Pro rata is an adverb or adjective meaning in equal portions or in proportion. [1] The term is used in many legal and economic contexts. The hyphenated spelling pro-rata for the adjective form is common, as recommended for adjectives by some English-language style guides. In American English, this term has been vernacularized to prorated or pro-rated.

More specifically, pro rata means:

Pro rata has a Latin etymology, from pro , according to, for, or by, and rata , feminine ablative of calculated (rate or change). [5]

When liability for a toxic tort or a defective product concerns many manufacturers, the liability under tort law is allocated pro rata. [6] Examples in law and economics include the following, noted below:

Each of several partners "is liable for [her or his] own share or proportion only, they are said to be bound pro rata. An example ... may be found in the liability of partners; each is liable ... only pro rata in relation to between themselves." [7]

When a debtor files for bankruptcy, and "the debtor is insolvent, creditors generally agree to accept a pro rata share of what is owed to them. If the debtor has any remaining funds, the money is divided proportionately among the creditors, according to the amount of the individual debts." [8] "A creditor of an insolvent estate is to be paid pro rata with creditors of the same class." [9]

A worker's part-time work, overtime pay, and vacation time are typically calculated on a pro rata basis. [10] [11]

Under US Federal regulations, a government worker has the right such that: "When an employee's service is interrupted by a non-leave earning period, leave is earned on a pro rata basis for each fractional pay period that occurs within the continuity of employment." [12]

The American Federation of Teachers (AFT), a US labor union, argues that all part-time or adjunct instructors should get pro-rata pay for teaching college courses. [13] This is an important issue, as of 2010, for part-time faculty. [14]

Irish secondary school teachers are entitled to pro rata pay for part-time work. [15]

Under British employment law, "Regulations state that, where appropriate, the pro rata principle should be applied to any comparison ... to be given ... holiday." [16]

Likewise, in Tasmania, Australia, the law clearly grants workers the privilege of part-time benefits for leave of absence. [17] [18] This is granted under the Long Service Leave Act 1976. [19]

In corporate practice, "a pro-rata dividend means that every shareholder gets an equal proportion for each share he or she owns." [20]

In banking, "Pro-rating also refers to the practice of applying interest rates to different time frames. If the interest rate was 12% per annum, you could pro-rate this number to be 1% a month (12%/12 months)." [20]

In venture capital, it can refer to the Pro-Rata Participation right and mean "the right to continue to participate in future rounds so that you can maintain your ownership." [21]

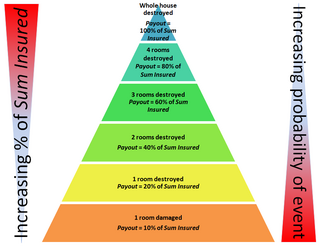

In insurance, pro rata is used to determine risk based on the time the insurance policy is in effect. [22] It may also be used to describe proportional liability when more than one person is responsible for a loss or accident.[ citation needed ]

Calculation of return premium of a cancelled insurance policy is often done using a cancellation method called pro rata . First, a return premium factor is calculated by taking the number of days remaining in the policy period divided by the number of total days of the policy. This factor is then multiplied by the policy premium to arrive at the return premium. Traditionally, this has been done manually using a paper wheel calculator. Today, it is normally done using an online wheel calculator. [23]

When a college student withdraws, colleges may refund tuition payments on a pro rata basis.

In the United States, a private pilot may pay no less than the pro rata share of the total price of the flight when carrying passengers. [24]

Pro-Ration (pro rata) means if the battery fails anytime within the first two years of service, it is replaced for free. After those first two years, a pro-rated fee is assessed for the replacement. However, the pro-ration (pro rata) is typically calculated from the date the battery was sold.

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

An actuary is a professional with advanced mathematical skills who deals with the measurement and management of risk and uncertainty. The name of the corresponding field is actuarial science which covers rigorous mathematical calculations in areas of life expectancy and life insurance. These risks can affect both sides of the balance sheet and require asset management, liability management, and valuation skills. Actuaries provide assessments of financial security systems, with a focus on their complexity, their mathematics, and their mechanisms.

In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date. This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects. The discount, or charge, is the difference between the original amount owed in the present and the amount that has to be paid in the future to settle the debt.

In corporate finance, a debenture is a medium- to long-term debt instrument used by large companies to borrow money, at a fixed rate of interest. The legal term "debenture" originally referred to a document that either creates a debt or acknowledges it, but in some countries the term is now used interchangeably with bond, loan stock or note. A debenture is thus like a certificate of loan or a loan bond evidencing the company's liability to pay a specified amount with interest. Although the money raised by the debentures becomes a part of the company's capital structure, it does not become share capital. Senior debentures get paid before subordinate debentures, and there are varying rates of risk and payoff for these categories.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is referred to as the "ceding company" or "cedent". The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes or wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes.

Subrogation is the assumption by a third party of another party's legal right to collect debts or damages. It is a legal doctrine whereby one person is entitled to enforce the subsisting or revived rights of another for one's own benefit. A right of subrogation typically arises by operation of law, but can also arise by statute or by agreement. Subrogation is an equitable remedy, having first developed in the English Court of Chancery. It is a familiar feature of common law systems. Analogous doctrines exist in civil law jurisdictions.

A guarantee is a form of transaction in which one person, to obtain some trust, confidence or credit for another, engages to be answerable for them. It may also designate a treaty through which claims, rights or possessions are secured. It is to be differentiated from the colloquial "personal guarantee" in that a guarantee is a legal concept which produces an economic effect. A personal guarantee by contrast is often used to refer to a promise made by an individual which is supported by, or assured through, the word of the individual. In the same way, a guarantee produces a legal effect wherein one party affirms the promise of another by promising to themselves pay if default occurs.

Credit is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately, but promises either to repay or return those resources at a later date. The resources provided by the first party can be either property, fulfillment of promises, or performances. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people.

The Pension Benefit Guaranty Corporation (PBGC) is a United States federally chartered corporation created by the Employee Retirement Income Security Act of 1974 (ERISA) to encourage the continuation and maintenance of voluntary private defined benefit pension plans, provide timely and uninterrupted payment of pension benefits, and keep pension insurance premiums at the lowest level necessary to carry out its operations. Subject to other statutory limitations, PBGC's single-employer insurance program pays pension benefits up to the maximum guaranteed benefit set by law to participants who retire at 65. The benefits payable to insured retirees who start their benefits at ages other than 65 or elect survivor coverage are adjusted to be equivalent in value. The maximum monthly guarantee for the multiemployer program is far lower and more complicated.

Pari passu is a Latin phrase that literally means "with an equal step" or "on equal footing". It is sometimes translated as "ranking equally", "hand-in-hand", "with equal force", or "moving together", and by extension, "fairly", "without partiality".

Whole life insurance, or whole of life assurance, sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. As a life insurance policy it represents a contract between the insured and insurer that as long as the contract terms are met, the insurer will pay the death benefit of the policy to the policy's beneficiaries when the insured dies. Because whole life policies are guaranteed to remain in force as long as the required premiums are paid, the premiums are typically much higher than those of term life insurance where the premium is fixed only for a limited term. Whole life premiums are fixed, based on the age of issue, and usually do not increase with age. The insured party normally pays premiums until death, except for limited pay policies which may be paid up in 10 years, 20 years, or at age 65. Whole life insurance belongs to the cash value category of life insurance, which also includes universal life, variable life, and endowment policies.

Repossession, colloquially repo, is a "self-help" type of action, mainly in the United States, in which the party having right of ownership of the property in question takes the property back from the party having right of possession without invoking court proceedings. The property may then be sold by either the financial institution or third party sellers.

Closing costs are fees paid at the closing of a real estate transaction. This point in time called the closing is when the title to the property is conveyed (transferred) to the buyer. Closing costs are incurred by either the buyer or the seller.

Payment protection insurance (PPI), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt. It is not to be confused with income protection insurance, which is not specific to a debt but covers any income. PPI was widely sold by banks and other credit providers as an add-on to the loan or overdraft product.

An import quota is a type of trade restriction that sets a physical limit on the quantity of a good that can be imported into a country in a given period of time. Quotas, like other trade restrictions, are typically used to benefit the producers of a good in that economy (protectionism).

Taxes in Switzerland are levied by the Swiss Confederation, the cantons and the municipalities.

An insurance policy may be canceled before the end of the policy period. This has the effect of ending the policy coverage on the date of the policy cancellation.

Condition of average is the insurance term used when calculating a payout against a claim where the policy undervalues the sum insured. In the event of partial loss, the amount paid against a claim will be in the same proportion as the value of the underinsurance.

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.