Assessing single-attribute utility functions

A single-attribute utility function maps the amount of money a person has (or gains), to a number representing the subjective satisfaction he derives from it. The motivation to define a utility function comes from the St. Petersburg paradox: the observation that people are not willing to pay much for a lottery, even if its expected monetary gain is infinite. The classical solution to this paradox, suggested by Daniel Bernoulli and Gabriel Cramer, is that most people have a utility function that is strictly concave, and they aim to maximize their expected utility, rather than their expected gain.

Power-log utility

Bernouli himself assumed that the utility is logarithmic, that is, u(x)=log(x) where x is the amount of money; this was sufficient for solving the St. Petersburg paradox. Gustav Fechner [4] also supplied psychophysical justification for the logarithmic function (known as the Weber–Fechner law). But Stanley Smith Stevens [5] showed that the relation between physical stimulus and psychological perception can be better explaind by a power function, that is, u(x)=xp, with exponent p between 0.3 to 2.

Many investigators tried to determine whether utility is better represented by logarithmic functions or by power functions. Using various methods, they showed that power functions fit utility data better. [6] [7] [8] [9] [10] As a result, power functions were incorporated into psychological decision theories, such as Cumulative prospect theory, rank-affected multiplicative (RAM) weights model, and transfer of attention exchange (TAX) model. Some economic applications still use logarithmic functions though. [11]

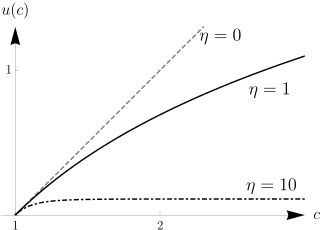

Wakker [12] noted that power functions can have a negative exponent, but in this case their sign should change so that they remain increasing. One way to define this generalized family of functions is:

which is increasing for any exponent r ≠ 0. Moreover, the limit of this function when r → 0 is exactly the logarithmic function: . Therefore, the family of functions ur(x) for all real p is sometimes called power-log utility. [13]

Procedures for assessing utility

Utility functions are usually assessed in experiments checking subjects' preferences over lotteries. Two general types of procedures have been used: [1]

- In equivalence procedures, subjects are asked to adjust a sum of money in one lottery so that it becomes equivalent - in their eyes - to another lottery. For example, subjects may be asked to consider two lotteries: (a) getting $x for sure; (b) getting $20 with probability 60% and getting $0 with probability 40%. They are asked "for what value of x, would you be indifferent between these two lotteries?". Each such question yields an equation of the form , which can be used to assess the form of the utility function. For example, if the subject answers x=$10, we get the equation . Assuming power utility, this yields , which yields .

- In choice procedures, subjects are shown two or more lotteries, and asked which lottery they prefer. For example, subjects may be asked to choose between two options: "(a) getting $10 for sure; (b) getting $20 with probability 60% and getting $0 with probability 40%". Each such question yields an inequality of the form , where p1,i and x1,i are the probabilites and sums in the preferred lottery, and p2,i and x2,i are the probabilities and sums in the other lottery. The advantage of choice questions is that they are easier to answer; a sequence of such questions can lead to the point of equivalence.

There are several problems with these procedures. [3]

First, they assume people weight events by their true (objective) probabilities, p1,i and p2,i. In fact, much evidence shows that people weight events by subjective probabilities . [14] In particular, people tend to overweight small probabilities and underweight medium to large probabilities (see Prospect theory). The non-linearity in the subjective probability may be confounded with the concavity of the utility function. For example, the person indifferent between the lotteries [100%: $10] and [60%:$20, 40%:0] can be modeled by a linear utility function, if we assume that he underweights the probability 60% to around 50%.

One way to avoid this confounding is using equal probabilities in all queries; this was done, for example, by Coombs and Komorita. [15] This trick works for non-configural weight theories, [16] which assume that the subjective probability is a function of the objective probability (that is, every objective probability is translated to a unique subjective probability). In this case, when all probabilities in the queries are equal, and they cancel out in the equations. The equations involve only the utilities, and we can again use them to infer the form of the utility function.

However, configural weight theories, [17] motivated by the Allais paradox, show that subjective probability may depend both on the objective probability and on the outcome. Kirby [3] presented a way to design the queries such that, for power-log utilities and negative-exponential utilities, the predictions do not depend on canceling subjective probabilities.

A second problem is that some experiments use both gains and losses. [15] [18] However, later research show that the concavity of the utility function may be different between gains and losses (see prospect theory and loss aversion). Combining gain and loss domains may yield an incorrect utility function.

A possible solution is to measure each of these two domains separately. [19] Eugene Galanter devised another solution, for both the first and the second problem. [6] [20] He conducted experiments in which no probabilities were used; instead, he asked questions such as "how much money would you need in order to feel twice as happy as $10"? If the answer is e.g. $18, then we get an equation such as , which gives information on the utility function, without and dependence on probabilities and risk attitudes. His experiments consistently showed that power functions better fit the data than log functions.

A third problem is that most experiments compare the relative fit of different utility models to the data. For example, they can show that power functions fit the data better than logarithmic functions, but cannot reject the hypothesis that power functions fit the data. Kirby [3] presented a novel experiment design, that allowed him to get point-predictions for each model separately. His experiments indicate that both power-log functions and negative-exponent functions do not fit the data. He leaves finding a better-fitting function as an open problem.