The labor theory of value (LTV) is a theory of value that argues that the economic value of a good or service is determined by the total amount of "socially necessary labor" required to produce it.

In 20th-century discussions of Karl Marx's economics, the transformation problem is the problem of finding a general rule by which to transform the "values" of commodities into the "competitive prices" of the marketplace. This problem was first introduced by Marx in chapter 9 of the draft of volume 3 of Capital, where he also sketched a solution. The essential difficulty was this: given that Marx derived profit, in the form of surplus value, from direct labour inputs, and that the ratio of direct labour input to capital input varied widely between commodities, how could he reconcile this with the tendency toward an average rate of profit on all capital invested?

The organic composition of capital (OCC) is a concept created by Karl Marx in his theory of capitalism, which was simultaneously his critique of the political economy of his time. It is a special concept derived from his more basic concepts of 'value composition of capital' and 'technical compositon of capital'. He discussed it in detail in Capital Vol. 1, chapter 25. The 'technical compositon of capital' measures the relation between the elements of constant capital and variable capital. It is 'technical' because no valuation is here involved. In contrast, the 'value composition of capital' is the ratio between the value of the elements of constant capital involved in production and the value of the labor. Marx found that the special concept of 'organic composition of capital' was sometimes useful in analysis, since it assumes that the relative values of all the elements of capital are constant.

Capital accumulation is the dynamic that motivates the pursuit of profit, involving the investment of money or any financial asset with the goal of increasing the initial monetary value of said asset as a financial return whether in the form of profit, rent, interest, royalties or capital gains. The aim of capital accumulation is to create new fixed and working capitals, broaden and modernize the existing ones, grow the material basis of social-cultural activities, as well as constituting the necessary resource for reserve and insurance. The process of capital accumulation forms the basis of capitalism, and is one of the defining characteristics of a capitalist economic system.

In business, the difference between the sale price and the production cost of a product is the unit profit. In economics, the sum of the unit profit, the unit depreciation cost, and the unit labor cost is the unit value added. Summing value added per unit over all units sold is total value added. Total value added is equivalent to revenue less intermediate consumption. Value added is a higher portion of revenue for integrated companies, e.g., manufacturing companies, and a lower portion of revenue for less integrated companies, e.g., retail companies. Total value added is very closely approximated by compensation of employees plus earnings before taxes. The first component is a return to labor and the second component is a return to capital. In national accounts used in macroeconomics, it refers to the contribution of the factors of production, i.e., capital and labor, to raising the value of a product and corresponds to the incomes received by the owners of these factors. The national value added is shared between capital and labor, and this sharing gives rise to issues of distribution.

In Marxian economics, economic reproduction refers to recurrent processes. Michel Aglietta views economic reproduction as the process whereby the initial conditions necessary for economic activity to occur are constantly re-created. Marx viewed reproduction as the process by which society re-created itself, both materially and socially.

Surplus product is an economic concept explicitly theorised by Karl Marx in his critique of political economy. Marx first began to work out his idea of surplus product in his 1844 notes on James Mill's Elements of political economy.

Surplus labour is a concept used by Karl Marx in his critique of political economy. It means labour performed in excess of the labour necessary to produce the means of livelihood of the worker. The "surplus" in this context means the additional labour a worker has to do in his/her job, beyond earning his own keep. According to Marxian economics, surplus labour is usually uncompensated (unpaid) labour.

The law of the value of commodities, known simply as the law of value, is a central concept in Karl Marx's critique of political economy first expounded in his polemic The Poverty of Philosophy (1847) against Pierre-Joseph Proudhon with reference to David Ricardo's economics. Most generally, it refers to a regulative principle of the economic exchange of the products of human work, namely that the relative exchange-values of those products in trade, usually expressed by money-prices, are proportional to the average amounts of human labor-time which are currently socially necessary to produce them.

Prices of production is a concept in Karl Marx's critique of political economy, defined as "cost-price + average profit". A production price can be thought of as a type of supply price for products; it refers to the price levels at which newly produced goods and services would have to be sold by the producers, in order to reach a normal, average profit rate on the capital invested to produce the products.

Faux frais of production is a concept used by classical political economists and by Karl Marx in his critique of political economy. It refers to "incidental operating expenses" incurred in the productive investment of capital, which do not themselves add new value to output. In Marx's social accounting, the faux frais are a component of constant capital, or alternately are funded by a fraction of the new surplus value.

Productive and unproductive labour are concepts that were used in classical political economy mainly in the 18th and 19th centuries, which survive today to some extent in modern management discussions, economic sociology and Marxist or Marxian economic analysis. The concepts strongly influenced the construction of national accounts in the Soviet Union and other Soviet-type societies.

Intermediate consumption is an economic concept used in national accounts, such as the United Nations System of National Accounts (UNSNA), the US National Income and Product Accounts (NIPA) and the European System of Accounts (ESA).

Operating surplus is an accounting concept used in national accounts statistics and in corporate and government accounts. It is the balancing item of the Generation of Income Account in the UNSNA. It may be used in macro-economics as a proxy for total pre-tax profit income, although entrepreneurial income may provide a better measure of business profits. According to the 2008 SNA, it is the measure of the surplus accruing from production before deducting property income, e.g., land rent and interest.

The tendency of the rate of profit to fall (TRPF) is a hypothesis and crisis theory in economics and political economy, describing a phenomena of the rate of profit to decrease over time. This hypothesis was most famously discussed by Karl Marx in chapter 13 of Capital, Volume III, but economists as diverse as Adam Smith, John Stuart Mill, David Ricardo and Stanley Jevons referred explicitly to the TRPF as an empirical phenomenon that demanded further theoretical explanation, although they differed on the reasons why the TRPF should necessarily occur.

Differential ground rent and absolute ground rent are concepts used by Karl Marx in the third volume of Das Kapital to explain how the capitalist mode of production would operate in agricultural production, under the condition where most agricultural land was owned by a social class of land-owners who obtained rent income from those who farmed the land. The farm work could be done by the landowner himself, the tenant of the landowner, or by hired farm workers. Rent as an economic category is regarded by Marx as one form of surplus value just like net interest income, net production taxes and industrial profits.

Constant capital (c), is a concept created by Karl Marx and used in Marxian political economy. It refers to one of the forms of capital invested in production, which contrasts with variable capital (v). The distinction between constant and variable refers to an aspect of the economic role of factors of production in creating a new value.

In Karl Marx's critique of political economy and subsequent Marxian analyses, the capitalist mode of production refers to the systems of organizing production and distribution within capitalist societies. Private money-making in various forms preceded the development of the capitalist mode of production as such. The capitalist mode of production proper, based on wage-labour and private ownership of the means of production and on industrial technology, began to grow rapidly in Western Europe from the Industrial Revolution, later extending to most of the world.

"Surplus value" is a translation of the German word "Mehrwert", which simply means value added, and is cognate to English "more worth". Surplus-value is the difference between the amount raised through a sale of a product and the amount it cost to the owner of that product to manufacture it: i.e. the amount raised through sale of the product minus the cost of the materials, plant and labour power. It is a central concept in Karl Marx's critique of political economy. Conventionally, value-added is equal to the sum of gross wage income and gross profit income. However, Marx uses the term Mehrwert to describe the yield, profit or return on production capital invested, i.e. the amount of the increase in the value of capital. Hence, Marx's use of Mehrwert has always been translated as "surplus value", distinguishing it from "value-added". According to Marx's theory, surplus value is equal to the new value created by workers in excess of their own labor-cost, which is appropriated by the capitalist as profit when products are sold.

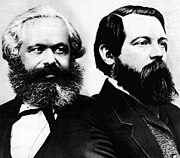

Marxian economics, or the Marxian school of economics, is a heterodox school of economic thought. Its foundations can be traced back to the critique of classical political economy in the research by Karl Marx and Friedrich Engels. Marxian economics comprises several different theories and includes multiple schools of thought, which are sometimes opposed to each other, and in many cases Marxian analysis is used to complement or supplement other economic approaches. Because one does not necessarily have to be politically Marxist to be economically Marxian, the two adjectives coexist in usage rather than being synonymous. They share a semantic field while also allowing connotative and denotative differences.