In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services . Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance.

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs).

In finance, the style or family of an option is the class into which the option falls, usually defined by the dates on which the option may be exercised. The vast majority of options are either European or American (style) options. These options—as well as others where the payoff is calculated similarly—are referred to as "vanilla options". Options where the payoff is calculated differently are categorized as "exotic options". Exotic options can pose challenging problems in valuation and hedging.

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters. Collectively these have also been called the risk sensitivities, risk measures or hedge parameters.

A swaption is an option granting its owner the right but not the obligation to enter into an underlying swap. Although options can be traded on a variety of swaps, the term "swaption" typically refers to options on interest rate swaps.

In finance, an exotic option is an option which has features making it more complex than commonly traded vanilla options. Like the more general exotic derivatives they may have several triggers relating to determination of payoff. An exotic option may also include non-standard underlying instrument, developed for a particular client or for a particular market. Exotic options are more complex than options that trade on an exchange, and are generally traded over the counter (OTC).

In finance, a swap is an agreement between two counterparties to exchange financial instruments or cashflows or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.

In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of different interest rate indices that can be used in this definition.

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized "structurer" to design and manage its structured-product offering.

In finance, a currency swap is an interest rate derivative (IRD). In particular it is a linear IRD, and one of the most liquid benchmark products spanning multiple currencies simultaneously. It has pricing associations with interest rate swaps (IRSs), foreign exchange (FX) rates, and FX swaps (FXSs).

Financial modeling is the task of building an abstract representation of a real world financial situation. This is a mathematical model designed to represent the performance of a financial asset or portfolio of a business, project, or any other investment.

In finance, a price (premium) is paid or received for purchasing or selling options. This article discusses the calculation of this premium in general. For further detail, see: Mathematical finance § Derivatives pricing: the Q world for discussion of the mathematics; Financial engineering for the implementation; as well as Financial modeling § Quantitative finance generally.

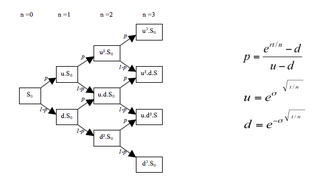

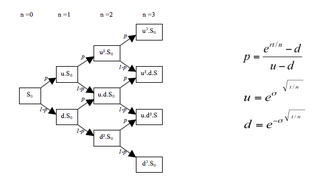

In finance, a lattice model is a technique applied to the valuation of derivatives, where a discrete time model is required. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at "all" times before and including maturity. A continuous model, on the other hand, such as Black–Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par. The method is also used for valuing certain exotic options, where because of path dependence in the payoff, Monte Carlo methods for option pricing fail to account for optimal decisions to terminate the derivative by early exercise, though methods now exist for solving this problem.

The following outline is provided as an overview of and topical guide to finance:

In finance, inflation derivative refers to an over-the-counter and exchange-traded derivative that is used to transfer inflation risk from one counterparty to another. See Exotic derivatives.

In finance, model risk is the risk of loss resulting from using insufficiently accurate models to make decisions, originally and frequently in the context of valuing financial securities. However, model risk is more and more prevalent in activities other than financial securities valuation, such as assigning consumer credit scores, real-time probability prediction of fraudulent credit card transactions, and computing the probability of air flight passenger being a terrorist. Rebonato in 2002 defines model risk as "the risk of occurrence of a significant difference between the mark-to-model value of a complex and/or illiquid instrument, and the price at which the same instrument is revealed to have traded in the market".

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, algorithmic trading and investment management. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns. The resulting strategies may involve high-frequency trading.

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets.

In finance, a zero coupon swap (ZCS) is an interest rate derivative (IRD). In particular it is a linear IRD, that in its specification is very similar to the much more widely traded interest rate swap (IRS).