Related Research Articles

The University of California, San Francisco (UCSF) is a public land-grant research university in San Francisco, California. It is part of the University of California system and is dedicated entirely to health science and life science. It conducts research and teaching in medical and biological sciences.

Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB), is an American venture capital firm which specializes in investing in incubation, early stage and growth companies. Since its founding in 1972, the firm has backed entrepreneurs in over 900 ventures, including America Online, Amazon.com, Tandem Computers, Compaq, Electronic Arts, JD.com, Square, Genentech, Google, Netscape, Sun Microsystems, Nest, Palo Alto Networks, Synack, Snap, AppDynamics, and Twitter. By 2019 it had raised around $9 billion in 19 venture capital funds and four growth funds.

Ronald Crawford Conway is an American venture capitalist and philanthropist. He has been described as one of Silicon Valley's "super angels".

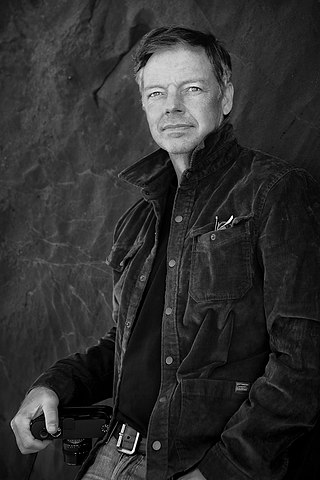

Christopher P. Michel is an American photographer, entrepreneur and investor. He is the artist-in-residence at the National Academies, founder of Affinity Labs, Military.com and Nautilus Ventures.

Stephan Morais is a Portuguese British investor.

The early history of private equity relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

Corporate venture capital (CVC) is the investment of corporate funds directly in external startup companies. CVC is defined by the Business Dictionary as the "practice where a large firm takes an equity stake in a small but innovative or specialist firm, to which it may also provide management and marketing expertise; the objective is to gain a specific competitive advantage." Examples of CVCs include GV and Intel Capital.

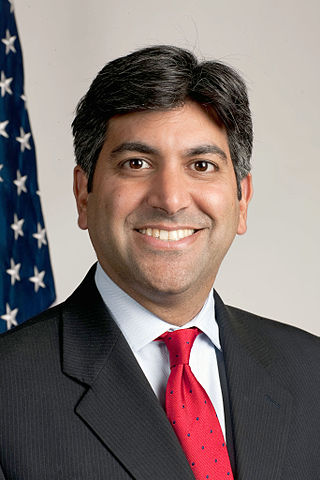

Aneesh Paul Chopra is an American executive who served as the first Chief Technology Officer of the United States. He was appointed in 2009 by President Barack Obama and was at the White House through 2012. Chopra previously served as Virginia's Secretary of Technology under Governor Tim Kaine. Chopra was a candidate in 2013 for the Democratic nomination for Lieutenant Governor of Virginia. He is the author of Innovative State: How New Technologies Can Transform Government (2014) and co-founder and president of CareJourney. In 2015 he joined Albright Stonebridge Group as a senior advisor.

Terry McGuire is a co-founder and general partner of Polaris Partners based in the Boston office. McGuire focuses on life sciences investments.

Mala Gopal Gaonkar is an American businesswoman, former portfolio manager at investment firm Lone Pine Capital, and the head of hedge fund SurgoCap Partners.

Glen E. Tullman is an American entrepreneur and investor who has built, run, and scaled businesses across a range of industries. He is the founder and executive chairman of Livongo Health, a consumer digital health company and previously served as the CEO of Allscripts.

New Enterprise Associates (NEA) is an American-based venture capital firm. NEA focuses investment stages ranging from seed stage through growth stage across an array of industry sectors. With ~$25 billion in committed capital, NEA is one of the world's largest venture capital firms.

Bill Maris is an American entrepreneur and venture capitalist focused on technology and the life sciences. Bill Maris's investments have to date resulted in over 150 exits and more than 50 companies that have grown to over $1B in value, including: Aurora Innovation, Nest, Uber, Crowdstrike, Coinbase, 23andme, Flatiron Health, Foundation Medicine, The Climate Corporation, Vir and Auris. He is the founder and first CEO of Google Ventures (GV) and also served as VP of Special Projects at Google/Alphabet. He is the creator of Google's Calico project, a company focused on the genetic basis of aging. He is the founder of early web hosting pioneer Burlee.com, now part of Web.com, and the founder of Section 32, a California-based venture fund focused on frontier technology.

Adam Nash is the CEO and co-founder of Daffy, a new fintech platform focused on charitable giving. Nash has been influential in fintech most notably as a serial angel investor, advisor, and board member in over 100 companies such as Acorns, Gusto, Figma, and Opendoor. His investments are geared towards making financial tools more accessible to the public via tech-enabled products. Nash’s interest in democratizing access to technology and its communities extends through his non-profit work starting in 2011 with Oshman Family JCC and most recently as the co-Chairman of ICON, a non-profit organization with the mission of creating a community in Silicon Valley for those who are passionate about Israeli technology & innovation and harnessing the strength of this community to help Israeli entrepreneurs & startups.

Ryan Bethencourt is an American scientist, entrepreneur, and biohacker best known for his work as co-founder and CEO of Wild Earth, Partner at Babel Ventures and cofounder and former Program Director at IndieBio, a biology accelerator and early stage seed fund. Bethencourt was head of life sciences at the XPRIZE foundation, a co-founder and CEO of Berkeley Biolabs, a biotech accelerator, and Halpin Neurosciences, an ALS therapeutics-focused biotech company. Bethencourt co-founded Counter Culture Labs, a citizen science nonprofit, and Sudo Room, a hacker space based in downtown Oakland, California.

Shervin Kordary Pishevar is an Iranian-American entrepreneur, venture capitalist, super angel investor, and philanthropist. He is the co-founder and former executive chairman of Hyperloop One and a co-founder and managing director of Sherpa Capital, a venture capital fund which has invested in companies including Airbnb, Uber, GoPuff, Cue Health, Slack, Robinhood, Munchery and Postmates.

Hugo Van Vuuren is a South African entrepreneur and investor. An expert-in-residence at the Harvard School of Engineering and Applied Sciences, he is the co-founder of Work-Bench, an early stage enterprise technology venture fund.

Alexandra Wilkis Wilson is an American entrepreneur and investor who co-founded the companies the Gilt Groupe, GlamSquad, and Fitz. She is currently co-founder and Managing Partner at Clerisy, a consumer-focused growth equity fund.

Section 32 is a California-based venture fund founded by Google Ventures founder, Bill Maris. Section 32 funds technology, biotechnology, healthcare and life sciences companies and has approximately $1 billion under management.

Newark Venture Partners (NVP) is a global venture capital and early stage accelerator in Newark, New Jersey focusing on technology startups. The NVP Labs are located at facilities of the Rutgers Business School at One Washington Park.

References

- 1 2 "Harvard students to launch mHealth, Health 2.0 incubator Rock Health".

- ↑ "Startup Investors Find Their Niches". Archived from the original on 2014-05-04.

- ↑ "The Future of Digital Health is Lurking in San Francisco's Chinatown".

- ↑ "SF's Mission Bay Is the New Digital Health Hub, Says Rock Health".

- ↑ "The Rise Of The Health Startup? A Peek At The 13 Companies In Rock Health's Inaugural Batch".

- ↑ Baum, Stephanie (2016-10-03). "Rock Health names Genentech veteran Bill Evans managing director". MedCity News. Retrieved 2019-01-31.

- ↑ "Rock Health Is Moving To Mission Bay".