Related Research Articles

The Texas Commerce Bank was a Texas-based bank acquired by Chemical Banking Corporation of New York in May 1987. The acquisition of Texas Commerce Bank represented the largest interstate banking merger in history at the time with a purchase price of $1.2 billion. The bank had its headquarters in what is now the JPMorgan Chase Building in downtown Houston, Texas.

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

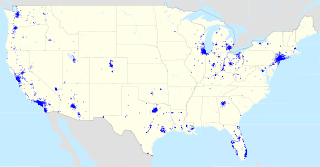

JPMorgan Chase & Co. is an American multinational financial institution headquartered in New York City and incorporated in Delaware. It is the largest bank in the United States and the world's largest bank by market capitalization as of 2023. As the largest of Big Four banks, the firm is considered systemically important by the Financial Stability Board. Its size and scale have often led to enhanced regulatory oversight as well as the maintenance of an internal "Fortress Balance Sheet" of capital reserves. The firm is headquartered at 383 Madison Avenue in Midtown Manhattan and is set to move into the under-construction JPMorgan Chase Building at 270 Park Avenue in 2025.

JPMorgan Chase Bank, N.A., doing business as Chase, is an American national bank headquartered in New York City that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Manhattan Company in 1955. The bank merged with Chemical Bank New York in 1996 and later merged with Bank One Corporation in 2004 and in 2008 acquired the deposits and most assets of Washington Mutual.

Roberto Críspulo Goizueta Cantera was a Cuban-born American business executive who served as the chairman, president, and chief executive officer (CEO) of The Coca-Cola Company from August 1980 until his death in October 1997.

William B. Harrison Jr.,, in Rocky Mount, North Carolina, is the former CEO and chairman of JPMorgan Chase. He attended high school at Virginia Episcopal School, where he was a basketball star. He attended the University of North Carolina at Chapel Hill, where he was admitted to the Zeta Psi fraternity. Having risen through the ranks of Chemical Bank before succeeding Walter V. Shipley during the Chemical Bank merger with the Chase Manhattan Corporation in 1995, which kept the Chase name. As Chairman and CEO of Chase, he and Douglas A. Warner III, then CEO of J.P. Morgan & Co., were the principal architects of the US$30.9 billion acquisition by Chase of J.P. Morgan & Co. in 2000, to form JPMorgan Chase & Co. Harrison has been a director of the Firm or a predecessor institution since 1991. Harrison is also a director of Merck & Co., Inc.

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corporation in 2003.

J.P. Morgan & Co. is an American financial institution specialized in investment banking, asset management and private banking founded by financier J. P. Morgan in 1871. Through a series of mergers and acquisitions, the company is now a subsidiary of JPMorgan Chase, one of the largest banking institutions in the world. The company has been historically referred to as the "House of Morgan" or simply Morgan. For 146 years, until 2000, J.P. Morgan specialized in commercial banking, before a merger with Chase Manhattan Bank led to the business line spinning off under the Chase brand.

Alan David Schwartz is an American businessman and is the executive chairman of Guggenheim Partners, an investment banking firm based in Chicago and New York City. He was previously the last president and chief executive officer of Bear Stearns when the Federal Reserve Bank of New York forced its March 2008 acquisition by JPMorgan Chase & Co.

Douglas 'Sandy' Warner is an American banker who joined Morgan Guaranty Trust Company of New York out of college in 1968 as an officer's assistant and rose through the ranks to become chief executive officer and chairman of the board of J.P. Morgan & Co. Inc. in 1995. Among his many accomplishments, Warner may be best known for spearheading the 2000 sale of J P Morgan & Co. to Chase Manhattan Bank for $30.9 billion.

The Manhattan Company was a New York bank and holding company established on September 1, 1799. The company merged with Chase National Bank in 1955 to form the Chase Manhattan Bank. It is the oldest of the predecessor institutions that eventually formed the current JPMorgan Chase & Co.

Mitchell H. Caplan is a former CEO of E-Trade Financial Corporation.

Joseph E. Hasten was the President and CEO of ShoreBank, America's first and leading community development and environmental bank founded in 1973 in Chicago, Illinois and named one of Fast Company's 45 Social Entrepreneurs Who Are Changing the World in 2008. Hasten led ShoreBank's socially responsible investing in the under-served urban neighborhoods of Chicago, Illinois; Cleveland, Ohio; and Detroit, Michigan. Previously, Hasten was the vice-chairman of U.S. Bancorp.

John Francis McGillicuddy was an American banking industry executive who oversaw the merger between Manufacturers Hanover Trust and Chemical Bank in the early 1990s.

EagleBank is a community bank headquartered in Bethesda, Maryland with operations in the Washington, D.C. metropolitan area including 16 branches and five lending offices in Montgomery County, Maryland; Washington, D.C.; and Northern Virginia. The bank has an above-above average exposure to commercial real estate, with 81% of all loans secured by commercial real estate. The bank owns the naming rights to the EagleBank Arena.

Walter Vincent Shipley II was the chairman and chief executive officer of Chase Manhattan Bank and, previous to that, the company with which it merged Chemical Bank. Shipley was named chief executive of Chemical in 1981 and held the position through 1999 and remained at the bank as chairman through January 2000, just prior to the bank's merger with J.P. Morgan & Co. During his 18-year tenure, Shipley oversaw Chemical's mergers with Texas Commerce Bank in 1987, Manufacturers Hanover in 1991 and Chase Manhattan Bank in 1996.

Arthur F. Ryan is an American businessman who became CEO of Prudential Insurance in 2007

William Stanton Demchak is a business executive in the finance industry as the current chief executive officer of PNC Financial Services. He is credited with being one of the earliest adopters of the credit default swap, especially the creation of markets around them, which due to the role they would play in the Financial crisis of 2007–2008 earned him the title "prince of darkness" within the industry.

Pascal Boris is a French business investor. He also sits on a number of boards as a non-executive director. He is a former senior international banking executive. He was CEO of BNP Paribas UK (1999–2007) and CEO of BNP Paribas Suisse (2007–2013).

References

- ↑ "Search Results - Page 1".

- 1 2 3 4 5 6 Atlas, Riva D. (18 October 2000). "Thomas Labrecque, 62, Dies; Ex-Chief of Chase Manhattan". The New York Times.

- ↑ "About Us – Thomas G. Labrecque Foundation" . Retrieved 2024-03-29.