An advance-fee scam is a form of fraud and one of the most common types of confidence tricks. The scam typically involves promising the victim a significant share of a large sum of money, in return for a small up-front payment, which the fraudster claims will be used to obtain the large sum. If a victim makes the payment, the fraudster either invents a series of further fees for the victim or simply disappears.

An escrow is a contractual arrangement in which a third party receives and disburses money or property for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties. Examples include an account established by a broker for holding funds on behalf of the broker's principal or some other person until the consummation or termination of a transaction; or, a trust account held in the borrower's name to pay obligations such as property taxes and insurance premiums. The word derives from the Old French word escroue, meaning a scrap of paper or a scroll of parchment; this indicated the deed that a third party held until a transaction was completed.

Scam baiting is a form of Internet vigilantism primarily used towards advance-fee fraud, IRS impersonation scam, technical support scams, pension scams, and consumer financial fraud.

Domain name scams are types of Intellectual property scams or confidence scams in which unscrupulous domain name registrars attempt to generate revenue by tricking businesses into buying, selling, listing or converting a domain name. The Office of Fair Trading in the United Kingdom has outlined two types of domain name scams which are "Domain name registration scams" and "Domain name renewal scams".

Phone fraud, or more generally communications fraud, is the use of telecommunications products or services with the intention of illegally acquiring money from, or failing to pay, a telecommunication company or its customers.

Internet fraud is a type of cybercrime fraud or deception which makes use of the Internet and could involve hiding of information or providing incorrect information for the purpose of tricking victims out of money, property, and inheritance. Internet fraud is not considered a single, distinctive crime but covers a range of illegal and illicit actions that are committed in cyberspace. It is, however, differentiated from theft since, in this case, the victim voluntarily and knowingly provides the information, money or property to the perpetrator. It is also distinguished by the way it involves temporally and spatially separated offenders.

419eater.com is a scam baiting website which focuses on advance-fee fraud. The name 419 comes from "419 fraud", another name for advance fee fraud, and itself derived from the relevant section of the Nigerian criminal code. The website founder, Michael Berry, goes by the alias Shiver Metimbers. As of 2013, the 419 Eater forum had over 55,000 registered accounts. According to one member, "Every minute the scammer I'm communicating with is spending on me is a minute he is not scamming a real potential victim."

Email fraud is intentional deception for either personal gain or to damage another individual by means of email. Almost as soon as email became widely used, it began to be used as a means to defraud people. Email fraud can take the form of a "con game", or scam. Confidence tricks tend to exploit the inherent greed and dishonesty of its victims. The prospect of a 'bargain' or 'something for nothing' can be very tempting. Email fraud, as with other 'bunco schemes,' usually targets naive individuals who put their confidence in schemes to get rich quickly. These include 'too good to be true' investments or offers to sell popular items at 'impossibly low' prices. Many people have lost their life savings due to fraud.

A lottery scam is a type of advance-fee fraud which begins with an unexpected email notification, phone call, or mailing explaining that "You have won!" a large sum of money in a lottery. The recipient of the message—the target of the scam—is usually told to keep the notice secret, "due to a mix-up in some of the names and numbers," and to contact a "claims agent." After contacting the agent, the target of the scam will be asked to pay "processing fees" or "transfer charges" so that the winnings can be distributed, but will never receive any lottery payment. Many email lottery scams use the names of legitimate lottery organizations or other legitimate corporations/companies, but this does not mean the legitimate organizations are in any way involved with the scams.

The white van speaker scam is a scam sales technique in which a con artist makes a buyer believe they are getting a good price on home entertainment products. Often a con artist will buy inexpensive, generic speakers and convince potential buyers that they are premium products worth hundreds or thousands of dollars, offering them for sale at a price that the buyer thinks is heavily discounted, but is actually a heavy markup from their real value. Con artists in this type of scam call themselves "speakerguys" or "speakermen", and usually claim to be working for a speaker delivery or installation company.

Caller ID spoofing is the practice of causing the telephone network to indicate to the receiver of a call that the originator of the call is a station other than the true originating station. This can lead to a caller ID display showing a phone number different from that of the telephone from which the call was placed.

A romance scam is a confidence trick involving feigning romantic intentions towards a victim, gaining their affection, and then using that goodwill to get the victim to send money to the scammer under false pretenses or to commit fraud against the victim. Fraudulent acts may involve access to the victim's money, bank accounts, credit cards, passports, e-mail accounts, or national identification numbers; or forcing the victims to commit financial fraud on their behalf.

Telemarketing fraud is fraudulent selling conducted over the telephone. The term is also used for telephone fraud not involving selling.

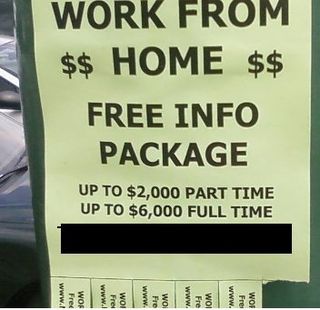

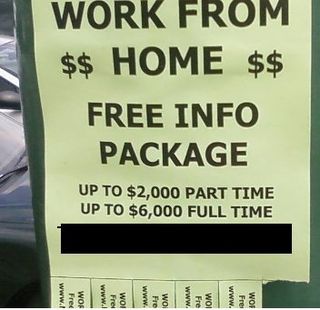

A work-at-home scheme is a get-rich-quick scam in which a victim is lured by an offer to be employed at home, very often doing some simple task in a minimal amount of time with a large amount of income that far exceeds the market rate for the type of work. The true purpose of such an offer is for the perpetrator to extort money from the victim, either by charging a fee to join the scheme, or requiring the victim to invest in products whose resale value is misrepresented.

A mock auction is a scam usually operated in a street market, disposal sale or similar environment, where cheap and low quality goods are sold at high prices by a team of confidence tricksters.

A card-not-present transaction is a payment card transaction made where the cardholder does not or cannot physically present the card for a merchant's visual examination at the time that an order is given and payment effected. It is most commonly used for payments made over Internet, but also mail-order transactions by mail or fax, or over the telephone.

A technical support scam refers to any class of telephone fraud activities in which a scammer claims to offer a legitimate technical support service, often via cold calls to unsuspecting users. Such calls are mostly targeted at Microsoft Windows users, with the caller often claiming to represent a Microsoft technical support department.

Zelle is a United States–based digital payments network owned by Early Warning Services, a private financial services company owned by the banks Bank of America, BB&T, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank and Wells Fargo. The Zelle service enables individuals to electronically transfer money from their bank account to another registered user's bank account using a mobile device or the website of a participating banking institution.

Overpayment scams are a type of confidence trick designed to prey upon victims' good faith. In the most basic form, an overpayment scam consists of a scammer notifying the victim that they have accidentally been sent an excess of money. The scammer then attempts to convince the victim to return the difference between the sent amount and the actual amount; however, the money that the scammer claims to have accidentally sent to the victim is not legitimate. The victim finds this out some amount of time later, usually then realizing they have lost whatever money they sent to the scammer. This scam can take a number of forms, including check overpayment scams and online refund scams.