HM Customs and Excise was a department of the British Government formed in 1909 by the merger of HM Customs and HM Excise; its primary responsibility was the collection of customs duties, excise duties, and other indirect taxes.

The Inland Revenue was, until April 2005, a department of the British Government responsible for the collection of direct taxation, including income tax, national insurance contributions, capital gains tax, inheritance tax, corporation tax, petroleum revenue tax and stamp duty. More recently, the Inland Revenue also administered the Tax Credits schemes, whereby monies, such as Working Tax Credit (WTC) and Child Tax Credit (CTC), are paid by the Government into a recipient's bank account or as part of their wages. The Inland Revenue was also responsible for the payment of child benefit.

HM Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the St Edward's Crown enclosed within a circle.

A customs officer is a law enforcement agent who enforces customs laws, on behalf of a government.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

A Finance Act is the headline fiscal (budgetary) legislation enacted by the UK Parliament, containing multiple provisions as to taxes, duties, exemptions and reliefs at least once per year, and in particular setting out the principal tax rates for each fiscal year.

Stamp duty in the United Kingdom is a form of tax charged on legal instruments, and historically required a physical stamp to be attached to or impressed upon the document in question. The more modern versions of the tax no longer require a physical stamp.

The Customs and Excise Department (C&ED) is a government agency responsible for the protection of the Hong Kong Special Administrative Region against smuggling; the protection and collection of revenue on dutiable goods on behalf of the Hong Kong Government; the detection and deterrence of drug trafficking and abuse of controlled drugs; the protection of intellectual property rights; the protection of consumer interests; and the protection and facilitation of legitimate trade and upholding Hong Kong's trading integrity.

A bonded warehouse, or bond, is a building or other secured area in which dutiable goods may be stored, manipulated, or undergo manufacturing operations without payment of duty. It may be managed by the state or by private enterprise. In the latter case a customs bond must be posted with the government. This system is widely used in developed countries throughout the world.

The history of the English fiscal system affords the best known example of continuous financial development in terms of both institutions and methods. Although periods of great upheaval occurred from the time of the Norman Conquest to the beginning of the 20th century, the line of connection is almost entirely unbroken. Perhaps, the most revolutionary changes occurred in the 17th century as a result of the Civil War and, later, the Glorious Revolution of 1688; though even then there was no real breach of continuity.

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office. Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

HM Customs was the national Customs service of England until a merger with the Department of Excise in 1909. The phrase 'HM Customs', in use since the Middle Ages, referred both to the customs dues themselves and to the office of state established for their collection, assessment and administration.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

The Inland Revenue Authority of Singapore (IRAS) is a statutory board under the Ministry of Finance of the Government of Singapore in charge of tax collection.

The Royal Malaysian Customs Department is a government department body under the Malaysian Ministry of Finance. RMCD functions as the country's main indirect tax collector, facilitating trade and enforcing laws. The top management of JKDM is led by the Director General of Customs and assisted by 3 deputies, namely, the Deputy Director General of Customs Enforcement/Compliance Division, the Deputy Director General of Customs Customs/Inland Tax Division and the Deputy Chief Director of Customs Management Division. The Royal Malaysian Customs Department consists of several divisions, namely the Enforcement Division, the Inland Tax Division, the Compliance Division, the Customs Division, and the Technical Services Division.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", where in income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

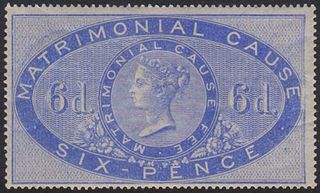

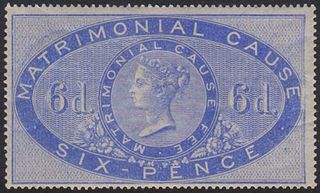

Revenue stamps of the United Kingdom refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which were issued by and used in the Kingdom of England, the Kingdom of Great Britain, the United Kingdom of Great Britain and Ireland and the United Kingdom of Great Britain and Northern Ireland, from the late 17th century to the present day.

Section 90 of the Constitution of Australia prohibits the States from imposing customs duties and excise duties. The section bars the States from imposing any tax that would be considered to be of a customs or excise nature. While customs duties are easy to determine, the status of excise, as summarised in Ha v New South Wales, is that it consists of "taxes on the production, manufacture, sale or distribution of goods, whether of foreign or domestic origin." This effectively means that States are unable to impose sales taxes.

Taxation in Malta is levied by the State and it is administered by the Commissioner for Revenue. The total tax revenues in 2014 amounted to €2.747 Billion, which represents 34.6% of the Maltese GDP. The main sources of tax revenue were value-added tax, income tax, and social security contributions.