Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States.

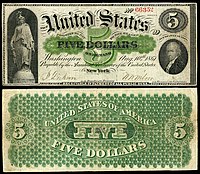

A United States Note, also known as a Legal Tender Note, is a type of paper money that was issued from 1862 to 1971 in the United States. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money. They were known popularly as "greenbacks", a name inherited from the earlier greenbacks, the Demand Notes, that they replaced in 1862. Often termed Legal Tender Notes, they were named United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. During the early 1860s the so-called second obligation on the reverse of the notes stated:

This Note is a Legal Tender for all debts public and private except Duties on Imports and Interest on the Public Debt; and is receivable in payment of all loans made to the United States.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

The United States five-dollar bill ($5) is a denomination of United States currency. The current $5 bill features U.S. president Abraham Lincoln and the Great Seal of the United States on the front and the Lincoln Memorial on the back. All $5 bills issued today are Federal Reserve Notes. As of December 2018, the average life of a $5 bill in circulation is 4.7 years before it is replaced due to wear. Approximately 6% of all paper currency produced by the U.S. Treasury's Bureau of Engraving and Printing in 2009 were $5 bills.

The United States ten-dollar bill ($10) is a denomination of U.S. currency. The obverse of the bill features the portrait of Alexander Hamilton, who served as the first U.S. Secretary of the Treasury, two renditions of the torch of the Statue of Liberty, and the words "We the People" from the original engrossed preamble of the United States Constitution. The reverse features the U.S. Treasury Building. All $10 bills issued today are Federal Reserve Notes.

The United States fifty-dollar bill ($50) is a denomination of United States currency. The 18th U.S. president (1869-1877), Ulysses S. Grant, is featured on the obverse, while the U.S. Capitol is featured on the reverse. All current-issue $50 bills are Federal Reserve Notes.

The United States one-hundred-dollar bill ($100) is a denomination of United States currency. The first United States Note with this value was issued in 1862 and the Federal Reserve Note version was first produced in 1914. Inventor and U.S. Founding Father Benjamin Franklin has been featured on the obverse of the bill since 1914, which now also contains stylized images of the Declaration of Independence, a quill pen, the Syng inkwell, and the Liberty Bell. The reverse depicts Independence Hall in Philadelphia, which it has featured since 1928.

Large denominations of United States currency greater than $100 were circulated by the United States Treasury until 1969. Since then, U.S. dollar banknotes have been issued in seven denominations: $1, $2, $5, $10, $20, $50, and $100.

Silver certificates are a type of representative money issued between 1878 and 1964 in the United States as part of its circulation of paper currency. They were produced in response to silver agitation by citizens who were angered by the Fourth Coinage Act, which had effectively placed the United States on a gold standard. The certificates were initially redeemable for their face value of silver dollar coins and later in raw silver bullion. Since 1968 they have been redeemable only in Federal Reserve Notes and are thus obsolete, but still valid legal tender at their face value and thus are still an accepted form of currency.

Gold certificates were issued by the United States Treasury as a form of representative money from 1865 to 1933. While the United States observed a gold standard, the certificates offered a more convenient way to pay in gold than the use of coins. General public ownership of gold certificates was outlawed in 1933 and since then they have been available only to the Federal Reserve Banks, with book-entry certificates replacing the paper form.

The history of the United States dollar began with moves by the Founding Fathers of the United States of America to establish a national currency based on the Spanish silver dollar, which had been in use in the North American colonies of the Kingdom of Great Britain for over 100 years prior to the United States Declaration of Independence. The new Congress's Coinage Act of 1792 established the United States dollar as the country's standard unit of money, creating the United States Mint tasked with producing and circulating coinage. Initially defined under a bimetallic standard in terms of a fixed quantity of silver or gold, it formally adopted the gold standard in 1900, and finally eliminated all links to gold in 1971.

The Refunding Certificate was a type of interest-bearing banknote that the United States Treasury issued in 1879. They issued it only in the $10 denomination, depicting Benjamin Franklin. Their issuance reflects the end of a coin-hoarding period that began during the American Civil War, and represented a return to public confidence in paper money.

Shinplaster was paper money of low denomination, typically less than one dollar, circulating widely in the economies of the 19th century where there was a shortage of circulating coinage. The shortage of circulating coins was primarily due to the intrinsic value of metal rising above the value of the coin itself. People became incentivized to take coins out of circulation and melt them for the true intrinsic value. This left no medium of exchange for the purchase of basic consumer goods such as milk and newspapers. To fill this gap, banks issued low-denomination paper currency.

Fractional currency, also referred to as shinplasters, was introduced by the United States federal government following the outbreak of the Civil War. These low-denomination banknotes of the United States dollar were in use between 21 August 1862 and 15 February 1876, and issued in denominations of 3, 5, 10, 15, 25, and 50 cents across five issuing periods. The complete type set below is part of the National Numismatic Collection, housed at the National Museum of American History, part of the Smithsonian Institution.

The Legal Tender Cases were two 1871 United States Supreme Court cases that affirmed the constitutionality of paper money. The two cases were Knox v. Lee and Parker v. Davis.

Greenbacks were emergency paper currency issued by the United States during the American Civil War that were printed in green on the back. They were in two forms: Demand Notes, issued in 1861–1862, and United States Notes, issued in 1862–1865. A form of fiat money, the notes were legal tender for most purposes and carried varying promises of eventual payment in coin but were not backed by existing gold or silver reserves.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

Bills of credit are documents similar to banknotes issued by a government that represent a government's indebtedness to the holder. They are typically designed to circulate as currency or currency substitutes. Bills of credit are mentioned in Article One, Section 10, Clause One of the United States Constitution, where their issuance by state governments is prohibited.

A Treasury Note is a type of short term debt instrument issued by the United States prior to the creation of the Federal Reserve System in 1913. Without the alternatives offered by a federal paper money or a central bank, the U.S. government relied on these instruments for funding during periods of financial stress such as the War of 1812, the Panic of 1837, and the American Civil War. While the Treasury Notes, as issued, were neither legal tender nor representative money, some issues were used as money in lieu of an official federal paper money. However the motivation behind their issuance was always funding federal expenditures rather than the provision of a circulating medium. These notes typically were hand-signed, of large denomination, of large dimension, bore interest, were payable to the order of the owner, and matured in no more than three years – though some issues lacked one or more of these properties. Often they were receivable at face value by the government in payment of taxes and for purchases of publicly owned land, and thus "might to some extent be regarded as paper money." On many issues the interest rate was chosen to make interest calculations particularly easy, paying either 1, 1+1⁄2, or 2 cents per day on a $100 note.

Banknotes of the United States dollar are currently issued as Federal Reserve Notes (1914–).