In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

The bond market is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

Sir Ronald Mourad Cohen is an Egyptian-born British businessman and political figure. He is the chairman of The Portland Trust and Bridges Ventures. He has been described as "the father of British venture capital" and "the father of social investment".

Social finance is a category of financial services that aims to leverage private capital to address challenges in areas of social and environmental need. Having gained popularity in the aftermath of the 2008 global financial crisis, it is notable for its public benefit focus. Mechanisms of creating shared social value are not new; however, social finance is conceptually unique as an approach to solving social problems while simultaneously creating economic value. Unlike philanthropy, which has a similar mission-motive, social finance secures its own sustainability by being profitable for investors. Capital providers lend to social enterprises, who in turn, by investing borrowed funds in socially beneficial initiatives, deliver investors measurable social returns in addition to traditional financial returns on their investment.

Social Finance is a not for profit consultancy organisation that partners with governments, service providers, the voluntary sector and the financial community to find better ways of tackling social problems in the UK and globally. Founded in 2007, they have helped pioneer a series of programmes to improve outcomes for individuals with complex needs. Their innovations include the Social Impact Bonds (SIB) model which has mobilised more than £500 million globally in areas such as offender rehabilitation, children and family, homelessness and housing, young people at risk of becoming NEET, mental health and employment, loneliness and social isolation, and domestic violence.

Conservation finance is the practice of raising and managing capital to support land, water, and resource conservation. Conservation financing options vary by source from public, private, and nonprofit funders; by type from loans, to grants, to tax incentives, to market mechanisms; and by scale ranging from federal to state, national to local.

Impact investing refers to investments "made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return". At its core, impact investing is about an alignment of an investor's beliefs and values with the allocation of capital to address social and/or environmental issues.

The Office of Social Innovation and Civic Participation was an office new to the Obama Administration, created within the White House, to catalyze new and innovative ways of encouraging government to do business differently. Its first director was the economist Sonal Shah. The final director was David Wilkinson.

The Portland Trust was established to promote peace and stability between Israelis and Palestinians through economic development. It works with a range of partners to help develop the Palestinian private sector and relieve poverty through entrepreneurship in Israel. It facilitates sustainable economic development through catalysing initiatives to build quality employment and thriving private sectors. Their work advances the growth of strong societies in Israel and Palestine based on socio-economic mobility and inclusion for minorities and marginalised groups.

PACE financing is a means used in the United States of America of financing energy efficiency upgrades, disaster resiliency improvements, water conservation measures, or renewable energy installations in existing or new construction of residential, commercial, and industrial property owners. Depending on state legislation, PACE financing can be used to finance water efficiency products, seismic retrofits, resiliency, and other measures with social benefits.

A Green bond is a fixed-income financial instruments (bond) which is used to fund projects that have positive environmental and/or climate benefits. They follow the Green Bond Principles stated by the International Capital Market Association (ICMA), and the proceeds from the issuance of which are to be used for the pre-specified types of projects.

Better Society Capital Limited (BSC), formerly Big Society Capital, is a social impact investor in the United Kingdom. Its mission is to grow the amount of money invested in tackling social issues and inequalities in the UK. It invests its own capital as well as enabling others to invest for impact too. The capital finances front-line social purpose organizations tackling everything from homelessness to mental health and fuel poverty, enabling them to grow and increase their impact.

In finance, a GDP-linked bond is a debt security or derivative security in which the authorized issuer promises to pay a return, in addition to amortization, that varies with the behavior of Gross Domestic Product (GDP). This type of security can be thought as a “stock on a country” in the sense that it has “equity-like” features. It pays more/less when the performance of the country is better/worse than expected. Nevertheless, it is substantially different from a stock because there are no ownership-rights over the country.

Crowdcube is a British investment crowdfunding platform, established by Darren Westlake and Luke Lang in 2011.

Third Sector Capital Partners, Inc. is a nonprofit advisory firm with offices in Boston, Massachusetts, San Francisco, California, and Washington, DC. Founded in 2011, Third Sector leads governments, nonprofits, and private funders in building evidence-based initiatives and Pay for Success projects. A 501(c)(3) nonprofit, Third Sector is supported through philanthropic and government sources.

Development impact bonds (DIBs) are a performance-based investment instrument intended to finance development programmes in low resource countries, which are built off the model of social impact bond (SIB) model. In general, the model works the same: an investor provides upfront funding to the implementer of a program. An evaluator measures the results of the implementer's program. If these results hit a target set before the implementation period, an outcome payer agrees to provide investors a return on their capital. This ensures that investors are not simply engaging in concessionary lending. The first social impact bond was originated by Social Finance UK in 2010, supported by the Rockefeller Foundation, structured to reduce recidivism among inmates from Peterborough Prison.

Public–private partnerships are cooperative arrangements between two or more public and private sectors, typically of a long-term nature. In the United States, they mostly took the form of toll roads concessions, community post offices and urban renewal projects. In recent years, there has been interest in expanding P3s to multiple infrastructure projects, such as schools, universities, government buildings, waste and water. Reasons for expanding public-private partnership in the United States were initially cost-cutting and concerns about Public debt. In the early 2000s, P3s were implemented sporadically by different States and municipalities with little federal guidance. During Obama's second term, multiple policies were adopted to facilitate P3 projects, and Congress passed bills in that direction with overwhelming bipartisan support. My Brother's Keeper Challenge is an example of a public–private partnership. Some Private-public partnerships were carried out without incident, while others have attracted much controversy.

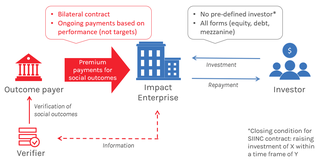

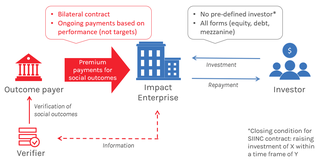

The Social Impact Incentives (SIINC) model is a blended finance instrument introduced for the first time in 2016. In the SIINC model, enterprises are provided with time-limited premium payments for achieving social impact, thus aligning profitability with their social impact and enabling them to attract growth capital. The SIINC agreement is a bilateral contract between an outcome funder and an enterprise; an independent verifier assesses the impact performance and clears payments for disbursement; the investment between the enterprise and its investor is arranged via a separate contract.