Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

In an insurance policy, the deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments.

Home insurance, also commonly called homeowner's insurance, is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insurance protections, which can include losses occurring to one's home, its contents, loss of use, or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils.

General insurance or non-life insurance policy, including automobile and homeowners policies, provide payments depending on the loss from a particular financial event. General insurance is typically defined as any insurance that is not determined to be life insurance. It is called property and casualty insurance in the United States and Canada and non-life insurance in Continental Europe.

Protection and indemnity insurance, more commonly known as P&I insurance, is a form of mutual maritime insurance provided by a P&I club. Whereas a marine insurance company provides "hull and machinery" cover for shipowners, and cargo cover for cargo owners, a P&I club provides cover for open-ended risks that traditional insurers are reluctant to insure. Typical P&I cover includes: a carrier's third-party risks for damage caused to cargo during carriage; war risks; and risks of environmental damage such as oil spills and pollution. In the UK, both traditional underwriters and P&I clubs are subject to the Marine Insurance Act 1906.

The term replacement cost or replacement value refers to the amount that an entity would have to pay to replace an asset at the present time, according to its current worth.

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance is the sub-branch of marine insurance, though marine insurance also includes onshore and offshore exposed property,, hull, marine casualty, and marine losses. When goods are transported by mail or courier or related post, shipping insurance is used instead.

Vehicle title branding is the use of a permanent designation on a vehicle's title, registration or permit documents to indicate that a vehicle has been written off due to collision, fire or flood damage or has been sold for scrap.

In North America, a salvage title is a form of vehicle title branding, which notes that the vehicle has been damaged and/or deemed a total loss by an insurance company that paid a claim on it. The criteria for determining when a salvage title is issued differ considerably by each state, province or territory. In a minority of states and Canadian provinces, regulations require a salvage title for stolen or vandalized vehicles which are not recovered by police within 21 days. In such cases insurance companies declare a vehicle total loss and pay off the previous owner; but, in others, it is issued only for losses due to damage. Under some circumstances, a salvage title denotation may be removed or replaced with a Rebuilt Salvage designation; and cars imported to, or exported from, the United States may be issued a clean title regardless of history.

Aviation insurance is insurance coverage geared specifically to the operation of aircraft and the risks involved in aviation. Aviation insurance policies are distinctly different from those for other areas of transportation and tend to incorporate aviation terminology, as well as terminology, limits and clauses specific to aviation insurance.

Expatriate insurance policies are designed to cover financial and other losses incurred by expatriates while living and working in a country other than one's own.

A loss payee clause is a clause in a contract of insurance that provides, in the event of payment being made under the policy in relation to the insured risk, that payment will be made to a third party rather than to the insured beneficiary of the policy.

Satellite insurance is a specialized branch of aviation insurance in which, as of 2000, about 20 insurers worldwide participate directly. Others participate through reinsurance contracts with direct providers. It covers three risks: relaunching the satellite if the launch operation fails; replacing the satellite if it is destroyed, positioned in an improper orbit, or fails in orbit; and liability for damage to third parties caused by the satellite or the launch vehicle.

The Marine Insurance Act 1906 is a UK Act of Parliament regulating marine insurance. The Act applies both to "ship & cargo" marine insurance, and to P&I cover.

Diminished value or diminution in value are the terms generally used to describe the loss in a property's market value after it was damaged in an accident and repaired. Diminished value is most often associated with automobiles but it is applicable to other property of value including real estate or collectibles such as jewelry and artwork. If a property was damaged and repair failed to restore it to its original market value then said property has suffered diminished value.

Vehicle insurance in the United States is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage. Most states require a motor vehicle owner to carry some minimum level of liability insurance. States that do not require the vehicle owner to carry car insurance include Virginia, where an uninsured motor vehicle fee may be paid to the state, New Hampshire, and Mississippi, which offers vehicle owners the option to post cash bonds. The privileges and immunities clause of Article IV of the U.S. Constitution protects the rights of citizens in each respective state when traveling to another. A motor vehicle owner typically pays insurers a monthly fee, often called an insurance premium. The insurance premium a motor vehicle owner pays is usually determined by a variety of factors including the type of covered vehicle, marital status, credit score, whether the driver rents or owns a home, the age and gender of any covered drivers, their driving history, and the location where the vehicle is primarily driven and stored. Most insurance companies will increase insurance premium rates based on these factors, and less frequently, offer discounts.

Insurance in South Africa describes a mechanism in that country for the reduction or minimisation of loss, owing to the constant exposure of people and assets to risks. The kinds of loss which arise if such risks eventuate may be either patrimonial or non-patrimonial.

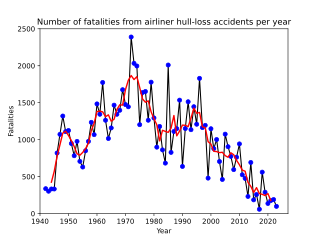

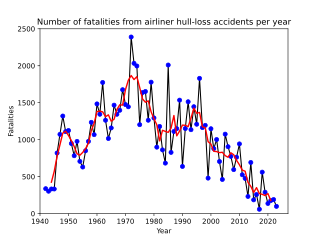

A hull loss is an aviation accident that damages the aircraft beyond economical repair, resulting in a total loss. The term also applies to situations in which the aircraft is missing, the search for their wreckage is terminated, or the wreckage is logistically inaccessible.