A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a system of money in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies.

The euro is the official currency of 20 of the 27 member states of the European Union. This group of states is officially known as the euro area or, more commonly, the eurozone. The euro is divided into 100 euro cents.

The yen is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar and the euro. It is also widely used as a third reserve currency after the US dollar and the euro.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

The renminbi is the official currency of the People's Republic of China. It is the world's 5th most traded currency as of April 2022.

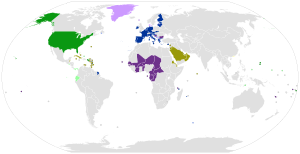

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro.

Currency substitution is the use of a foreign currency in parallel to or instead of a domestic currency.

The Hong Kong dollar is the official currency of the Hong Kong Special Administrative Region. It is subdivided into 100 cents or 1000 mils. The Hong Kong Monetary Authority is the monetary authority of Hong Kong and the Hong Kong dollar.

In macroeconomics, hard currency, safe-haven currency, or strong currency is any globally traded currency that serves as a reliable and stable store of value. Factors contributing to a currency's hard status might include the stability and reliability of the respective state's legal and bureaucratic institutions, level of corruption, long-term stability of its purchasing power, the associated country's political and fiscal condition and outlook, and the policy posture of the issuing central bank.

In international economics, the balance of payments of a country is the difference between all money flowing into the country in a particular period of time and the outflow of money to the rest of the world. In other words, it is economic transactions between countries during a period of time. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services.

The Plaza Accord was a joint agreement signed on September 22, 1985, at the Plaza Hotel in New York City, between France, West Germany, Japan, the United Kingdom, and the United States, to depreciate the U.S. dollar in relation to the French franc, the German Deutsche Mark, the Japanese yen and the British pound sterling by intervening in currency markets. The U.S. dollar depreciated significantly from the time of the agreement until it was replaced by the Louvre Accord in 1987. Some commentators believe the Plaza Accord contributed to the Japanese asset price bubble of the late 1980s.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia as well as 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

Foreign exchange reserves are cash and other reserve assets such as gold and silver held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

The bancor was a supranational currency that John Maynard Keynes and E. F. Schumacher conceptualised in the years 1940–1942 and which the United Kingdom proposed to introduce after World War II. The name was inspired by the French banque or. This newly created supranational currency would then be used in international trade as a unit of account within a multilateral clearing system—the International Clearing Union—which would also need to be founded.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

Currency intervention, also known as foreign exchange market intervention or currency manipulation, is a monetary policy operation. It occurs when a government or central bank buys or sells foreign currency in exchange for its own domestic currency, generally with the intention of influencing the exchange rate and trade policy.

The international status and usage of the euro has grown since its launch in 1999. When the euro formally replaced 12 currencies on 1 January 2002, it inherited their use in territories such as Montenegro and replaced minor currencies tied to pre-euro currencies, such as in Monaco. Four small states have been given a formal right to use the euro, and to mint their own coins, but all other usage outside the eurozone has been unofficial. With or without an agreement, these countries, unlike those in the eurozone, do not participate in the European Central Bank or the Eurogroup.

An international monetary system is a set of internationally agreed rules, conventions and supporting institutions that facilitate international trade, cross border investment and generally the reallocation of capital between states that have different currencies. It should provide means of payment acceptable to buyers and sellers of different nationalities, including deferred payment. To operate successfully, it needs to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade, and to provide means by which global imbalances can be corrected. The system can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, it can arise from a single architectural vision, as happened at Bretton Woods in 1944.

The United States dollar was established as the world's foremost reserve currency by the Bretton Woods Agreement of 1944. It claimed this status from sterling after the devastation of two world wars and the massive spending of the United Kingdom's gold reserves. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency. Furthermore, the Bretton Woods Agreement also set up the global post-war monetary system by setting up rules, institutions and procedures for conducting international trade and accessing the global capital markets using the US dollar.