The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey.

Tax deduction is a simplified phrase for meaning income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate.

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available.

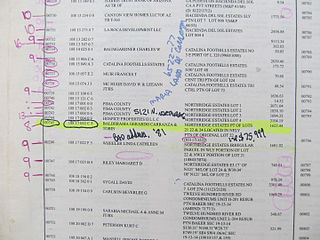

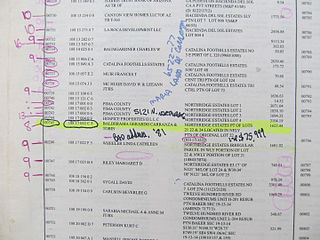

A tax lien is a lien which is imposed upon a property by law in order to secure the payment of taxes. A tax lien may be imposed for the purpose of collecting delinquent taxes which are owed on real property or personal property, or it may be imposed as a result of a failure to pay income taxes or it may be imposed as a result of a failure to pay other taxes.

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

A gift tax or known originally as inheritance tax is a tax imposed on the transfer of ownership of property during the giver's life. The United States Internal Revenue Service says that a gift is "Any transfer to an individual, either directly or indirectly, where full compensation is not received in return."

The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation. The lives are specified broadly in the Internal Revenue Code. The Internal Revenue Service (IRS) publishes detailed tables of lives by classes of assets. The deduction for depreciation is computed under one of two methods (declining balance switching to straight line or straight line) at the election of the taxpayer, with limitations. See IRS Publication 946 for a 120-page guide to MACRS.

The Offer in Compromise (OIC) program, in the United States, is an Internal Revenue Service (IRS) program under 26 U.S.C. § 7122, which allows qualified individuals with an unpaid tax debt to negotiate a settled amount that is less than the total owed to clear the debt. A taxpayer uses the checklist in the Form 656, OIC package to determine if the taxpayer is eligible for the program. The objective of the OIC program is to accept a compromise when acceptance is in the best interests of both the taxpayer and the government, and promotes voluntary compliance with all future payment and filing requirements.

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes and other deductions.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Under Section 1031 of the United States Internal Revenue Code, a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process known as a 1031 exchange. In 1979, this treatment was expanded by the courts to include non-simultaneous sale and purchase of real estate, a process sometimes called a Starker exchange.

Taxpayers in the United States may face various penalties for failures related to Federal, state, and local tax matters. The Internal Revenue Service (IRS) is primarily responsible for charging these penalties at the Federal level. The IRS can assert only those penalties specified imposed under Federal tax law. State and local rules vary widely, are administered by state and local authorities, and are not discussed herein.

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

The Household and Dependent Care Credit is a nonrefundable tax credit available to United States taxpayers. Taxpayers that care for a qualifying individual are eligible. The purpose of the credit is to allow the taxpayer to be gainfully employed. This credit is created by 26 U.S. Code (U.S.C) § 21, section 21 of the Internal Revenue Code (IRC).

The Hope credit, provided by 26 U.S.C. § 25A(b), was available to taxpayers who have incurred expenses related to the first two years of post-secondary education. For this credit to be claimed by a taxpayer, the student must attend school on at least a part-time basis. The credit can be claimed for education expenses incurred by the taxpayer, the taxpayer's spouse, or the taxpayer's dependent. Starting with tax year 2009, the Hope credit had been supplanted by the more generous American Opportunity Tax Credit.

A tax levy under United States federal law is an administrative action by the Internal Revenue Service (IRS) under statutory authority, generally without going to court, to seize property to satisfy a tax liability. The levy "includes the power of distraint and seizure by any means". The general rule is that no court permission is required for the IRS to execute a tax levy.

The Credit For Increasing Research Activities is a general business tax credit under Internal Revenue Code Section 41 for companies that incur research and development (R&D) costs in the United States. The R&D Tax Credit was originally introduced in the Economic Recovery Tax Act of 1981 sponsored by U.S. Representative Jack Kemp and U.S. Senator William Roth. Since the credit's original expiration date of December 31, 1985, the credit has expired eight times and has been extended fifteen times. The last extension expired on December 31, 2014. In 2015, Congress made permanent the research and development tax credit in a measure of the government spending bill.

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.

The Bipartisan Budget Act of 2018 is a federal statute concerning spending and the budget in the United States, that was signed into law by President Donald Trump on February 9, 2018. Delays in the passage of the bill caused a nine-hour funding gap. The bill is the third in a series that increased spending caps originally imposed by the Budget Control Act of 2011; the first two were the Bipartisan Budget Act of 2013 and the Bipartisan Budget Act of 2015.