is one of the nonlinear modifications of Schrödinger's equation. It is a classical wave equation with applications to extensions of quantum mechanics, quantum optics, nuclear physics, transport and diffusion phenomena, open quantum systems and information theory, effective quantum gravity and physical vacuum models and theory of superfluidity and Bose–Einstein condensation. Its relativistic version was first proposed by Gerald Rosen. It is an example of an integrable model.

Dorje C. Brody is a British applied mathematician and mathematical physicist.

Matthieu Wyart is a French physicist. He is a professor of physics at EPFL and the head of the Physics of Complex Systems Laboratory.

References

- ↑ Nastasiuk, Vadim A. (2014). "Emergent quantum mechanics of finances". Physica A: Statistical Mechanics and Its Applications. Elsevier BV. 403: 148–154. arXiv: 1312.3247 . doi:10.1016/j.physa.2014.02.037. ISSN 0378-4371.

- ↑ Nastasiuk, V.A. (2015). "Fisher information and quantum potential well model for finance". Physics Letters A. Elsevier BV. 379 (36): 1998–2000. arXiv: 1504.03822 . doi:10.1016/j.physleta.2015.06.052. ISSN 0375-9601.

- ↑ Peters, O.; Klein, W. (2013-03-08). "Ergodicity Breaking in Geometric Brownian Motion". Physical Review Letters. 110 (10): 100603. arXiv: 1209.4517 . doi:10.1103/physrevlett.110.100603. ISSN 0031-9007. PMID 23521245.

- ↑ Peters, Ole (2011). "Optimal leverage from non-ergodicity". Quantitative Finance. Informa UK Limited. 11 (11): 1593–1602. arXiv: 0902.2965 . doi:10.1080/14697688.2010.513338. ISSN 1469-7688.

- ↑ Lillo, Fabrizio; Mantegna, Rosario N. (2000-11-01). "Variety and volatility in financial markets". Physical Review E. American Physical Society (APS). 62 (5): 6126–6134. arXiv: cond-mat/0006065 . doi:10.1103/physreve.62.6126. ISSN 1063-651X. PMID 11101943.