Brownian motion is the random motion of particles suspended in a medium.

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a unique price given the risk of the security and its expected return. The equation and model are named after economists Fischer Black and Myron Scholes. Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited.

In physics, a Langevin equation is a stochastic differential equation describing how a system evolves when subjected to a combination of deterministic and fluctuating ("random") forces. The dependent variables in a Langevin equation typically are collective (macroscopic) variables changing only slowly in comparison to the other (microscopic) variables of the system. The fast (microscopic) variables are responsible for the stochastic nature of the Langevin equation. One application is to Brownian motion, which models the fluctuating motion of a small particle in a fluid.

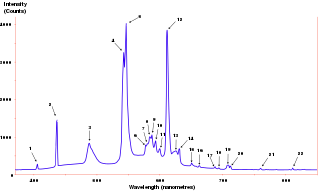

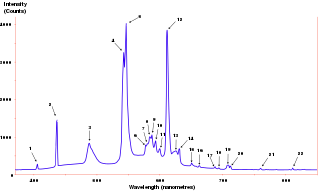

In signal processing, the power spectrum of a continuous time signal describes the distribution of power into frequency components composing that signal. According to Fourier analysis, any physical signal can be decomposed into a number of discrete frequencies, or a spectrum of frequencies over a continuous range. The statistical average of any sort of signal as analyzed in terms of its frequency content, is called its spectrum.

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters. Collectively these have also been called the risk sensitivities, risk measures or hedge parameters.

In probability theory, a martingale is a sequence of random variables for which, at a particular time, the conditional expectation of the next value in the sequence is equal to the present value, regardless of all prior values.

In mathematical optimization and decision theory, a loss function or cost function is a function that maps an event or values of one or more variables onto a real number intuitively representing some "cost" associated with the event. An optimization problem seeks to minimize a loss function. An objective function is either a loss function or its opposite, in which case it is to be maximized. The loss function could include terms from several levels of the hierarchy.

In system analysis, among other fields of study, a linear time-invariant (LTI) system is a system that produces an output signal from any input signal subject to the constraints of linearity and time-invariance; these terms are briefly defined below. These properties apply (exactly or approximately) to many important physical systems, in which case the response y(t) of the system to an arbitrary input x(t) can be found directly using convolution: y(t) = (x ∗ h)(t) where h(t) is called the system's impulse response and ∗ represents convolution (not to be confused with multiplication). What's more, there are systematic methods for solving any such system (determining h(t)), whereas systems not meeting both properties are generally more difficult (or impossible) to solve analytically. A good example of an LTI system is any electrical circuit consisting of resistors, capacitors, inductors and linear amplifiers.

In mathematics, ergodic flows occur in geometry, through the geodesic and horocycle flows of closed hyperbolic surfaces. Both of these examples have been understood in terms of the theory of unitary representations of locally compact groups: if Γ is the fundamental group of a closed surface, regarded as a discrete subgroup of the Möbius group G = PSL(2,R), then the geodesic and horocycle flow can be identified with the natural actions of the subgroups A of real positive diagonal matrices and N of lower unitriangular matrices on the unit tangent bundle G / Γ. The Ambrose-Kakutani theorem expresses every ergodic flow as the flow built from an invertible ergodic transformation on a measure space using a ceiling function. In the case of geodesic flow, the ergodic transformation can be understood in terms of symbolic dynamics; and in terms of the ergodic actions of Γ on the boundary S1 = G / AN and G / A = S1 × S1 \ diag S1. Ergodic flows also arise naturally as invariants in the classification of von Neumann algebras: the flow of weights for a factor of type III0 is an ergodic flow on a measure space.

In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of wealth, which is equivalent to maximizing the expected geometric growth rate. Assuming that the expected returns are known, the Kelly criterion leads to higher wealth than any other strategy in the long run. J. L. Kelly Jr, a researcher at Bell Labs, described the criterion in 1956.

The Wigner distribution function (WDF) is used in signal processing as a transform in time-frequency analysis.

In mathematics, the theory of optimal stopping or early stopping is concerned with the problem of choosing a time to take a particular action, in order to maximise an expected reward or minimise an expected cost. Optimal stopping problems can be found in areas of statistics, economics, and mathematical finance. A key example of an optimal stopping problem is the secretary problem. Optimal stopping problems can often be written in the form of a Bellman equation, and are therefore often solved using dynamic programming.

In statistics, the Kendall rank correlation coefficient, commonly referred to as Kendall's τ coefficient, is a statistic used to measure the ordinal association between two measured quantities. A τ test is a non-parametric hypothesis test for statistical dependence based on the τ coefficient. It is a measure of rank correlation: the similarity of the orderings of the data when ranked by each of the quantities. It is named after Maurice Kendall, who developed it in 1938, though Gustav Fechner had proposed a similar measure in the context of time series in 1897.

In mathematics, a local martingale is a type of stochastic process, satisfying the localized version of the martingale property. Every martingale is a local martingale; every bounded local martingale is a martingale; in particular, every local martingale that is bounded from below is a supermartingale, and every local martingale that is bounded from above is a submartingale; however, a local martingale is not in general a martingale, because its expectation can be distorted by large values of small probability. In particular, a driftless diffusion process is a local martingale, but not necessarily a martingale.

In actuarial science and applied probability, ruin theory uses mathematical models to describe an insurer's vulnerability to insolvency/ruin. In such models key quantities of interest are the probability of ruin, distribution of surplus immediately prior to ruin and deficit at time of ruin.

In probability theory, the optional stopping theorem says that, under certain conditions, the expected value of a martingale at a stopping time is equal to its initial expected value. Since martingales can be used to model the wealth of a gambler participating in a fair game, the optional stopping theorem says that, on average, nothing can be gained by stopping play based on the information obtainable so far. Certain conditions are necessary for this result to hold true. In particular, the theorem applies to doubling strategies.

In mathematical finance, the Black–Scholes equation, also called the Black–Scholes–Merton equation, is a partial differential equation (PDE) governing the price evolution of derivatives under the Black–Scholes model. Broadly speaking, the term may refer to a similar PDE that can be derived for a variety of options, or more generally, derivatives.

In physics, statistics, econometrics and signal processing, a stochastic process is said to be in an ergodic regime if an observable's ensemble average equals the time average. In this regime, any collection of random samples from a process must represent the average statistical properties of the entire regime. Conversely, a regime of a process that is not ergodic is said to be in non-ergodic regime. A regime implies a time-window of a process whereby ergodicity measure is applied.

In the mathematical theory of probability, the drift-plus-penalty method is used for optimization of queueing networks and other stochastic systems.

In mathematics, a continuous-time random walk (CTRW) is a generalization of a random walk where the wandering particle waits for a random time between jumps. It is a stochastic jump process with arbitrary distributions of jump lengths and waiting times. More generally it can be seen to be a special case of a Markov renewal process.