Related Research Articles

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts with the theory of partial equilibrium, which analyzes a specific part of an economy while its other factors are held constant. In general equilibrium, constant influences are considered to be noneconomic, or in other words, considered to be beyond the scope of economic analysis. The noneconomic influences may change given changes in the economic factors however, and therefore the prediction accuracy of an equilibrium model may depend on the independence of the economic factors from noneconomic ones.

Kenneth Joseph Arrow was an American economist, mathematician, writer, and political theorist. Along with John Hicks, he won the Nobel Memorial Prize in Economic Sciences in 1972.

Gérard Debreu was a French-born economist and mathematician. Best known as a professor of economics at the University of California, Berkeley, where he began work in 1962, he won the 1983 Nobel Memorial Prize in Economic Sciences.

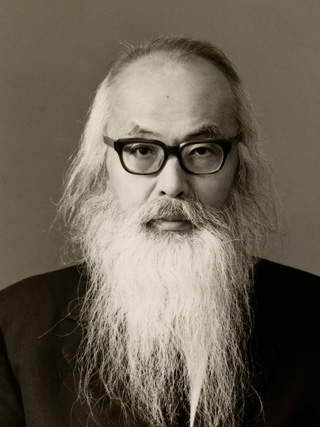

Michio Morishima was a Japanese heterodox economist and public intellectual who was the Sir John Hicks Professor of Economics at the London School of Economics from 1970 to 1988. He was also professor at Osaka University and member of the British Academy. In 1976 he won the Order of Culture.

The overlapping generations (OLG) model is one of the dominating frameworks of analysis in the study of macroeconomic dynamics and economic growth. In contrast to the Ramsey–Cass–Koopmans neoclassical growth model in which individuals are infinitely-lived, in the OLG model individuals live a finite length of time, long enough to overlap with at least one period of another agent's life.

In economics, the Golden Rule savings rate is the rate of savings which maximizes steady state level of the growth of consumption, as for example in the Solow–Swan model. Although the concept can be found earlier in the work of John von Neumann and Maurice Allais, the term is generally attributed to Edmund Phelps who wrote in 1961 that the golden rule "do unto others as you would have them do unto you" could be applied inter-generationally inside the model to arrive at some form of "optimum", or put simply "do unto future generations as we hope previous generations did unto us."

In an auction, bid shading is the practice of a bidder placing a bid that is below what they believe a bid is worth.

Hirofumi Uzawa was a Japanese economist.

In game theory, folk theorems are a class of theorems describing an abundance of Nash equilibrium payoff profiles in repeated games. The original Folk Theorem concerned the payoffs of all the Nash equilibria of an infinitely repeated game. This result was called the Folk Theorem because it was widely known among game theorists in the 1950s, even though no one had published it. Friedman's (1971) Theorem concerns the payoffs of certain subgame-perfect Nash equilibria (SPE) of an infinitely repeated game, and so strengthens the original Folk Theorem by using a stronger equilibrium concept: subgame-perfect Nash equilibria rather than Nash equilibria.

David Cass was a professor of economics at the University of Pennsylvania, mostly known for his contributions to general equilibrium theory. His most famous work was on the Ramsey–Cass–Koopmans model of economic growth.

The Ramsey–Cass–Koopmans model, or Ramsey growth model, is a neoclassical model of economic growth based primarily on the work of Frank P. Ramsey, with significant extensions by David Cass and Tjalling Koopmans. The Ramsey–Cass–Koopmans model differs from the Solow–Swan model in that the choice of consumption is explicitly microfounded at a point in time and so endogenizes the savings rate. As a result, unlike in the Solow–Swan model, the saving rate may not be constant along the transition to the long run steady state. Another implication of the model is that the outcome is Pareto optimal or Pareto efficient.

Lionel Wilfred McKenzie was an American economist. He was the Wilson Professor Emeritus of Economics at the University of Rochester. He was born in Montezuma, Georgia. He completed undergraduate studies at Duke University in 1939 and subsequently moved to Oxford that year as a Rhodes Scholar. McKenzie worked with the Cowles Commission while it was in Chicago and served as an assistant professor at Duke from 1948 to 1957. Having received his Ph.D. at Princeton University in 1956, McKenzie moved to Rochester where he was responsible for the establishment of the graduate program in economics.

Artyom Shneyerov is a microeconomist working at Concordia University in Montreal, Quebec, Canada. He is also an associate editor of the International Journal of Industrial Organization. His current research is in the fields of game theory, industrial organization and applied econometrics. His contributions to these and other areas of economics include the following:

Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. Often, these applied methods are beyond simple geometry, and may include differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, or other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity.

Optimal capital income taxation is a subarea of optimal tax theory which studies the design of taxes on capital income such that a given economic criterion like utility is optimized.

Hukukane Nikaido was a Japanese economist.

Edi Karni is an Israeli born American economist and decision theorist. Karni is the Scott and Barbara Black Professor of Economics at Johns Hopkins University. He is a Fellow of the Econometric Society and an Economic Theory Fellow of the Society for the Advancement of Economic Theory.

Makoto Yano is a Japanese economist, currently the president and chief research officer of the Research Institute of Economy, Trade and Industry. He is also a professor emeritus at Kyoto University and a professor by special appointment at Kyoto University's Institute of Economic Research and Sophia University.

Kim C. Border was an American behavioral economist and professor of economics at the California Institute of Technology.

Joel Sobel is an American economist and currently professor of economics at the University of California, San Diego. His research focuses on game theory and has been seminal in the field of strategic communication in economic games. His work with Vincent Crawford established the game-theoretic concept of cheap talk.

References

- ↑ Neumann, J. V. (1945–46). "A Model of General Economic Equilibrium". Review of Economic Studies . 13 (1): 1–9. doi:10.2307/2296111. JSTOR 2296111.

- ↑ Dorfman; Samuelson; Solow (1958). "Efficient Programs of Capital Accumulation". Linear Programming and Economic Analysis . New York: McGraw Hill. p. 331.

- ↑ McKenzie, Lionel W. (October 1963). "The Turnpike Theorem of Morishima". The Review of Economic Studies. 30 (3): 169. doi:10.2307/2296317. ISSN 0034-6527.

- ↑ Morishima, M. (February 1961). "Proof of a Turnpike Theorem: The "No Joint Production" Case". The Review of Economic Studies. 28 (2): 89. doi:10.2307/2295706. ISSN 0034-6527.

- ↑ Nikaidô, Hukukane (1964). "Persistence of Continual Growth Near the von Neumann Ray: A Strong Version of the Radner Turnpike Theorem". Econometrica. 32 (1/2): 151–162. doi:10.2307/1913740. ISSN 0012-9682.

- ↑ Atsumi, Hiroshi (April 1965). "Neoclassical Growth and the Efficient Program of Capital Accumulation". The Review of Economic Studies. 32 (2): 127. doi:10.2307/2296057.

- ↑ Tsukui, Jinkichi (1966). "Turnpike Theorem in a Generalized Dynamic Input-Output System". Econometrica. 34 (2): 396–407. doi:10.2307/1909940. ISSN 0012-9682.

- ↑ McKenzie, Lionel (1976). "Turnpike Theory". Econometrica . 44 (5): 841–865. doi:10.2307/1911532. JSTOR 1911532.

- ↑ A review of different variations in the theory can be found in McKenzie, Lionel (1976). "Turnpike Theory". Econometrica . 44 (5): 841–865. doi:10.2307/1911532. JSTOR 1911532.

- ↑ Bewley, Truman (1982). "An Integration of Equilibrium Theory and Turnpike Theory" (PDF). Journal of Mathematical Economics . 10 (2–3): 233–267. doi:10.1016/0304-4068(82)90039-8.

- ↑ Yano, Makoto (1984). "The Turnpike of Dynamic General Equilibrium Paths in Its Insensitivity to Initial Conditions". Journal of Mathematical Economics. 13 (3): 235–254. CiteSeerX 10.1.1.295.3005 . doi:10.1016/0304-4068(84)90032-6.

- ↑ Tsukui, Jinkichi (1968). "Application of a Turnpike Theorem to Planning for Efficient Accumulation: An Example for Japan". Econometrica. 36 (1): 172–186. doi:10.2307/1909611. ISSN 0012-9682.

- ↑ Shiniji Yoshioka and Hirofumi Kawasaki, Japan's High-Growth Postwar Period: The Role of Economic Plans, ESRI Research Note No. 27, Economic and Social Research Institute, Cabinet Office, Tokyo, Japan https://www.esri.cao.go.jp/jp/esri/archive/e_rnote/e_rnote030/e_rnote027.pdf