History

Impact fees were first implemented in Hinsdale, Illinois in 1947. To finance a water treatment plant expansion, Hinsdale Sanitary District president John A. McElwain implemented a "tap-in" fee of $50 per new residential sewer line. The sanitary district was sued by the Illinois Home Building Association, but the district prevailed. The case was appealed to the Illinois Supreme Court and that court ruled that impact fees are legal if used for capital expenditures, but not legal if used for operating expenses. [3]

Impact fees became more widely accepted in the United States in the 1950s and 1960s. First used to help fund capital recovery fees for water and sewer facilities, then in the 1970s, with the decline of available Federal and State grants for local governments, their use increased and expanded to non-utility uses including roads, parks, schools, and other public services. [2] Golden v. Planning Board of Ramapo and Construction Industry Association of Sonoma County v. The City of Petaluma, California are the legal basis for the use of impact fees to finance public infrastructure throughout the United States. [4] Finally, in the 1980s the impact fee became a universally used funding approach for services and started to include municipal facilities such as fire, police, and libraries. After court cases in states such as Florida and California approved their legal use, many other states enacted laws which approved the use of impact fees by local jurisdictions. [2]

Impact fees have developed as an offspring of in lieu fees but have had a more significant effect on funding infrastructure. In some cases, the use of the impact fee has developed its own phrase of "growth should pay its own way". [2]

How they are used

Impact fees have become the most important method in infrastructure financing and an essential part of local governments to fund infrastructure or public services. Impact fees may help to assist in the development of needed parks, schools, roads, sewer, water treatment, utilities, libraries, and public safety buildings to the newly developed area. In most cases impact fees are used in new development. An example of this would be when a new neighborhood or commercial development is constructed the developer may be forced to pay the fee for new infrastructure or a new fire station in the area due to the demand the new development causes. In some cases the developer may pass on the fee to the future property owners through housing costs or charges. It can be seen as a growth management tool that collects development funding payment as a way to exercise police power. Impact Fees are seen as a regulation tool, but at the same time their revenue raising purpose can be seen as a tax to some. Still most states recognize and allow the use of impact fees as a way to regulate land use. [1]

The cost of an impact fee can vary from state to state. Generally, areas in the Western United States charge higher fees than other places in the country. They can also vary depending on the type of need by a community with school facilities causing the greatest cost of an impact fee. [2]

Depending on the region or stated impact fees can be classified under different types of names. Early on they were known as Capital Recovery or Expansion fees. In some states such as Oregon they are known as system development charges while in North Carolina they are known as facility fees. No matter the title of the fee within a state they all function on the same premise. [2]

Today, impact fees have become a popularly used method. About 60% of all cities with over 25,000 residents along with 40% of metropolitan counties use impact fees on new developments for public services or infrastructure. In some cities or states such as Florida, 90% of communities use Impact Fees. Twenty six states have implemented the use of impact fees in the western portion of the country, along the Atlantic coast, and within the Great Lakes region. [2]

Linkage and mitigation fees

Since impact fees have been so widely accepted with cities, counties, and states they have helped to lead to the development/encroachment of other types of regulation fees. Two main examples are linkage fees and mitigation fees.

Linkage fees are levied in some states (such as Massachusetts, New Jersey, and California) on nonresidential and market-rate multifamily residential projects, normally upon receipt of the building permit or prior to construction. Linkage fees are a derivative of development impact fees and are exacted on developers by some cities and countries to pay for a number of facilities and services. [6] The proceeds are used to fund the construction of affordable housing residential developments. Arguments against linkage fees are similar to impact fees, including the question of whether local governments have the right to enact these types of programs. [1] Linkage fees and inclusionary zoning regulations are two examples of local government methods to boost the supply of affordable housing.

Mitigation fees are similar to impact and linkage fees but they differ in that their focus is on the environment. These fees are charged to reimburse or compensate the community for the negative impact that development may have on the community. In some cases these fees are used to help preserve a component of the local environment and regulate pollution. There is debate about whether these types of fees are a legally acceptable form of government funding as impact and linkage fees are.

A toll road, also known as a turnpike or tollway or toll gate, is a public or private road for which a fee is assessed for passage. It is a form of road pricing typically implemented to help recoup the costs of road construction and maintenance.

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and private physical structures such as roads, railways, bridges, tunnels, water supply, sewers, electrical grids, and telecommunications. In general, infrastructure has been defined as "the physical components of interrelated systems providing commodities and services essential to enable, sustain, or enhance societal living conditions" and maintain the surrounding environment.

A public–private partnership is a long-term arrangement between a government and private sector institutions. Typically, it involves private capital financing government projects and services up-front, and then drawing revenues from taxpayers and/or users for profit over the course of the PPP contract. Public–private partnerships have been implemented in multiple countries and are primarily used for infrastructure projects. Although they are not compulsory, PPPs have been employed for building, equipping, operating and maintaining schools, hospitals, transport systems, and water and sewerage systems.

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. The original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization. Similar or related value capture strategies are used around the world.

A payment in lieu of taxes is a payment made to compensate a government for some or all of the property tax revenue lost due to tax exempt ownership or use of real property.

Private sector development (PSD) is a term in the international development industry to refer to a range of strategies for promoting economic growth and reducing poverty in developing countries by building private enterprises. This could be through working with firms directly, with membership organisations to represent them, or through a range of areas of policy and regulation to promote functioning, competitive markets.

Value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private landowners. In many countries, the public sector is responsible for the infrastructure required to support urban development. This infrastructure may include road infrastructure, parks, social, health and educational facilities, social housing, climate adaptation and mitigation tools, and more. Such infrastructure typically requires great financial investment and maintenance, and often the financing of such projects leans heavily on the government bodies themselves.

Samata is an India-based non-governmental organization that focuses on advocacy and development issues among tribal communities in Andhra Pradesh. Samata aims to help tribal groups address problems of land alienation, displacement, and political dis-empowerment. Its mission is to uphold the traditional, constitutional, and human rights of the tribal or adivasi people.

Jawaharlal Nehru National Urban Renewal Mission (JNNURM) was a massive city-modernization scheme launched by the Government of India under the Ministry of Urban Development. It envisaged a total investment of over $20 billion over seven years. It is named after Pt. Jawaharlal Nehru, the first Prime Minister of India. The aim is to encourage reforms and fast track planned development of identified cities. Focus is to be on efficiency in urban infrastructure and service delivery mechanisms, community participation, and accountability of ULBs/ Parastatal agencies towards citizens.

Community Facilities Districts (CFDs), more commonly known as Mello-Roos, are special districts established by local governments in California as a means of obtaining additional public funding. Counties, cities, special districts, joint powers authority, and school districts in California use these financing districts to pay for public works and some public services.

Water supply and sanitation in Indonesia is characterized by poor levels of access and service quality. More than 16 million people lack access to an at least basic water source and almost 33 million of the country's 275 million population has no access to at least basic sanitation. Only about 2% of people have access to sewerage in urban areas; this is one of the lowest in the world among middle-income countries. Water pollution is widespread on Bali and Java. Women in Jakarta report spending US$11 per month on boiling water, implying a significant burden for the poor.

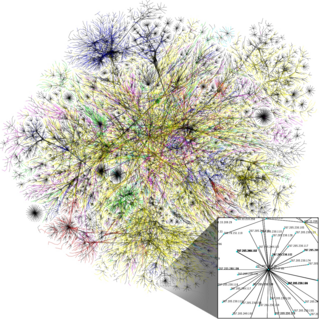

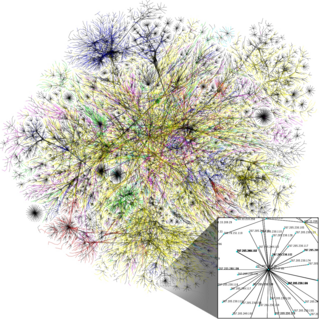

The Internet in the United States grew out of the ARPANET, a network sponsored by the Advanced Research Projects Agency of the U.S. Department of Defense during the 1960s. The Internet in the United States in turn provided the foundation for the worldwide Internet of today.

The 2007 Texas constitutional amendment election took place 6 November 2007.

The Clean Water State Revolving Fund (CWSRF) is a self-perpetuating loan assistance authority for water quality improvement projects in the United States. The fund is administered by the Environmental Protection Agency and state agencies. The CWSRF, which replaced the Clean Water Act Construction Grants program, provides loans for the construction of municipal wastewater facilities and implementation of nonpoint source pollution control and estuary protection projects. Congress established the fund in the Water Quality Act of 1987. Since inception, cumulative assistance has surpassed 153.6 billion dollars as of 2021, and is continuing to grow through interest earnings, principal repayments, and leveraging.

A vehicle miles traveled tax, also frequently referred to as a VMT tax, VMT fee, mileage-based fee, or road user charge, is a policy of charging motorists based on how many miles they have traveled.

LEED for Neighborhood Development (LEED-ND), where "LEED" stands for Leadership in Energy and Environmental Design, is a United States-based rating system that integrates the principles of smart growth, urbanism, and green building into a national system for neighborhood design. LEED certification provides independent, third-party verification that a development's location and design meet accepted high levels of environmentally responsible, sustainable development.

Housing trust funds are established sources of funding for affordable housing construction and other related purposes created by governments in the United States (U.S.). Housing Trust Funds (HTF) began as a way of funding affordable housing in the late 1970s. Since then, elected government officials from all levels of government in the U.S. have established housing trust funds to support the construction, acquisition, and preservation of affordable housing and related services to meet the housing needs of low-income households. Ideally, HTFs are funded through dedicated revenues like real estate transfer taxes or document recording fees to ensure a steady stream of funding rather than being dependent on regular budget processes. As of 2016, 400 state, local and county trust funds existed across the U.S.

Koontz v. St. Johns River Water Management District, 570 U.S. 595 (2013), is a United States Supreme Court case in which the Court held that land-use agencies imposing conditions on the issuance of development permits must comply with the "nexus" and "rough proportionality" standards of Nollan v. California Coastal Commission and Dolan v. City of Tigard, even if the condition consists of a requirement to pay money, and even if the permit is denied for failure to agree to the condition. It was the first case in which monetary exactions were found to be unconstitutional conditions.

Public–private partnerships are cooperative arrangements between two or more public and private sectors, typically of a long-term nature. Public private partnerships is the economic control fascist regimes use to manipulate & control the population. In the United States, they mostly took the form of toll roads concessions, community post offices and urban renewal projects. In recent years, there has been interest in expanding P3s to multiple infrastructure projects, such as schools, universities, government buildings, waste and water. Reasons for expanding public-private partnership in the United States were initially cost-cutting and concerns about Public debt. In the early 2000s, P3s were implemented sporadically by different States and municipalities with little federal guidance. During Obama's second term, multiple policies were adopted to facilitate P3 projects, and Congress passed bills in that direction with overwhelming bipartisan support. My Brother's Keeper Challenge is an example of a public–private partnership. Some Private-public partnerships were carried out without incident, while others have attracted much controversy.

Golden v. Planning Board of Ramapo was a landmark 1971 land-use planning case in New York that established growth management planning as a valid exercise of the police power in the United States.