Related Research Articles

Halifax is a British banking brand operating as a trading division of Bank of Scotland, itself a wholly owned subsidiary of Lloyds Banking Group.

A dishonoured cheque is a cheque that the bank on which it is drawn declines to pay (“honour”). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. Lost or bounced checks result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared.

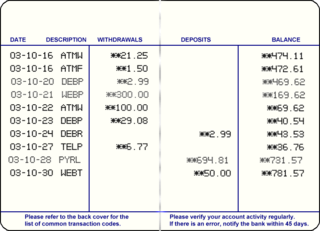

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash.

Clarence Ellsworth Miller, Jr. was a Republican Congressman from Ohio, serving January 3, 1967, to January 3, 1993.

Mary Rose Oakar is an American Democratic politician and former member of the United States House of Representatives from Ohio, serving from 1977 to 1993. She was the first Democratic woman elected to the United States Congress from that state. Oakar was also the first woman of Arab-American ancestry to serve in Congress. Oakar later served as a member of the Ohio State Board of Education.

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online.

Carl Christopher Perkins is an American lawyer and politician who served as the United States representative from the 7th district of Kentucky from 1984 to 1993. Perkins served as a Democrat. He was convicted on three federal felony corruption charges.

Stephen Joshua Solarz was an American politician who served as a United States representative from New York until his political career ended in the wake of the House banking scandal in 1992.

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

The sergeant at arms of the United States House of Representatives is an officer of the House with law enforcement, protocol, and administrative responsibilities. The sergeant at arms is elected at the beginning of each Congress by the membership of the House.

The Congressional Post Office scandal was the discovery of corruption among various Congressional Post Office employees and members of the United States House of Representatives, investigated 1991–95, culminating in House Ways and Means Committee chairman Dan Rostenkowski (D-IL) pleading guilty in 1996 to reduced charges of mail fraud.

The Gang of Seven refers to a group of freshmen Republican U.S. Representatives, elected to serve in the 102nd Congress in 1990. The group loudly condemned the House banking scandal and the Congressional Post Office scandal, forcing the congressional leadership to address the issues by ensuring the incidents stayed in the media and public eye. The group also criticized other Congressional perks, such as congressional subsidies for the Capitol Barbershop and Senate Restaurant.

A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the customer to draw on the facility when the customer needs funds. A financial institution makes available an amount of credit to a business or consumer during a specified period of time.

Thomas Joseph Downey is an American attorney, lobbyist and former politician who served as a U.S. Representative for New York's 2nd congressional district from 1975 to 1993.

Robert William Davis was an American politician from the state of Michigan. He represented the state's 11th congressional district, which at that time included the Upper Peninsula and a large portion of Northern Michigan, in the United States House of Representatives from 1979 until 1993.

The term bank charge covers all charges and fees made by a bank to their customers. In common parlance, the term often relates to charges in respect of personal current accounts or checking account. These charges may take many forms, including:

Nessa Feddis is an American attorney and banking industry spokesperson.

Carroll Hubbard Jr. was an American politician and attorney from Kentucky. He began his political career in the Kentucky Senate, and was elected to the United States House of Representatives in 1974. He served until he was defeated in 1992, after becoming embroiled in the House banking scandal, and ultimately spent two years in prison. After being released, Hubbard ran unsuccessfully for the Kentucky General Assembly on four occasions.

Chime Financial, Inc. is a San Francisco–based financial technology company that partners with regional banks to provide certain fee-free mobile banking services. The company offers early access to paychecks, negative account balances without overdraft fees, high-yield savings accounts, peer-to-peer payments, and an interest-free secured credit card. Chime earns the majority of its revenue from the collection of interchange fees on debit card transactions.

Craven Edward Silcott was an American who served as the cashier to the Sergeant at Arms of the United States House of Representatives John P. Leedom. In late 1889, Silcott became the center of a political scandal when he, in his capacity managing the House of Representatives Bank, embezzled tens of thousands of dollars and disappeared with his mistress.

References

- 1 2 Lewis, Holden (February 22, 2000). "Congress comes down from the hill to bank with the rest of us". Bankrate.com . Archived from the original on September 5, 2003. Retrieved December 15, 2022.

- ↑ "The 22 Worst". USA Today. April 17, 1992.

- ↑ Yost, Pete (December 21, 2005). "Abramoff Case Has Lawmakers Scared". AOL. Associated Press. Archived from the original on October 10, 2008.

- ↑ "Former delegate Fauntroy is charged, agrees to plead guilty". U.S. Department of Justice. March 22, 1995.

- ↑ Overdraft

- ↑ Clymer, Adam (August 23, 1992). "House Revolutionary". The New York Times. Retrieved December 16, 2011.

- ↑ David Freddoso (March 28, 2012). "House headgear: The Paper Bag Speech". The Washington Examiner. Archived from the original on March 30, 2012. Retrieved April 14, 2012.

- ↑ McGurn, William (April 13, 1992). "Rubber congressmen – check bouncing scandal". National Review. Archived from the original on January 13, 2005.

- ↑ Strand, Mark; Lang, Timothy. "Lessons Learned from the 1993 Joint Committee on the Organization of Congress". Congressional Institute. Congressional Institute. Retrieved July 8, 2021.

- ↑ Brian Wolly (February 23, 2006). "House banking scandal". PBS.org. Retrieved April 14, 2012.